Canadian blue-chip stocks naturally offer capital stability to investment portfolios as they generate stable cash flows from mature, well-established, de-risked businesses. As a welcome bonus, they may offer valuable passive income streams through regular dividends. Naturally, the market values such businesses highly, meaning their dividend yields are usually low, rarely above 5%. But exceptions do happen. Enbridge’s (TSX:ENB) and BCE’s (TSX:BCE) 5.6% and 5.4% respective dividend yields appear juicy and attractive yet intriguing for investors looking to buy safe high-yield dividend stocks in November for passive income purposes.

Let’s check out which high-yield blue-chip Canadian dividend stock could be a better buy right now.

BCE’s 5.4% dividend is safer following 20% cash flow growth

BCE is one of Canada’s three largest, well-established telecommunications companies ruling the Canadian market and growing its revenue base as the population increases and information economy expands. Following a 56% dividend cut in May this year, the investment community is warming up to BCE stock as it strengthens its balance sheet, re-engineers revenue and cash flow growth, and pays a sustainable dividend going forward.

In a recent third-quarter earnings installment, BCE grew consolidated revenue by 1.3% and increased its adjusted earnings before interest, taxes, depreciation, and amortization (Adjusted EBITDA) by 5.3% year over year. Meanwhile, free cash flow grew 20.6% year-over-year to entice dividend investors.

Although the telecoms giant continues to suffer under a heavy debt load during a disruptive yet abating price competition that weakened debt servicing capacity, so do its industry peers. Though declining interest rates in 2025 could offer it some breathing room. Aided by non-core asset sales, which improved liquidity, BCE is finally improving its financial health.

The mobile phone subscriber base continues to grow, now nearing 10.4 million, while BCE prepares to roll out revolutionary direct-to-satellite services to keep abreast of the competition.

BCE’s 5.3% dividend yield remains one of the highest among Canadian blue-chip stocks, which make up the S&P/TSX 60 Index. The payout appears much safer now following the rationalization of capital expenditures.

Management recently confirmed its financial guidance for 2025, which included up to 2% revenue growth and 6% to 11% growth in free cash flow. Perhaps BCE could return to dividend growth at some point in the near future. By mid-August, BCE stock had risen more than 12% after its dividend cut, a sign of market approval.

If the worst is over for the telecoms and media industry, BCE stock could be a rewarding contrarian bet on the future stability of the Canadian telecoms and media industry.

Enbridge: A high-yield blue-chip stock for passive income

There’s no denying Enbridge’s cash flow gushing fortress as the pipelines behemoth continues to offer dividend yields that compete with Guaranteed Investment Certificate (GIC) offerings. ENB’s high yield, combined with dividend yield growth and potential capital appreciation, far outperforms fixed income today. Enbridge stock is up nearly 10% year-to-date, yet its 5.6% dividend yield remains high and juicy enough to offer a sleep-well-at-night passive income source that dividend stock investors could buy in November and hold for decades.

Enbridge recently reported record-high third-quarter EBITDA. The company’s “toll-booth” asset base remains well positioned to generate stable operating cash flow. Although market sentiment implied that Enbridge’s 2023 acquisition of U.S. gas utility assets was expensive, the company expanded its capacity to generate boatloads of distributable cash flow as U.S. energy demand soars.

Moreover, Enbridge’s dividends are well covered by distributable cash flow, with a payout rate well under 70%. Following nearly 30 years of dividend growth, there’s no doubt Enbridge’s management would wish to maintain that reputation for a decade or more to come. The 5.6% yield could keep growing.

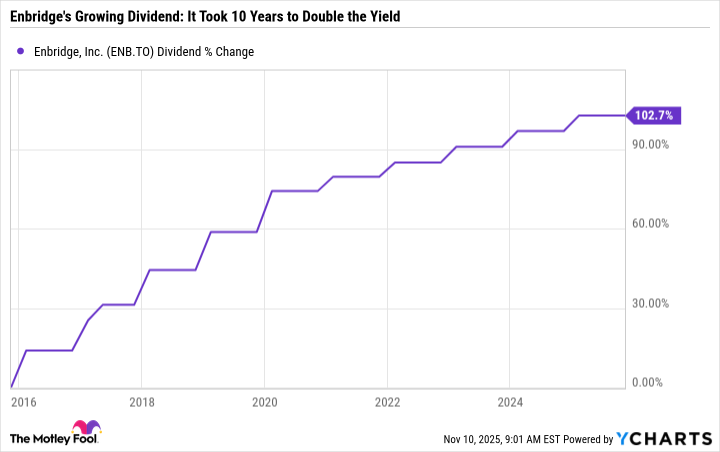

ENB Dividend data by YCharts

Enbridge has doubled its dividend during the past decade. Early investors could have doubled their yields (on cost). Past performance isn’t indicative of the future, but if the same dividend growth happens by 2035, an 11.2% yield could be nice to harvest from ENB stock during retirement.

Management’s current capital investment budget provides for distributable cash flow growth of 5% per annum post 2026.