It seems like everything that could have gone wrong did go wrong for Goldcorp’s (TSX:G)(NYSE:GG) third quarter. The gold producer reported a huge loss with gold production of 503,000 ounces that was 20.5% lower and all-in sustaining costs (AISC) rising 20.8% to US$999 per ounce, compared to the same quarter in 2017.

After reporting the results on Thursday, Goldcorp stock fell as much as 18%. That was probably an overreaction, as the stock bounced 4.4% the following day.

We should not read the negativity from face value, though. Let’s take a step back and look at the results objectively.

Net loss for Q3

In Q3, Goldcorp reported a net loss of US$101 million or $0.12 per share. However, there was a loss of $0.04 per share due to foreign currency translation. Excluding the non-cash item, the loss would have been a bit more digestible.

Reasons for the poor quarter

Management pointed out that a part of the reason for the poor quarter was because the company completed the Pyrite Leach project ahead of schedule and decided to prioritize low-grade material in its flagship mine.

Goldcorp invested US$420 million in the Pyrite Leach project to improve the processing facilities at the Peñasquito mine in Mexico. As explained on the company’s website, the project “will make processing higher carbon sulphide ore more efficient and recover 40% of the gold that currently sits in the tailings as waste.”

Better results coming soon

Since the processing facilities at the Peñasquito mine were being upgraded, there was unavoidable lower production for Q3. Now that the upgrade is complete, Q4 is expected to achieve much better results, especially since the gold price trades at +US$1,200 per ounce, while the company expects AISC to be about US$750 per ounce next quarter.

In the press release, it stated, “Goldcorp expects gold production and operating costs to improve substantially in the fourth quarter of 2018 to approximately 620,000 ounces of gold at AISC of approximately US$750 per ounce as substantially all of Peñasquito’s production will come from higher grade ore from the main Peñasco pit, and Éléonore and Cerro Negro continue their ramp ups to optimum production rates.”

Investor takeaway

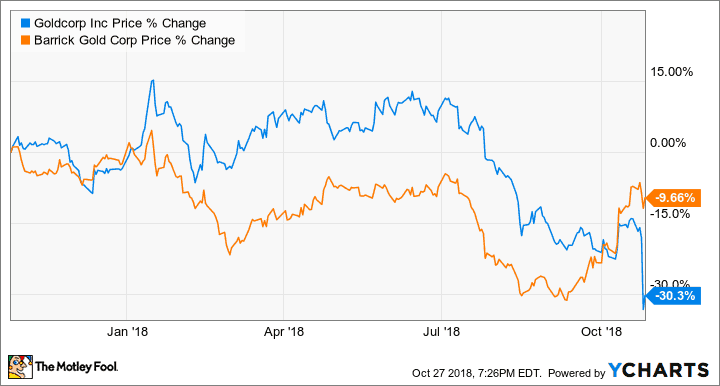

G data by YCharts. G underperformed ABX in the last year.

Goldcorp has substantially underperformed Barrick Gold in the last year and three-year periods. The company has been working on improving its efficiencies and aims to achieve US$350 million of sustainable annual efficiencies by the end of 2019. By mid-2018, it had achieved US$250 million.

At $11.58 per share as of writing, Goldcorp is ridiculously cheap. The consensus analyst 12-month target is +70% higher. With the Pyrite Leach project delivered ahead of schedule in Q3, we should see substantially better results next quarter, which could send the stock much higher.