In no uncertain terms, Microsoft (NASDAQ: MSFT) is coming after Slack (NYSE: WORK). After opting not to make a multibillion-dollar acquisition offer years ago, the enterprise software giant instead developed its competing Teams app internally, which launched in 2016. Teams recently eclipsed Slack in terms of daily active users (DAUs), but Slack still isn’t concerned.

Slack’s first earnings release as a public company disappointed investors, as its guidance suggested decelerating growth, but it continues to brush aside fears about Microsoft.

Anecdotal evidence

Microsoft Office 365 is easily the most prominent competitive threat that Slack faces, as Teams is bundled in with the suite for little to no extra cost. Even if Slack is better than Teams in numerous ways, Teams might be good enough to displace Slack given its lower cost. A recent survey of IT executives and decision makers suggested that many organizations are planning to reduce spending on Slack’s software-as-a-service (SaaS) platform in favor of Microsoft Office 365.

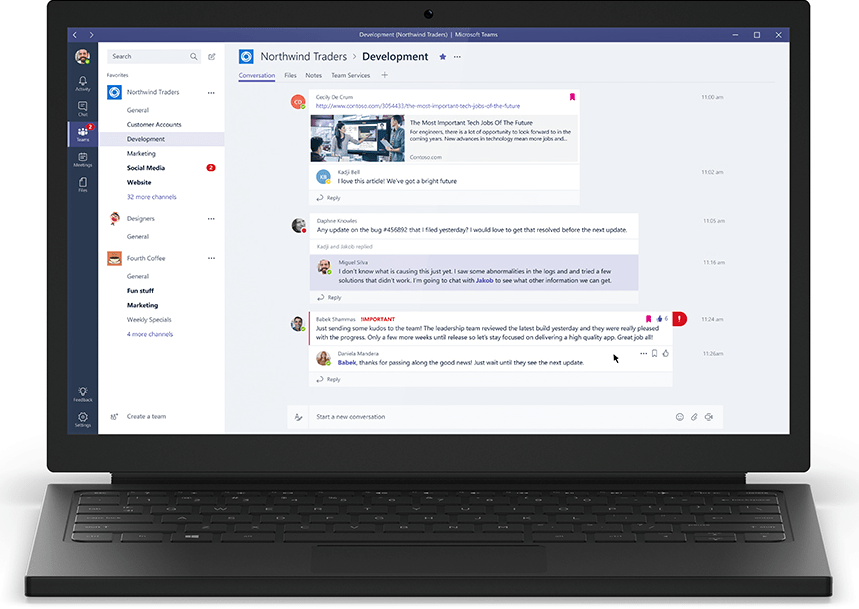

Slack. Image source: Slack.

It should come as no surprise, then, that Slack CEO Stewart Butterfield discussed Office 365 quite a bit on the conference call this week, pointing to examples where mutual customers still preferred Slack. For example, a large financial services firm that has been a longtime customer continues to expand its Slack implementation, according to Butterfield:

Of course, like most of our large enterprise customers, they run on Office 365. They still chose Slack because only Slack was capable of meeting their needs. Increasingly, in regulated industries, we are seeing significant traction because Slack wants security and compliance with scalability, an open platform and a great user experience.

Butterfield recently pointed to Slack’s interoperability as a key differentiator and competitive advantage. The chief executive provided another example to illustrate how important Slack’s approach is:

This is another Office 365 customer, and they chose Slack because only Slack’s open platform integrates with the full range of internally and externally developed tools they use. With more than 1,800 apps in our app directory ranging from partners like Atlassian, Salesforce, SAP, and Zoom, to Slack-first services like Lattice, Guru, and Troops, our open platform continues to play an important role in enterprise adoption.

It’s not uncommon for companies to tout specific examples of customer wins on earnings calls, but the evidence is still largely anecdotal. It remains to be seen whether Microsoft can continue putting a dent in Slack’s growth. Slack is still growing its paid customer base, as well as the number of customers that generate over $100,000 in annual revenue — all while maintaining a strong net dollar retention rate.

If those key metrics start to deteriorate, it will almost certainly be due to Microsoft.