Trash isn’t exactly a thrilling investment or dinner party topic. While everyone was chasing the next hot tech stock or the most promising cannabis stock a decade ago, a quiet, essential service business was methodically turning modest investments into small fortunes. If you’re looking to build a formidable retirement portfolio, sometimes the most profound wisdom lies not in what’s flashy, but in what is fundamentally indispensable.

This is the story of Waste Connections (TSX:WCN), a stellar example of how a so-called “dull” business can deliver spectacular returns. If you had invested your retirement savings in this integrated solid waste services company a decade ago, your patience would be handsomely rewarded.

Source: Getty Images

Waste Connections stock: From a merger to a six-fold return

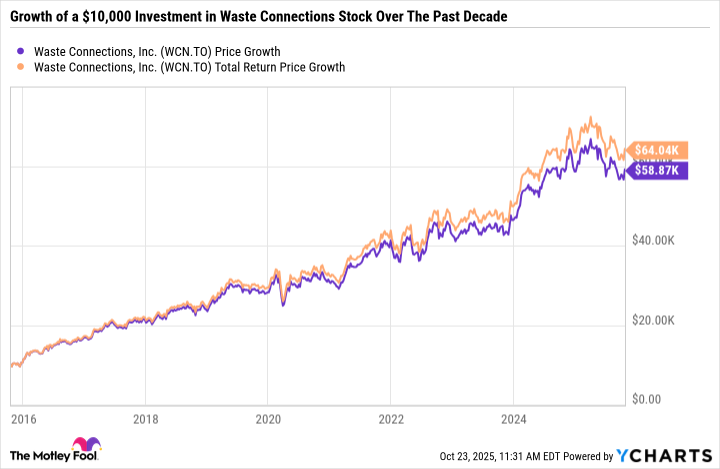

Imagine it’s June 2016. United States-based Waste Connections has just merged with Canada’s Progressive Waste and is listed on the TSX, with shares trading around $60.60. You decide to commit $10,000 to this North American waste collection and disposal enterprise, trusting in the constant need for its services.

Fast forward to today. That initial investment, with dividends faithfully reinvested, would have ballooned to approximately $64,350. Even if you had simply pocketed the dividends, your capital would be worth about $59,160. That’s a more than six-fold increase, a testament to the power of WCN stock’s steady, compounding growth.

This transformative return is precisely why Waste Connections stock stands tall among the top TSX stocks to buy and hold for the long run.

The engine behind WCN’s growth

How did a waste company achieve such remarkable growth? The answer lies in a brilliantly executed, disciplined strategy. Waste Connections actively engineers its revenue and earnings growth through a savvy acquisitions-led model. The company consistently identifies and acquires smaller, often less efficient, waste businesses. Then, it applies its deep operational expertise to improve their profitability, seamlessly integrating them into its vast network.

This strategy is still in play today. Following its strong third-quarter 2025 earnings report on October 21, the company announced commitments for new acquisitions that could add up to $300 million in annual revenue. For the first nine months of 2025, revenue climbed 6.5% year-over-year to $7.1 billion. Normalized earnings per share grew 6.3% to $3.86, and the company’s adjusted EBITDA margin – a key measure of profitability that stands for Earnings Before Interest, Taxes, Depreciation, and Amortization – remains impressively strong at 33.8%. The business has superb control over its costs and operations despite some impairments during the past quarter.

The power of a wide economic moat

In investing, an “economic moat” refers to a business’s sustainable competitive advantage. Waste Connections has dug a very wide one. By focusing on providing essential services in secondary, often rural and suburban markets, it avoids brutal price wars with competitors in major urban centres. This strategic focus grants it strong pricing power, allowing it to protect its profit margins even during inflationary periods. It’s a classic case of a business doing one thing exceptionally well and being irreplaceable in the communities it serves.

Waste Connections’ 0.8% dividend tells a story

Just this week, Waste Connections announced an 11.1% increase to its quarterly cash dividend. To a new investor, the resulting annual yield of 0.8% might seem negligible. But here’s the magic of long-term investing: for an investor who bought shares a decade ago at that original $60 price, the effective yield on their initial cost is a much more respectable 3.2% and growing.

This payout highlights a critical lesson for long-term investing: starting early and holding through consistent dividend raises can transform a tiny initial yield into a significant passive income stream in retirement.

It’s worth noting that the stock isn’t cheap today, trading at a premium with a forward price-to-earnings (P/E) ratio of 43.2 that reflects the market’s high confidence in its future. While this may give value hunters a pause, it also underscores the quality and reliability the market is willing to pay for.