The Tax-Free Savings Account (TFSA) has some great news for 2025: the contribution limit is again set at $7,000.

But before you start planning for next year, don’t forget about 2024! If you haven’t maxed out this year’s contribution room, you’ve got another $7,000 to work with right now. And the sooner you invest, the more compounding you get.

With TFSA room being limited, it’s important to be strategic. The last thing you want is to take a speculative gamble, suffer a capital loss, and miss out on the opportunity to claim that loss on your taxes—as you could in a non-registered account.

That said, it’s fine to take some calculated risks. Here’s one unique exchange-traded fund (ETF) that offers a blend of tax-free high growth and monthly income.

The TFSA’s hidden drawback

Let’s say you want to take on a little more risk in your TFSA to chase higher returns but without picking individual stocks.

The natural thought might be to use leverage—borrowing money to invest more than you have. This is common in non-registered accounts, where you can use a margin loan to amplify your exposure.

Here’s how it works: if you have $1,000 in a non-registered account, your broker might let you borrow an additional 25%, giving you control of $1,250. This boosts your potential gains, but it also increases your risk.

Unfortunately, you can’t do this in a TFSA. Brokers don’t offer margin loans for TFSAs, so leveraging directly within the account isn’t an option. While you could take out an external loan to fund your TFSA, today’s high interest rates make that a less appealing route for most investors.

So, does this mean leveraging is completely off the table in a TFSA? Not at all. There’s an ETF solution designed to give you the benefits of leverage while keeping things simple and accessible—no margin account required.

1.25x exposure to Canadian utility stocks

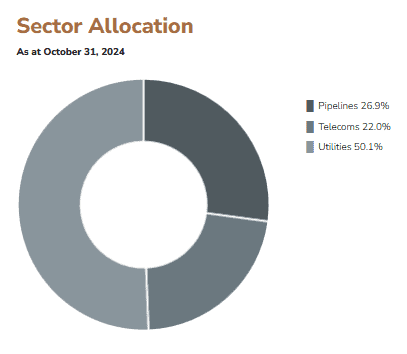

If you think utilities are just about electricity and gas, think again. Hamilton Enhanced Utilities ETF (TSX:HUTS) takes a more modern approach.

HUTS includes not just traditional utility companies but also telecoms and pipelines via the Solactive Canadian Utility Services High Dividend Index. These stocks are already known for their high dividends.

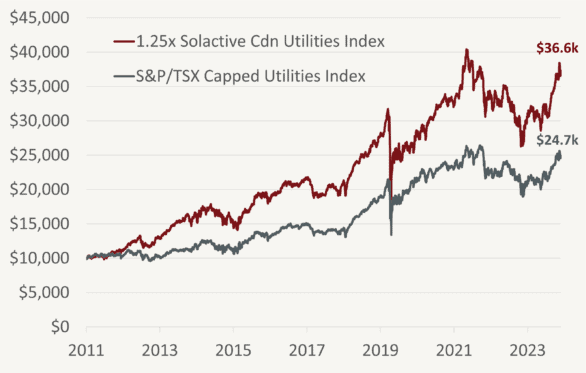

Using 1.25x leverage—borrowing at institutional rates—it delivers an annualized 6.99% yield with monthly payouts. Historically, this strategy has worked out well, as 1.25x the index has outperformed over time.