In August, Statistics Canada (StatCan) released its economic data for the second quarter, including the closely watched gross domestic product (GDP) reading. To call the release disappointing would be an understatement. Thanks to U.S. tariffs, Canada’s economy shrank 1.6% in Q2, with goods-producing industries leading the decline. The weakness in manufacturing and other export industries was offset somewhat by higher household and government spending, but overall growth was still negative. When U.S. President Donald Trump announced his tariffs this past April, Canadians responded forcefully, pledging to spend more money on Canadian-made goods and services. If StatCan’s Q2 data is any indication, Canadians did just that.

Nevertheless, the economic data StatCan released last month painted an overall negative picture of the economy. It would seem that, for as long as Trump tariffs are in effect, Canada’s manufacturing sector will suffer. It is what it is; but on the other hand, there are pockets of strength in Canada’s economy despite the slowdown. In this article, I will share where you can safely park your money as Trump tariffs continue to strangle the economy.

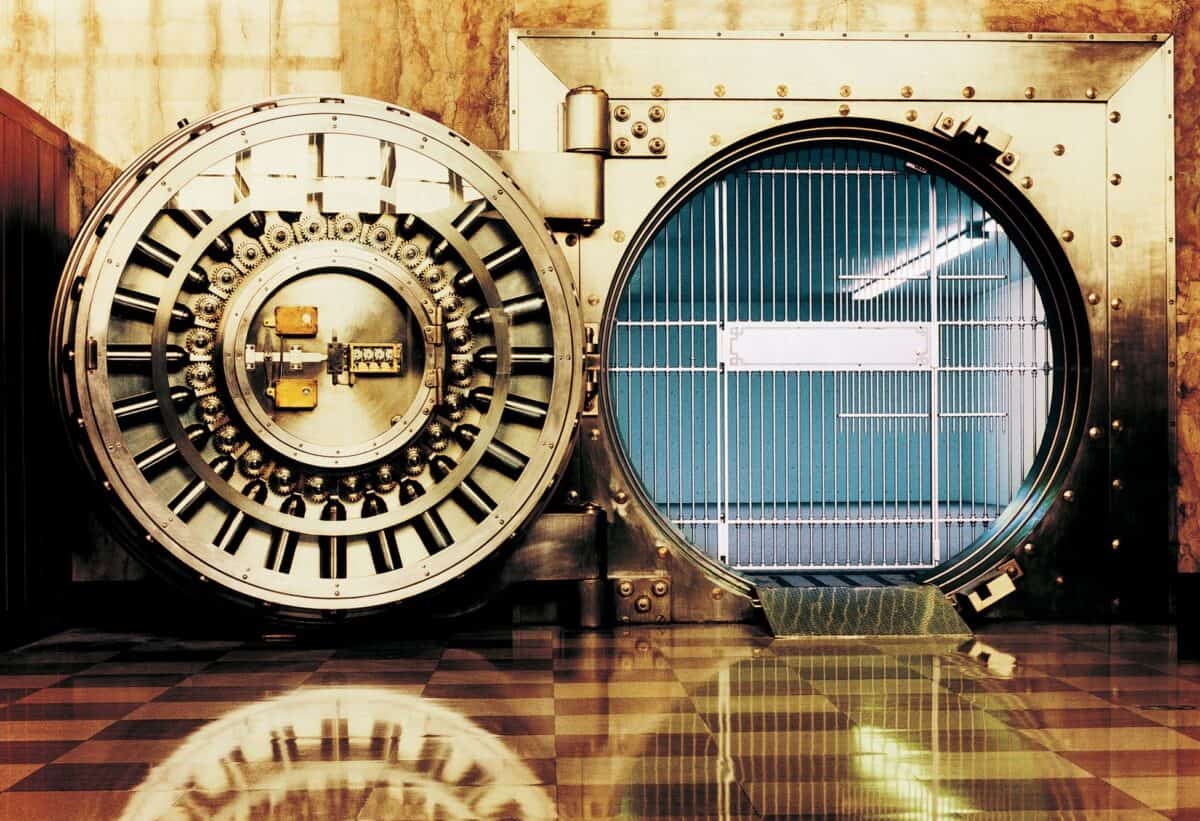

Banks

Canadian banks have generally been doing well this year. Bank earnings are up, and stock prices are largely following suit. Despite a cooling housing market and higher unemployment in tariff-hit sectors, Canadians are still making enough money to pay their mortgage and credit card interest. In the second quarter, mortgage delinquencies inched up to 0.19% while credit card delinquencies rose to 1.7%. Both types of delinquencies increased, but remained low by long-term historical standards.

One Canadian bank stock I have invested in and have been doing well with is Toronto-Dominion Bank (TSX:TD). My history with this stock is long. I established an initial position in 2019 and sold years later for a meagre gain. However, last year, when the bank dipped to $74 amid a money laundering scandal, I started scooping up shares, making TD my biggest position. Since then, TD stock has risen about 50% and outperformed the market.

TD has several advantages, such as conservative lending standards (with a 14.9% CET1 ratio), responsible loan loss provisioning, and highly profitable operations. The bank also has a large U.S. business that, while capped by regulators, does offset potential weakness in the Canada segment.

Utilities

Another sector that’s been doing well amidst Canada’s economic contraction is utilities. Utilities do not usually export anything. Some do import energy from energy distributors, but they usually have ways around tariffs on supplies

One Canadian utility stock worth looking at is Fortis Inc (TSX:FTS). Fortis has been one of the best performing Canadian utilities over the long term. It has operations all over Canada, the U.S. and the Caribbean. Ninety eight percent of its operations are regulated utilities, providing significant protection from competition. Finally, the stock is a dividend superstar, with 51 consecutive years of dividend increases.

Currently, Fortis is embarking on a $26 billion capital expenditure plan. While costly, these expenditures will increase the utility’s rate base, ultimately bringing in more revenue. In the past, Fortis’s growth initiatives worked out quite well. I’d expect the current CAPEX plan to work out, too.

Foolish takeaway

In late 2025, it seems clear that Donald Trump’s tariffs are taking a bite out of Canada’s economy. That’s a real drag. However, there is still cause for optimism. Many segments of Canada’s economy are doing well, and the stock market is booming. Overall, there are many reasons for Canadians to be optimistic in 2025.