Day-to-day price swings are the least of our concern here at The Fool. Generally speaking, we’re long-term investors. So, we pay far more attention to what a given company is doing, as opposed to what its stock is doing. Of course, taking a closer at particularly big swings can be useful — just in case the long-term thesis has changed.

With that in mind, here are three stocks that were hit hard last week. Will they keep slumping? Or will they bounce right back?

Let’s try to figure it out.

Hydro One

It was a trying week for Hydro One Ltd. (TSX:H) investors, who watched their shares fall about 5%. The big news, of course, was the ousting of CEO Mayo Schmidt (along with the entire board) by Ontario premier Doug Ford.

Bay Street is naturally nervous.

Plenty of uncertainty surrounds the new management search. And there’s worry about what Ford’s intervention will mean for Hydro One’s long-term direction. While Schmidt’s high pay was controversial, he was definitely “all-in” on growth.

That said, Hydro One’s current dividend yield of 4.6% — almost the highest it’s ever been — looks awfully tempting.

Couple that fat yield with a comforting payout ratio of 74%, and you have the makings of an attractive contrarian income play.

Silver miners

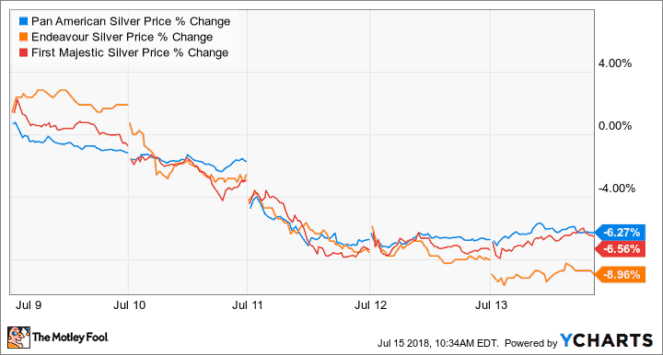

Silver companies across the board also had a bad week.

Small-cap miners like Endeavour Silver Corp. (TSX:EDR)(NYSE:EXK) were hit especially hard — down 9% over the past five days. But even larger plays, including Pan American Silver Corp. (TSX:PAAS)(NYSE:PAAS) and First Majestic Silver Corp. (TSX:FR)(NYSE:AG)weren’t spared from the beat-down.

As usual, the move in silver miners was directly related to the move in the price of silver. And on Tuesday, the price of silver fell below $16 per ounce. I’m no chartist, but there’s probably fear that silver will keep falling below this “threshold” level.

Unless you can handle the high volatility of with these silver plays (few can), staying on the sidelines seems prudent.

Marijuana stocks

Big weed stocks Aurora Cannabis Inc. (TSX:ACB) and Canopy Growth Corp. (TSX:WEED)(NYSE:CGC) round out last week’s list of losers. They’re down about 7% and 4%, respectively, over the past five days.

To be sure, there wasn’t any big bad news that caused the declines. It was probably just part of the natural roller coaster of weed stock investing. After all, the stocks have been on a nice tear since May, so profit taking was definitely to be expected.

But where do investors go from here? Tough call.

The cannabis industry’s long-term growth prospects are alluring. But the space is still young, speculative, and volatile. That said, if you were dead-set on jumping in, this recent “technical” pullback might be a good chance to do it.

Foolish bottom line

There it is, Fools: six stocks that suffered notable losses last week.

They might look a bit scary. But as long as you do your homework and proceed with caution, one or two plays might be worth pouncing on.