Short-selling might sound ominous, but it’s really a big nothing burger. Don’t listen to the meme stock bagholders who blame short-sellers for their own poor stock picks and losses—short interest doesn’t tank a business; poor fundamentals do.

If you want to know which stocks investors are betting against on the TSX, the definitive authority is the Canadian Investment Regulatory Organization (CIRO). On a bi-weekly basis, CIRO publishes the Short Sale Trading Statistics Summary Report, which details short-selling activity across Canadian-listed securities.

In this piece, I’ll walk you through the most recent report from March 15 and offer a quick primer on how short selling works, why it happens, and whether or not it’s something retail investors need to worry about.

What is short selling anyway?

In short (pun intended), short selling is a way for investors to profit when they believe a stock’s price is going to fall.

Here’s how it works. Suppose I think a hypothetical company, Acme Inc. (ACME), is about to release a terrible earnings report. ACME trades at $20 per share, and I want to profit if it drops. To short it, I borrow 100 shares and immediately sell them at the current price, pocketing $2,000 in cash.

Now, let’s say I’m right—earnings are awful, and a month later, ACME crashes to $10 per share. I now “close out” my short position by buying back 100 shares at $10, costing me just $1,000. I return the borrowed shares and keep the $1,000 difference as profit.

But the risk cuts both ways. If ACME goes up instead, I still have to return those shares—at a higher price. If it rises to $30, for example, I’ll need to spend $3,000 to buy them back, losing $1,000 on the trade. Plus, while I’m holding the short position, I’m paying interest or borrowing fees on the shares, which can chip away at any gains or deepen losses.

Some investors view short selling as unethical, but there’s nothing shady about it. It’s like betting “don’t pass” in craps—you’re just taking the opposite side of the trade. Investing isn’t a team sport, and you’re free to legally make money in any direction the market allows.

The most shorted TSX stocks

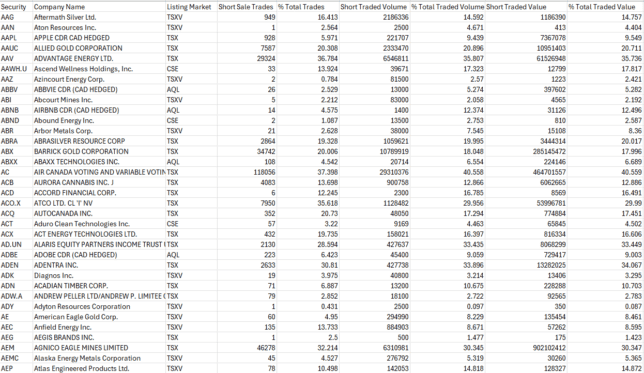

Here’s a screenshot from the latest report, and as always, it’s a mixed bag. But if you take a closer look, a few clear themes emerge.

First, you’ll notice how many of these are U.S. companies trading as Canadian Depositary Receipts (CDRs). That suggests a growing number of Canadian investors are bearish on the U.S. market and are using these CDRs to bet against American stocks without dealing with currency conversion or cross-border trading complications.

You’ll also see the usual suspects: junior mining and cannabis companies. These are highly speculative sectors with spotty track records, inconsistent earnings, and heavy reliance on hype and financing. That makes them frequent targets for short sellers looking to profit from overvalued or struggling firms.

So, should you do anything with this information? Honestly, probably not. This data is a lagging indicator; by the time it’s published, the market has usually already priced in much of what short-sellers anticipated.

I believe the average investor can succeed in the stock market without ever placing a short trade. Just buy quality assets, hold them through market cycles, and let time and dividends do the work. Speculating on short positions might be flashy, but long-term ownership is where the real wealth is built.