Investors seeking passive income love the dream of getting paid every quarter, just for owning a high-quality dividend stock. If you’re looking for a Canadian energy giant to add to your dividend portfolio, Suncor Energy (TSX:SU) stock is making a powerful investment case that it wants to be your top pick for passive income growth in November 2025.

Suncor’s reputation among income investors took a hit during the pandemic’s oil price collapse, forcing a painful dividend cut. But that’s old news. Today, Suncor is in the midst of a stunning redemption story, aggressively growing its payout and transforming itself into a reliable dividend-gushing machine.

A cash-generating juggernaut

A dividend is only as safe as the cash flow that backs it up. Suncor’s recent third-quarter (Q3) 2025 results show a company that is absolutely firing on all dividend-propelling cylinders. The company is “sweating its assets” and achieving operational excellence, posting record-breaking productivity numbers that translate directly into shareholder value.

Suncor achieved record Q3 upstream production of 870,000 barrels per day (bbls/d) and record refinery throughput of 492,000 bbls/d. Its assets are running at incredible utilization rates, with upgraders at 102% and refineries at 106%. This is a strategic move that allows the company to capture maximum value for shareholders, even as oil prices take a breather.

The company’s operational strength means Suncor is generating a mountain of cash. In Q3 alone, it produced $2.3 billion in free funds flow — a fancy term for the cash left over after all bills, operational investments, and declared dividends are paid. This money is used to reward shareholders, and Suncor is generating plenty of it.

This performance may not be a short-term fluke. The company’s long-life oil sands assets have an expected reserve life of 25 years, meaning Suncor can potentially maintain this level of productivity for decades, paying out juicy dividends all the while.

Suncor stock’s impressive dividend redemption

Here’s where Suncor’s passive-income growth story gets exciting. Since returning to dividend growth in 2022, Suncor has been on a tear, nearly tripling its payout. The company has raised its dividend by a staggering 185% over the past three years.

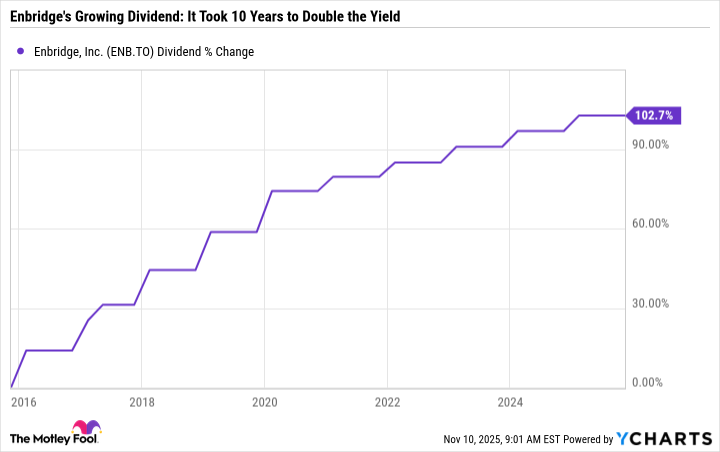

ENB Dividend data by YCharts

Good news keeps coming out of this tariff-proof energy company. Hot on the heels of its blowout third-quarter earnings performance, Suncor’s management announced another 5% increase to the quarterly dividend, bringing it to $0.60 per share. The new payout yields 4% annually.

Suncor has a clear, shareholder-friendly capital-allocation plan in action. The company achieved its net debt target (of $8 billion a year ago) and is now committed to returning 100% of its excess funds to shareholders through share buybacks and a reliable, growing dividend. Its net debt position improved to $7.1 billion last quarter, and management has more confidence as it targets 3-5% annual dividend growth, signalling to investors that this payout is a top priority.

So, how many SU shares for $1,000 in passive income?

With the new quarterly dividend of $0.60 per share, Suncor stock should pay $2.40 per share in dividends over the next 12 months.

To generate $1,000 in annual passive income, you would need to own 417 shares, as shown in the table below.

| Company | Recent Price | Number of Shares | Dividend | Total Payout | Frequency | Total annual Dividend |

| Suncor Energy (TSX:SU) | $59.76 | 417 | $0.60 | $250.20 | Quarterly | $1,000.80 |

Based on a recent share price of $59.76, acquiring those 417 shares would represent a total investment of just under $25,000.

Beyond hitting that $1,000 dividend mark, there could be some compound growth opportunities. If Suncor follows through on its 3-5% dividend-growth target, your $1,000 income stream could become $1,050, then $1,100, and beyond — all without you lifting a finger.

Long-term-oriented investors building a retirement portfolio may view Suncor stock as more than just another Canadian energy stock, but as a powerful passive income growth story to buy into and stay invested in for decades to come.