Non-destructive excavator Badger Daylighting (TSX:BAD) is a magnificent recovery story, as the stock is currently trading at all-time highs after a 46% rally so far in 2019, while shrugging off a malicious short-seller attack. There could be further price momentum if the company maintains its earnings-growth trajectory shown in its first-quarter results release in May.

Here are three reasons why investors may want to consider loading up on the stock, even when the share price has already taken off.

Strong revenue growth, better outlook

First-quarter revenues grew by a staggering 22% over comparable revenue in 2018, mainly as a result of a strong U.S. segment sales performance.

The strong showing from U.S. operations resulted from “increased customer demand as a result of the ongoing adoption of hydro excavation as the preferred method for non-destructive excavation” and may be expected to recur in future accounting periods.

The company’s internal sustainable revenue measure, the revenue per truck per month (RPT), has shown sustainable per-unit growth in the first quarter over the past three years too, with a RPT of $30,832 per month coming in 8% higher than in a prior year comparable quarter.

RPT per month has grown 46% since the first quarter of 2016, and the sales measure is 24% higher than comparable 2017 figures, as the company benefited from improved asset utilization.

Most noteworthy, management anticipates to add between 190 and 220 new hydrovac trucks to the fleet this year on top of the 1,221 units already in service going into 2019, and these could generate even more revenue if the company’s sales channel manages to keep sourcing new business, as demonstrated in the first quarter.

Better profit margins

The company reported some impressive margin expansions in the first quarter of this year.

The quarterly gross margin was 14% stronger at 29% for the quarter, while the adjusted EBITDA margin, a very strong measure of operating profitability, was nearly 12% higher at a nice 22.7% — much better than comparable quarterly performance last year.

Margin expansions show increasing earning power in the company’s assets and business processes, and investors will pay higher premiums for higher-quality earnings. We could see Badger’s price-to-earnings multiple rise higher if the stock’s valuation multiple reflects the improving earnings quality.

Very encouraging was the revelation by management that first-quarter margins benefited from lower direct operating expenses and improved asset utilization, which are sustainable sources of earnings growth.

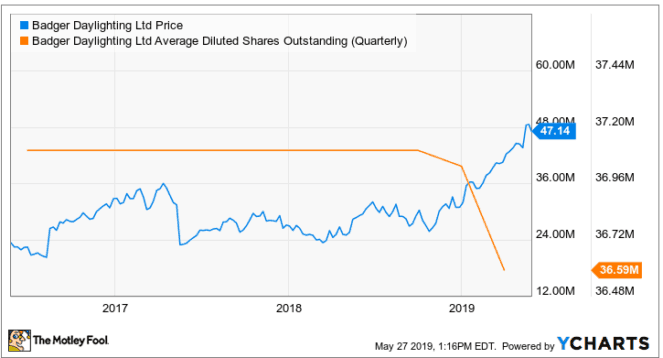

Company is reducing its share count

While recovering from a massive short-seller attack, management saw a great opportunity to buy back some of the company’s outstanding shares at low valuations. The remaining shareholders will enjoy a larger piece of the Badger pie as the share price hits record highs.

The company announced a normal course issuer bid (NCIB) to repurchase up to 7.5% of its public float in May last year and went on to buy about 63% of the allowable 2,000,000 shares in the NCIB before it expired this year.

Subsequently, management managed to renew the NCIB this month and can repurchase up 5.61% of the available outstanding shares until May 2020. Such opportunistic buys will improve all per-share metrics, including reported earnings per share, resulting in better valuation for the stock, all else equal.

A dividend increase could be easier to effect if corporate cash flows continue to grow and per-share values improve over time.

Foolish bottom line

There’s so much to like about this Badger, and the current price momentum could sustain for much longer as the year progresses. The company has even raised its monthly dividend, and if operating performance continues improving, we could see income investors flocking to the stock too.