Cargojet (TSX:CJT) could be a lucrative investment opportunity hiding in plain sight, obscured by trade war headlines and market jitters. As Canada’s premier cargo airline, Cargojet has seen its stock take a beating this year, down roughly 15% year to date. Tariff fears are the major culprit. But dig into the undervalued company’s latest results, and a different, far more bullish picture emerges. This isn’t an airline stock buckling under pressure; it’s one built to thrive in this exact moment. Here’s why buying this dip could be a remarkably savvy move for patient investors.

Cargojet stock: Thriving amidst chaos

Think about the global landscape Cargojet has navigated since 2020: a pandemic, Canadian wildfires disrupting rail, low Panama Canal water levels delaying ships, conflicts in Ukraine and the Middle East snarling supply chains, and the disruptive rise of ultra-efficient e-commerce giants like Temu and Shein shipping directly from China globally. It’s a relentless parade of logistical nightmares.

Yet, fast forward to the first quarter (Q1 2025). Cargojet’s revenue was more than double what it was in Q1 2020. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) — a key measure of core profitability — also doubled. The airline posted record first-quarter revenue of $249.9 million, up 8.1% year over year. Net earnings soared 47.7% to $48 million. Cargojet is thriving in 2025!

As co-CEO Jamie Porteous aptly put it in April, disruptions have consistently created opportunities, and Cargojet is “very well positioned to navigate this rapidly shifting global supply chain environment.”

Tariffs a tailwind for Cargojet

The recent sell-off on Cargoject stock was fueled by fears of escalating tariffs and a global trade war. But here’s the critical twist: Cargojet might be one of the biggest winners in this scenario.

The expected “decoupling” of North American supply chains means companies are scrambling to avoid new U.S. tariffs on goods from China and Southeast Asia. The solution involves routing more cargo directly into Canada first. Cargojet is perfectly positioned to capture this rerouted traffic. The airliner has built the infrastructure and expertise, learning during the pandemic how to efficiently serve China. The company is actively flying scheduled charters from China directly into Canada.

Crucially, this traffic bypasses the U.S. tariff chaos entirely. Cargojet is leveraging its domestic network (serving 16-17 Canadian cities) to distribute cargo nationally and even using its multi-year relationship with DHL to connect this cargo onwards to places like Mexico City — again, bypassing U.S. final destination tariffs. This direct-to-Canada shift is a structural change playing directly into Cargojet’s strengths.

Cargojet stock’s valuation: The disconnect is glaring

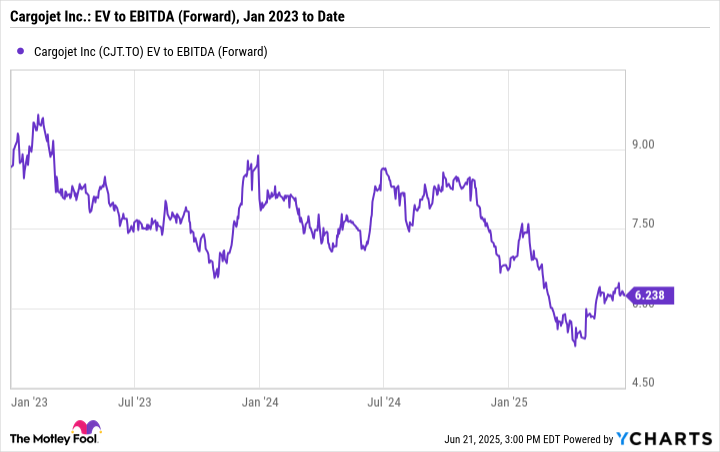

Back in Q1 2020, amidst pandemic panic, Cargojet stock traded around $100 per share. Today, after doubling revenue and adjusted EBITDA, the stock languishes below that $100 mark. In 2025, the business is fundamentally twice as large and profitable as it was during its last major crisis, yet the market values it lower. Cargojet stock’s forward enterprise value-to-adjusted EBITDA (EV/EBITDA) multiple sits around 6.2 — significantly cheaper than its average since early 2023.

CJT EV to EBITDA (Forward) data by YCharts

Management is opportunistically repurchasing shares to take advantage of the dip. It bought back $32.2 million worth of Cargojet stock during the first quarter, recognizing the pricing disconnect

Cargojet continues to fund growth initiatives by adding capacity cautiously. It’s increasing its net aircraft fleet by three this year and retains the flexibility to adjust if needed.

The Foolish bottom line

Market panics create opportunities. The sell-off on Cargojet stock, driven by surface-level tariff fears, ignored the company’s proven ability to thrive amidst disruption and its strategic positioning to benefit from shifting trade routes.

Cargojet has navigated far worse than today’s tariff uncertainty and emerged stronger. It has built the network, the partnerships, and the operational excellence to turn global chaos into Canadian growth opportunities. Investors looking beyond the current headlines with a three- to five-year horizon could buy this dip in Cargojet stock and potentially earn respectable gains as the airline stock reprises higher in the near future.