The stock market can be a very noisy place with daily headlines screaming about the next big crash, scary tariff war turns, or the latest signs of an artificial intelligence (AI) bubble. For Canadian investors looking to build true, lasting wealth, this noise can be a distraction. The real secret to a “forever” investment portfolio may not be in finding a hot stock that doubles overnight, but lies in finding financially stable dividend-paying stocks that pay you reliably, year after year, regardless of what the market, or economy, does.

When looking for dividend stocks to buy and hold for life, look at essential domestic businesses with a history of rewarding shareholders. Ideally, I’d prefer dividends that grow and management teams that prioritize cash flow over hype.

If you are looking to lock away some capital in your TFSA or RRSP, here are two Canadian dividend heavyweights that offer income you can count on.

TELUS

TELUS (TSX:T) stock, one of the big-three Canadian telecommunications providers, is a screaming buy for yield hunters following its latest mid-term financial outlook during the past week. With management’s plan to reduce net debt and grow free cash flow over the next three years, the beaten-down high-yield dividend stock is ripe for the dividend investor’s shopping basket.

The TELUS dividend currently yields 9%. It makes sense why management is pausing dividend increases after 21 consecutive years of religious hikes to better allocate capital. According to the Rule of 72, a yield this high could double one’s capital in eight short years, with dividend reinvestment.

TELUS sees a path to increasing free cash flow from $2.2 billion expected for 2025 at a 10% (or more) annual growth rate through 2028. If management meets targets, capital gains could follow, and the elevated dividend yield could begin to disappear.

With a dividend payout rate within a prospective range of 60–75% of free cash flow, the yield looks secure for a long-term holding. The dividend is staying alive, supported by resilient utility-like cash flows from telecoms services and strong results from TELUS Digital.

Algoma Central Corporation

Algoma Central Corporation (TSX:ALC) is a sea shipping giant that owns and operates a fleet of liquid and dry bulk carriers moving Canadian commerce across the Great Lakes. Satisfied with the business’ performance since a turnaround in 2022, management has raised Algoma Central’s dividends for three consecutive years now. With a low earnings payout rate under 40%, this could be a dividend growth stock to buy and hold for the long term.

Sea shipping should remain the lowest cost transportation method for bulk products across seas and oceans, a competitive advantage that airliners won’t likely match, maybe ever. Therefore, Algoma Central’s business in the Great Lakes should remain intact and grow with the North American economy.

Algoma Central recently increased its total fleet in September as it took delivery of its 100th vessel, growing its fleet from 40 ships a decade ago. A larger fleet increases revenue-generating capacity.

For the first nine months of 2025, revenue increased by 12.7% year-over-year despite the negative impact of U.S. tariffs on Canadian steel exports. The dividend stock’s adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA) increased by 30% year over year. Rate increases and strong demand in other product areas, including a larger fleet, combined to grow revenue and operating earnings nicely.

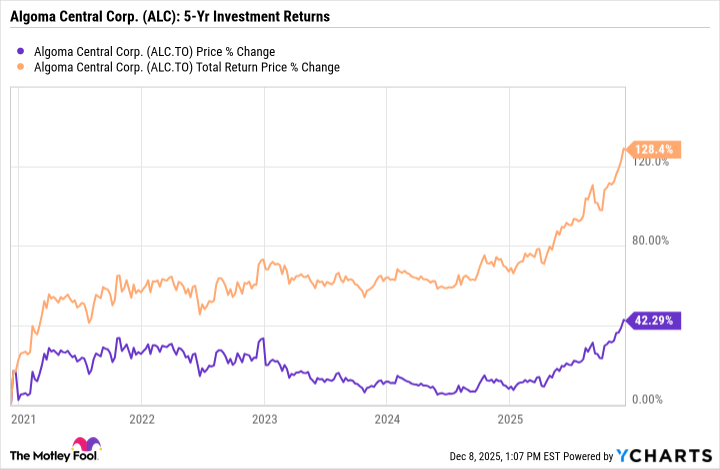

The Algoma Central stock dividend yields 4.3% annually. It propelled total returns on the sea shipping stock from a 42% capital gain to a 128% total return over the past five years.

Regular and special dividends have been significant drivers of total investment returns on ALC stock, and the future could look this way if management sticks to dividend raises as the fleet, rates, and partnerships grow.

Algoma Central stock is a value play that trades below book value and at a low price-earnings multiple of 7.7.