This article first appeared on our U.S. website.

After posting incredible returns in 2023 and 2024, Palantir (NASDAQ: PLTR) stochas had another strong year. It’s up 150% so far in 2025, and knocking on the door of all-time highs again.

While investors might feel like they’ve missed out on one of the biggest winners of the artificial intelligence (AI) investment trend, Palantir’s growth rate has been steadily rising, and there’s a lot more business it can capture, which could lead to a higher stock price.

We’ll get an update from Palantir on Nov. 3 about its Q3 results, which could send shares soaring again if it announces growth that exceeds expectations. So, should you scoop up shares before this announcement?

Palantir’s platform is seeing monster growth from commercial and government clients alike

Palantir started off as an AI data analytics program for government use only. Those early contracts helped build and shape Palantir into the business it is today. Eventually, the company figured out there was a commercial use case for its product lineup as well, so Palantir expanded to capture that audience, too. Both segments contributed to strong growth at times, but each is growing rapidly, thanks to the massive AI buildout that’s ongoing.

In Q2, Palantir’s commercial revenue rose 47% year over year to US$451 million. Government revenue rose 49% year over year to US$553 million. So, not only is Palantir’s government division still the largest by revenue, it also has a slightly faster growth rate. Combined, they delivered 48% growth to US$1 billion, allowing Palantir to surpass the US$1 billion quarterly revenue mark for the first time.

Unlike many growing software companies, Palantir emphasized becoming profitable. During Q2, Palantir’s profit margin totaled 33%, a level most software companies target.

This is clearly the sign of a growing and dominant business, and it’s hard to find fault with any of Palantir’s results. Management has a strong track record of outperforming expectations it lays out, so another earnings beat seems likely on Nov. 3. A beat could send the stock up, making it a no-brainer buy today.

However, growth isn’t everything in an investment, and there’s one massive red flag that investors cannot ignore.

Palantir’s valuation is unbelievable

Even the best companies bought at the wrong price can turn out to be terrible investments. Palantir has an incredibly high valuation that few companies have ever reached, especially with Palantir’s relatively “slow” growth rate compared with companies that have reached these sky-high levels.

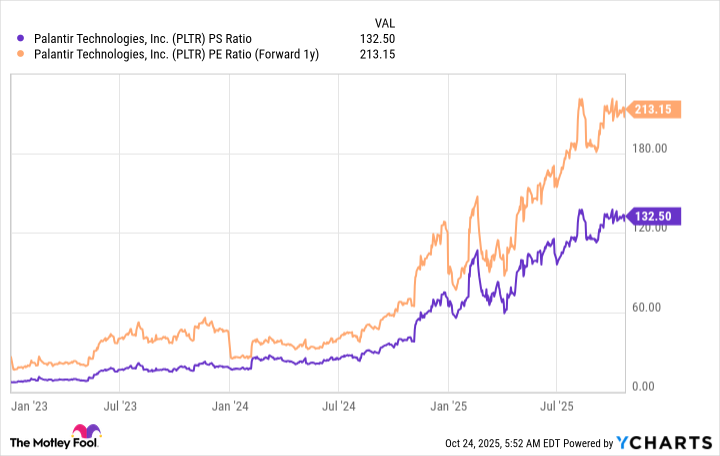

Palantir’s stock trades for 132 times sales and 213 times 2026 earnings.

PLTR PS Ratio data by YCharts

Those valuation metrics are hard to believe, especially for a company with Palantir’s growth rates. Companies that achieve a 100 times sales or greater valuation are rare, but when you find them, they’re typically doubling or tripling their revenue year over year for multiple quarters.

While Palantir’s revenue growth is very strong, it’s nowhere near the rate that some of its peers that traded for 100 times sales or more have achieved. This makes the stock incredibly risky because as soon as growth shows signs of weakness, the stock price will come tumbling down. This hasn’t happened yet, so investors have continued to drive up the stock price of an incredible business that has just uncoupled from its stock.

If I’m a Palantir shareholder, I’m taking some of the monster gains I’ve achieved and moving that money into a different investment. While Palantir will likely be a successful company and build out its AI platform across government and commercial clients, there are multiple years’ worth of growth already priced into Palantir’s stock. This concerns me, I think and investors should stay away from this one until after Q3 results are released; then we’ll see how the growth rate is doing and make another assessment.