Finding a safe energy stock to invest in that also pays dividends is a tall task. Low oil prices compounded by a lack of demand for travel is making it difficult to find decent stocks to buy that also have exposure to the industry. But there’s one energy stock that’s doing well amid the pandemic, so much so that it’s not even changing its outlook for 2020.

TC Energy (TSX:TRP)(NYSE:TRP) released its second-quarter results on July 30 for the period ending June 30. Remarkably, the company’s profits were higher than they were a year ago. Net income of $1.3 billion was up 13.8% from last year’s tally of $1.1 billion. Although revenue of $3.1 billion declined by 8.4% year over year, lower operating expenses and a decline in financial charges resulted in a pre-tax profit that looked nearly unchanged from the prior-year period. The bump up in net income was due to a lower tax bill this quarter.

The company credits the stability of its financials to regulated assets and long-term contracts that it has in place, which generate about 95% of the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA). That, in turn, also makes its dividend strong.

Dividends are secure and further increases are still on the way

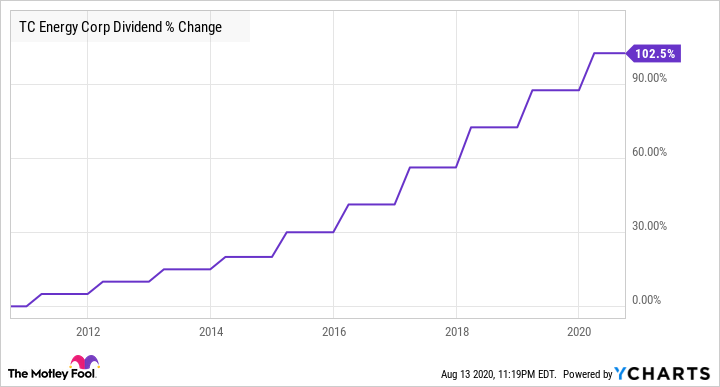

The Alberta-based energy company is doing so well that it anticipates it will be able to continue growing its dividend by between 8% and 10% next year and between 5% and 7% after that. Currently, the company pays a quarterly dividend of $0.81, which on an annual basis yields 5%. TC Energy’s been growing its dividend over the years, with its latest hike being an 8% increase from the $0.75 that it was paying a year ago. Over the past 10 years, the company has doubled its dividend payments:

The dividend payments were just $0.40 a decade ago and have increased at an average compounded annual growth rate of 7.3% during that time. It’s a good sign that even amid the crash in oil prices, TC Energy was able to continue hiking its payouts, and even now, amid the pandemic, it’s planning to continue with more rate hikes.

TC Energy reported a per-share profit of $1.36 in Q2, which is well above its per-share dividend of $0.81. That computes out to a payout ratio of 60% if TC Energy is able to continue posting such strong profit numbers.

Is the stock a buy?

There’s little doubt that TC Energy might be one of the best energy stocks out there right now. With a solid dividend that’s likely to increase, and shares of the company trading at just 14 times their earnings, it makes for a solid value investment and dividend stock to put into your portfolio. While it’s not a stock that I’d suggest buying and forgetting about, the stability that offers through long-term contracts and regulated assets means that, at least for the foreseeable future, things should remain relatively stable for the company.

Year to date, TC Energy’s stock is down a modest 6% — just a few points below the TSX’s 3% decline thus far.