The share price of Suncor Energy (TSX:SU)(NYSE:SU) is down significantly in 2020, but a rebound in Suncor stock could be on the way next year.

Oil price impact on Suncor stock

West Texas Intermediate (WTI) oil started 2020 above US$60 per barrel. Then the pandemic hit and sent the market into a tailspin. As governments around the world implemented lockdowns and travel restrictions, oil prices tanked on falling demand. By the end of March, WTI was down to US$20. At one point in April, the futures price went negative amid fears the world would run out of storage capacity.

Once countries began to reopen their economies in May, demand started to recover, led by China. Oil gradually drifted higher through the summer, finishing August above US$40 per barrel. The market gave back some gains in the first two weeks of September but has moved higher in recent days.

At the time of writing, WTI oil trades near US$41 per barrel.

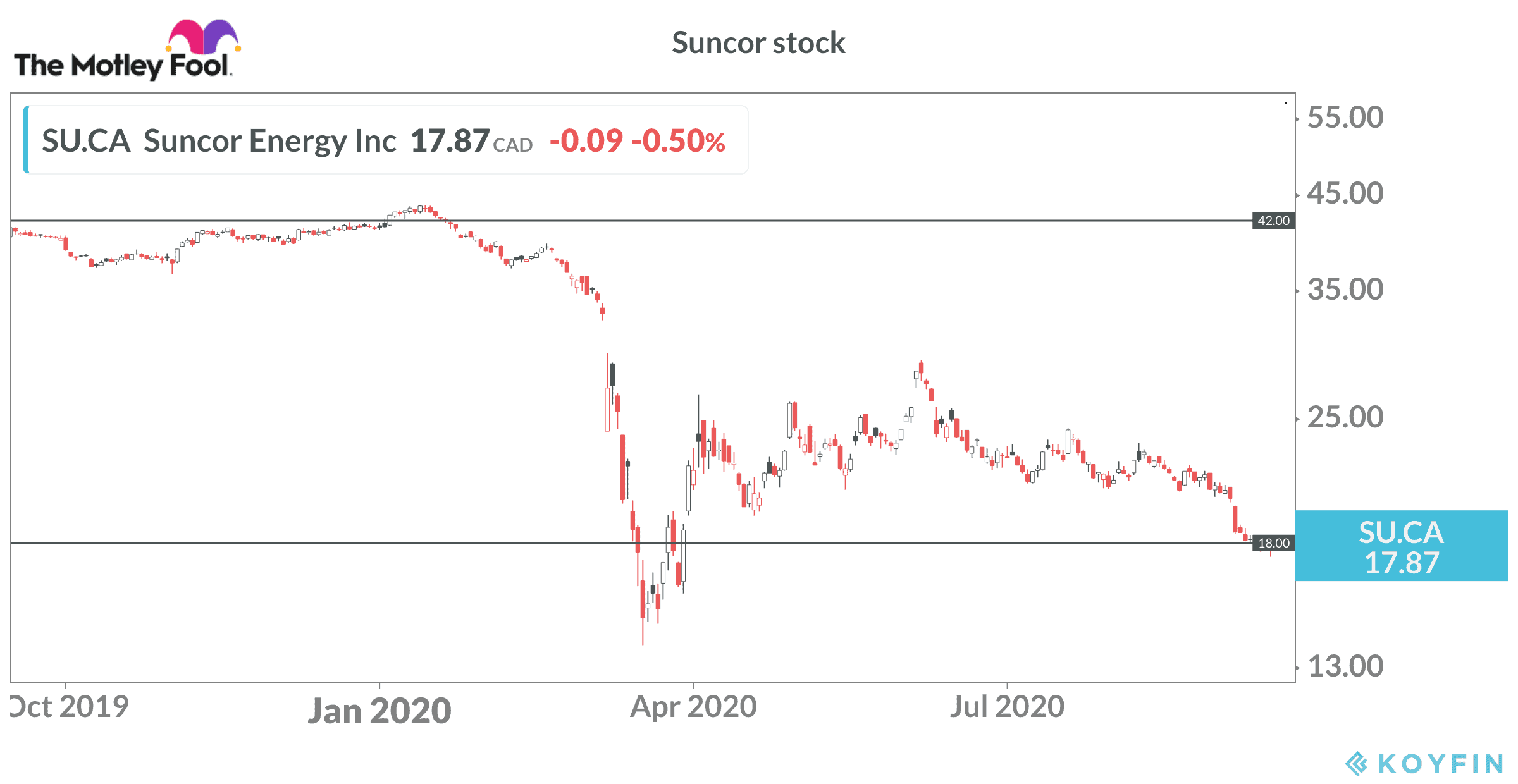

Suncor stock initially followed the moves in the price of oil. The share price dropped from above $40 in January to a March closing low near $15. A choppy recovery occurred in April and May, and by the first part of June, the stock traded as high as $28.

Since then, however, Suncor’s share price has trended lower, despite relative strength in the oil market. At the time of writing, investors can buy Suncor stock for less than $18.

Is Suncor stock oversold?

Markets tend to be forward-looking, and this might explain why Suncor trades so cheaply today.

Despite WTI’s move back above US$40, investors are pricing in difficult times for Suncor. The International Energy Agency (IEA) says the outlook for oil is becoming “more fragile” with new waves of COVID-19 infections rising in several key markets, including Europe and the United States.

In its latest report, the IEA highlights slowing demand recovery in the oil market due to ongoing weak fuel demand. People continue to work from home, and the airline industry remains challenged.

China’s buying binge has slowed, and IEA research indicates a resurgence in demand for ships to store oil.

In short, the near-term outlook appears bleak and that might be why Suncor stock remains under pressure. The company is not only a producer, but it also owns four large refineries and has roughly 1,500 Petro-Canada retail locations.

Opportunity for big gains

Warren Buffett is famous for saying investors should be greedy when the market is fearful. It doesn’t always work, but the idea is that things tend to re-balance, especially in commodity markets. In fact, Warren Buffett’s Berkshire Hathaway has owned Suncor stock in recent years.

COVID-19 vaccines could be widely available by the middle of next year. This should drive a recovery in the airline industry. In addition, people are expected to return to their offices next year. That might trigger a strong surge for gasoline, as commuters decide to drive rather than take public transport.

Beyond 2021, some energy analysts predict a strong oil market in five years. Record cuts to investment in the industry could eventually lead to tight supplies and drive prices significantly higher.

Should Suncor stock be on your buy list?

Ongoing volatility should be expected in the next few months, but contrarian investors might want to start buying Suncor stock at this level. You get paid a nice 4.7% dividend yield and have a shot at attractive gains as the market recovers.

The global economy could rebound stronger than expected in 2021 and oil prices should drift higher. In that scenario, a rally in Suncor stock back above $35 by the end of next year wouldn’t be a surprise.