Dividend stocks pay you to hold them, and dividend growth stocks raise your annual compensation. At times, dividend growers raise their regular payouts every year to richly reward long-term shareholders with growing passive-income streams and higher yields.

It pays to invest in dividend-growth stocks and to track Canadian dividend stocks that have recently raised their payouts.

Three TSX-listed companies that have recently announced dividend increases in October include Tamarack Valley Energy (TSX:TVE), Waste Connections (TSX:WCN), and Capital Power (TSX:CPX).

Let’s take a closer look at which one could be a promising investment for dividend-growth purposes in November.

Tamarack Valley Energy raises dividends and changes payout frequency

On October 29, 2025, Canadian oil and gas producer Tamarack Valley Energy reported strong production and cash flow growth for the third quarter of 2025. The $3.1 billion TSX energy company announced a 5% increase to its monthly dividend from $0.01275 per share to $0.01333 per share, effective with the November 2025 dividend (payable in December). The new payout should yield 2.6% annually.

Tamarack Valley Energy will transition from monthly dividend payments to quarterly payments starting with the first quarter of 2026 payout. With a dividend payout rate under 40%, the payout appears sustainable.

Tamarack has made production design breakthroughs that are increasing productivity while lowering average costs and breakeven points in 2025. Third-quarter production increased 11% year over year at its core project, Clearwater, and management recently raised its annual production outlook for 2025 from 65,000-67,000 to 67,000-69,000 barrels of oil equivalent per day (boe/d).

Free cash flow generation has increased by 7% year over year despite weaker commodity prices. And the company has reduced its net debt by 19% so far in 2025, earning it a credit rating upgrade in October.

Most noteworthy, management is enhancing shareholder returns through growing dividends and share repurchases. Tamarack has repurchased about 5.6% of its outstanding share float year to date. Remaining shareholders own a larger piece of the company’s revenue and future earnings.

How good have Tamarack Valley Energy stock’s historical returns been?

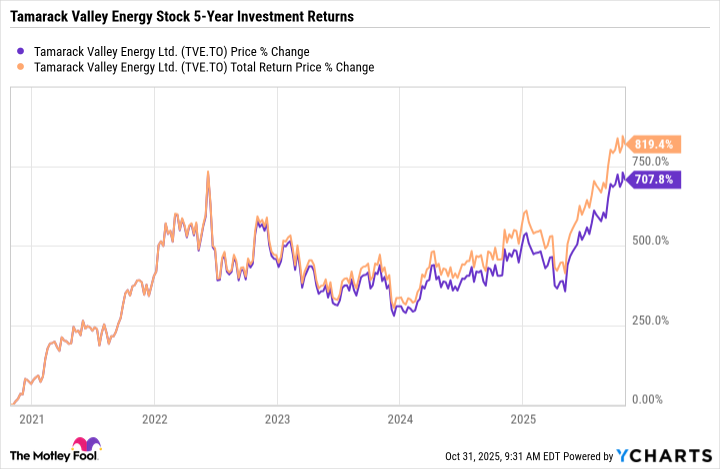

Over the past five years, Tamarack Valley Energy stock rewarded investors with a 707% capital gain, which was amplified by growing dividends to an 819% total return, an average compound annual return above 55%.

Such performance may be worth your attention.

Waste Connections raised dividends by 11.1%

Waste Connections’s business model of turning trash into gold is generating good returns for early investors. The $60 billion waste management services company continues to generate boatloads of cash flow from its moat-fortified businesses, and, as tradition dictates, it raised its quarterly dividend by 11.1% on October 21, 2025, to US$0.35 per share.

The higher dividend payout is meant to enhance shareholder returns. However, due to an already elevated share price, Waste Connections’s dividend yield is only 0.8% annually. Capital gains remain the key consideration for new investors today.

WCN stock has generated nearly 90% in total returns over the past five years, with capital gains doing the heavy lifting. That said, investors who acquired shares a decade ago could be earning higher dividend yields (on cost) following a 13.2% average annual increase in dividends during the past decade.

The current dividend payout rate, at 52% of earnings, appears safe, and management has room to maintain a double-digit dividend-growth spree, following a good 15 consecutive years of dividend raises.

Capital Power pays 6% higher dividend

Independent power producer and renewable energy giant Capital Power Corporation paid a 6% higher dividend scheduled for October 31, 2025. The utility announced its dividend raise earlier on July 29, 2025, increasing the quarterly payout from $0.6519 to $0.6910 per share.

Capital Power’s latest dividend should yield a respectable 3.9% annually. The regulated utility has raised dividends for 11 consecutive years now.

A sustained revenue and cash flow growth spree supports further dividend growth.

Capital Power has grown its asset base through organic construction and accretive acquisitions. Given robust electricity demands in North America, including from artificial intelligence data centres, Capital Power has won a fair share of data-center power projects and invested in new battery storage deals in 2025. The utility’s growing cash flow base helps support healthy dividend growth rates into the future.