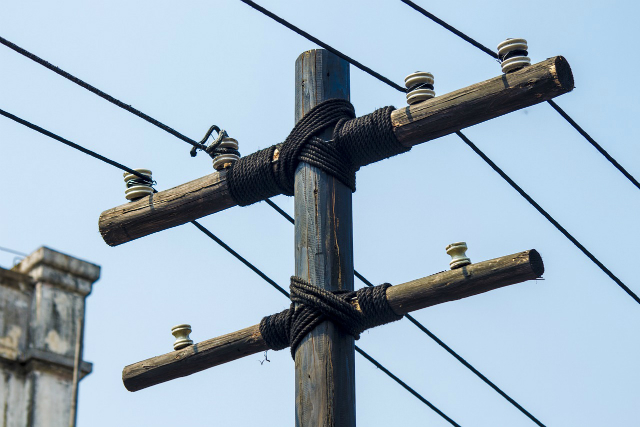

Coming to market in November of 2016, Hydro One Ltd. (TSX:H) was a very exciting initial public offering (IPO) for many investors, specifically for those in Ontario who couldn’t wait to get a piece of the pie they’ve paid into as customers for so long. Hydro One is the company responsible for getting the electricity to Ontario consumers, enabling them to heat their homes.

However, consumers in Ontario aren’t very happy with the price they’ve had to pay for electricity. In recent months, there have been demonstrations at Queens Park in Toronto. Consumers have made it very clear: electricity is too expensive. With demonstrations like this, future price increases may become very difficult for the company. Earnings may not take the upwards trajectory that many new IPOs do; the growth just isn’t there to sustain a higher stock price.

As investors, the situation leads us to set proper expectations regarding the amount of risk and reward when purchasing this security. With this investment, new investors will receive a yield on cash (YOC) of approximately 3.5% with only small potential future dividend increases or future capital appreciation; it may be best to dump this security and look elsewhere to make money.

Looking at another company in the same space, Algonquin Power & Utilities Corp. (TSX:AQN)(NYSE:AQN) offers new investors a YOC in excess of 5% with a much higher opportunity for capital appreciation. There is a similar payout ratio between Algonquin Power & Utilities and Hydro One.

When digging into the financials of Algonquin Power & Utilities and the company it just acquired, Empire District Electric, for $3.2 billion, the potential becomes obvious. Since Empire District Electric previously had a much lower dividend-payout ratio, the potential for an increase is now imminent.

Unlike Hydro One, which is clearly in the public spotlight, most consumers have never heard of Algonquin Power & Utilities, which is responsible for generating the electricity — and not for billing — for individual households.

Although the dividend as a percentage of cash from operations (CFO) for both companies (assuming the combination) is approximately 40%, Algonquin Power & Utilities, in reality, has a much higher potential for dividend increases. It’s able to pay a higher amount of CFO in dividends, so the company doesn’t have to be overly concerned with the retail customer or the public perception of the company. Advantage: Algonquin Power & Utilities.

As has been proven time and time again, most IPOs don’t lead to above-average profits for investors who purchase shares on the open market in the year following the IPO. The excess profit is typically made by those who are part of the IPO process and potentially those who buy much further down the line.

I will be avoiding Hydro One and opting for Algonquin Power & Utilities during the next year in the hopes of buying a company with an increasing dividend.