Do you have room in your Tax-Free Savings Account (TFSA) and are looking for a safe dividend stock to put in it? The good news is that there are plenty of options available for you.

Below, I’ll show you two stocks that pay decent yields — one as high as 5.4% — that you can safely put into your TFSA for years and not worry about. They’re well known and stable companies based out of Montreal that don’t need to worry about demand running low for their products and servies.

BMO

First on the list is Bank of Montreal (TSX:BMO)(NYSE:BMO). The Big Five bank stock may sound like a boring investment, but that also makes it stable. From credit cards to personal banking products, mortgages, and investment services, BMO offers a wide range of services that are essential for the economy and its health. And when things are going well in the economy, revenue and profit numbers are strong for a top bank like BMO.

Admittedly, the outlook could be better amid COVID-19, as many investors are down on financial stocks. However, that’s a mistake, because over the long term, bank stocks will continue to perform well.

While the economy’s in a recession right now, BMO will come out of it, and when it does, banking activity will be up, and the banks will be looking great again. The benefit of buying BMO stock today is that it’s so cheap. It’s currently trading at $78 per share. Prior to 2020, the last time shares of BMO were trading this low was back in early 2016.

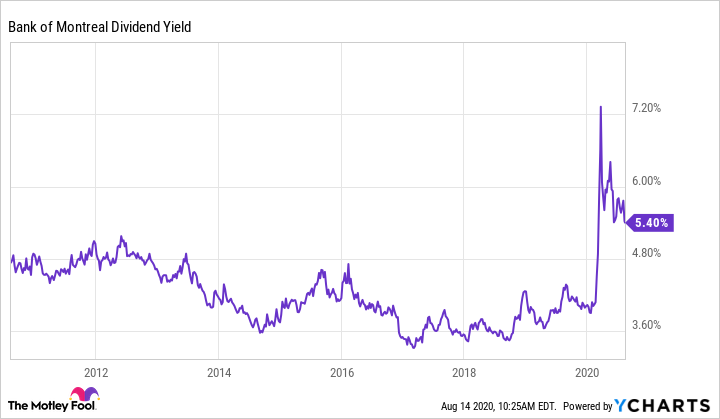

And yet, its dividend remains intact. Buying at a reduced price means that investors today can earn a dividend yield of 5.4%. That’s a lot higher than the bank stock normally yields:

Outside of this year, you would’ve been very lucky to buy shares of BMO and earn this high of a payout.

Saputo

Saputo (TSX:SAP) doesn’t pay nearly as high of a yield as BMO does, but at around 2%, it’s still a good way to boost your portfolio’s recurring income. Saputo recently raised its quarterly dividend payments by 2.9% from $0.17 to $0.175.

But what makes this stock a great long-term hold is that the company sells many types of dairy products all over the world. Its products are essential for many people, and whether there’s a recession or a pandemic, the demand for dairy products is going to be there.

That’s why it’s no surprise that in the company’s most recent quarterly results, which were up until the end of June, Saputo’s numbers didn’t take much of a big hit. It did see a modest 7.6% increase but many companies have suffered more significant declines amid lockdowns due to the COVID-19 pandemic.

And while sales dropped in the U.S., in its Canadian and European segments, Saputo’s sales were up during the quarter. Total net earnings of $141.9 million were also 16.9% higher than what the company reported during the same period last year.

Saputo’s generally been very safe in that regard, recording profit in each of its last 10 reporting periods.