For passive income generation, I prefer exchange-traded funds (ETFs) over individual dividend stocks. Why? Mainly because the payments are more predictable and less lumpy.

Most ETFs pay quarterly, each with different ex-dividend and payout dates, but consolidating into one ETF streamlines the entire process.

There are plenty of options out there for generating passive income, but one of the oldest and most established is the iShares Canadian Financial Monthly Income ETF (TSX:FIE).

This ETF currently pays a 6.1% 12-month trailing yield, trades at around just $8 per share, and offers monthly distributions. Here’s my breakdown of FIE if you’re considering it for your portfolio.

FIE: Preferred shares

As of October 10, 18.2% of FIE is invested in another iShares ETF that holds preferred shares of various Canadian financial companies.

Preferred shares are a bit of an odd hybrid between stocks and bonds. They typically offer less potential for capital appreciation than common stocks but provide more income, similar to bonds.

They are also generally less liquid, so purchasing them via an ETF like FIE is an easy way to add diversification to your portfolio without the hassle of buying individual preferred shares.

FIE: Corporate bonds

To enhance stability within the portfolio, 9.1% of FIE is allocated to an iShares Canadian corporate bond ETF.

Corporate bonds are essentially investment-grade loans issued by Canadian companies. They don’t carry the same market risk as stocks, but they do have credit and interest rate risks. These bonds generate monthly income, which helps FIE provide steady returns to its investors.

Including this type of investment helps lower the overall risk of FIE and contributes to more consistent income generation. It’s always beneficial to diversify your investments beyond just stocks, and incorporating corporate bonds is a prudent strategy within this ETF.

FIE: Financial sector stocks

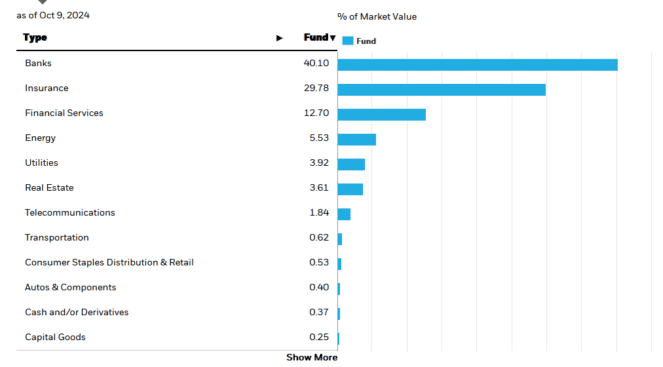

To drive capital appreciation and primarily offer qualified dividends, the remaining portions of FIE are invested in a collection of 24 Canadian stocks.

The majority of these holdings are prominent players in the financial sector, encompassing a robust selection of big banks, asset managers, insurance companies, and stock exchanges, along with a few specialty lenders.

Additionally, FIE includes a sprinkling of Real Estate Investment Trusts (REITs) to diversify its income sources and enhance the fund’s yield potential.