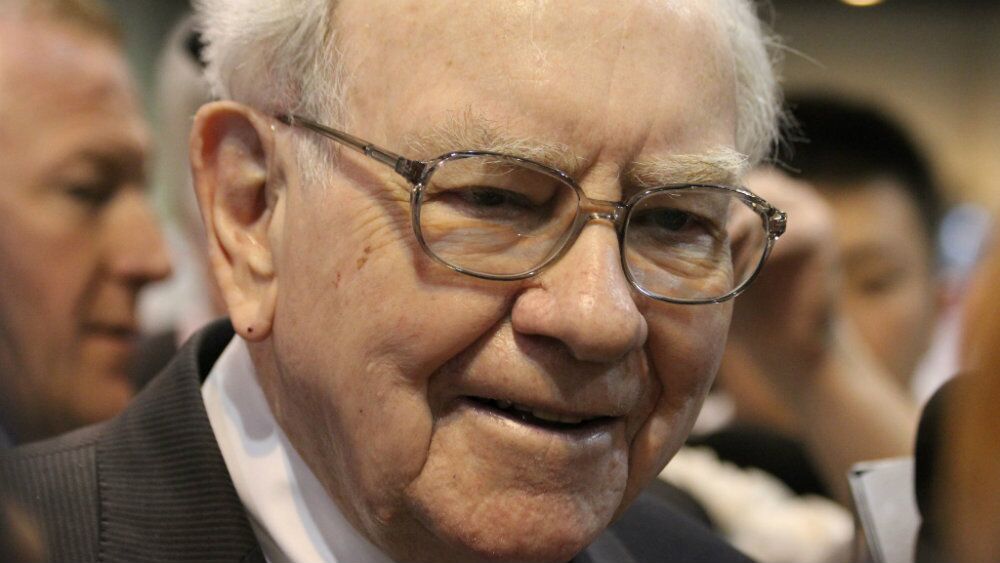

Warren Buffett is 94 years old, and while his investment wisdom is unmatched, I’d be lying if I said I wasn’t slightly apprehensive about his longevity.

At the last Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) AGM, he didn’t seem as sharp as he once was, and his gradual conversion of Class A shares to Class B shares for charity donations feels like a subtle transition plan.

That said, when the inevitable happens, I plan to buy the dip like never before. Berkshire Hathaway is one of the most impressive collections of wholly owned private businesses and stock investments you’ll ever find. I have every confidence Buffett’s handpicked lieutenants are groomed for success.

Plus, let’s not forget the $325 billion cash pile on the company’s balance sheet—it gives the company a significant margin of safety for whatever comes next.

For Canadians, there are multiple ways to channel his legendary investment strategies. Here’s my guide to three different approaches.

Buy the class B shares

Buffett has long maintained that Berkshire Hathaway Class A shares will never split, which is why they trade at a jaw-dropping US$692,904 per share. Let’s face it: I’ll probably never afford one, but hey, a person can dream.

For the rest of us, there are Berkshire Hathaway Class B shares, a much more accessible option currently trading at around US$460 per share.

Yes, you’ll need to convert your CAD to USD to buy them, and the current exchange rate isn’t exactly favourable. That said, using a cost-effective brokerage like Interactive Brokers can help minimize currency conversion costs.

One thing I love about BRK.B is its efficiency. Unlike many blue-chip stocks, Berkshire doesn’t pay dividends—a deliberate choice by Buffett to reinvest all profits into the business.

This makes it an ideal holding for corporate or non-registered accounts, where dividend income can be less tax-efficient. If you’re looking for a pure growth play that reflects Buffett’s long-term strategy, BRK.B is hard to beat.

Buy the CDR

If your brokerage charges exorbitant fees for CAD-to-USD conversions or you’re wary of the strong U.S. dollar, there’s a convenient way to invest in Berkshire Hathaway without ever leaving Canadian dollars behind.

Enter Berkshire Hathaway CDR (NEOE:BRK)—a Canadian Depositary Receipt. This CDR allows you to invest in Berkshire Hathaway Class B shares in CAD, providing exposure to the same company but without the hassle of currency exchange.

The CDR currently trades at a much more accessible price of around $34. Yes, it still represents actual ownership in Berkshire Hathaway, and you even retain voting rights as a shareholder.

The one catch? There’s an up to 0.5% annual currency hedging fee, which will slightly reduce your returns over time. But for many investors, the simplicity and convenience of trading in CAD make it a worthwhile trade-off.

Buy the ETF

The third option is the unique Purpose Berkshire Hathaway Yield Shares ETF (NEOE:BRKY), which is designed to provide leveraged exposure to Berkshire Hathaway while generating consistent income.

Here’s how it works: the ETF borrows 25% of its net asset value to invest in Berkshire Hathaway, effectively giving you 1.25 times leverage. This amplifies both the ups and downs of the stock’s performance.

To complement this strategy, the ETF also sells covered call options on up to 50% of its portfolio. This generates tax-efficient income, primarily in the form of capital gains and return of capital.

As of January 15, the ETF boasts an annualized distribution yield of 4.45% with monthly payouts, offering a unique way to capture the majority of Berkshire Hathaway’s price returns while also earning income.