Everyone knows about the big-name exchange-traded funds (ETFs), the ones tracking the S&P 500 or the S&P/TSX 60. And while those are solid building blocks, it’s worth giving smaller ETFs with less assets under management (AUM) a shot, too.

Canadian asset managers have been hard at work developing innovative alternatives that cater to long-term, dividend-focused investors. One of the best under-the-radar options is Hamilton CHAMPIONS™ Canadian Dividend Index ETF (TSX:CMVP).

I think CMVP is affordable, thoughtfully constructed, and built to serve buy-and-hold investors looking for dependable, tax-efficient income that could grow steadily over time. Here’s how it works.

It uses a great index

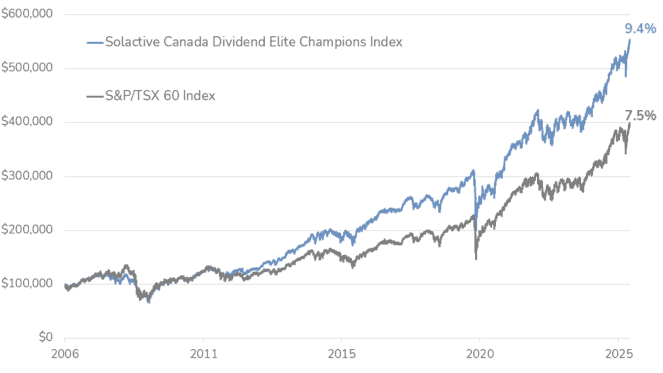

CMVP tracks the Solactive Canada Dividend Elite Champions Index, which equally weights Canadian companies that have increased their dividends for at least six consecutive years, with no dividend cuts. This simple screen ensures the ETF only includes proven dividend growers with a consistent track record of shareholder returns.

The average market cap of CMVP holdings is $73 billion, and the average historical dividend-growth rate across its constituents is around 10% per year. That’s important, especially if you’re investing for long-term income. Dividends that grow over time help you outpace inflation and maintain your purchasing power in retirement.

It’s tax-efficient

CMVP currently pays a 3.27% yield, and much of that is expected to be made up of eligible Canadian dividends, which receive favourable tax treatment in non-registered accounts thanks to the dividend tax credit.

You may also see a small portion of the distributions come as return of capital (ROC) at year-end, which isn’t taxed when received, but instead reduces your adjusted cost base. This can defer taxes until you sell the ETF, another benefit for taxable accounts.

Another tax advantage? The index excludes real estate investment trusts, whose distributions are taxed at your full marginal rate. Instead, CMVP focuses on blue-chip Canadian dividend growers, most of which are well-established companies that fit nicely in a taxable portfolio.

It’s low-cost

Hamilton isn’t just talking the talk. They’re actually waiving CMVP’s management fee entirely through January 31, 2026. After that, the fee will revert to 0.19% per year, which is still very competitive in the Canadian ETF industry.

That’s well below what some other TSX-listed dividend growth ETFs charge, many of which have management fees up to 0.55%. Whether you’re focused on cost efficiency or maximizing your dividend growth, CMVP is built with investors in mind.