Here at Motley Fool, our goal is help investors navigate the equity markets and build wealth. This looks different depending on the state of the markets. These days, the market appears like it may be on the cusp of another market crash. A second wave of the coronavirus is building, and more economic pain is heading our way.

In this article, I would like to share my two top stocks to buy when the market crashes. They are on my watch list, and I stand ready to move in and buy on weakness.

Fortis stock is the stock to buy for income and stability

Fortis (TSX:FTS)(NYSE:FTS) is a North American leader in the regulated gas and electric utility industry. This means that revenues are quite stable and predictable. This also means that revenues are pretty insensitive to economic weakness.

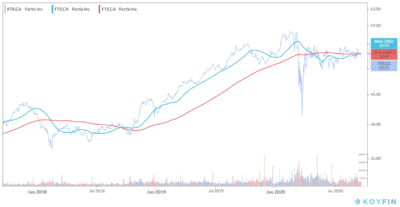

Despite these facts, Fortis stock lost 28% its value in the stock market crash back in March 2020. Today, Fortis has recovered most of that loss. In the chart below, we can see that Fortis’s stock price is high relative to the last three years. I have also graphed Fortis’s short- and long-term moving average. In technical analysis terms, when the short-term moving average crosses the long-term moving average, we have a buy or sell trigger.

I’m waiting for Fortis stock price to trade in the $40 range again. Once this happens, I plan on watching the chart carefully. I’ll make my buy move when Fortis’s short-term moving average crosses its long-term moving average on the upside.

So, while Fortis’s stock price will get hit in a general market crash, there are a few key points to remember. Fortis’s earnings are rising, even in these difficult times. Fortis’s liquidity position remains strong at $5 billion. And Fortis has a low-risk, highly executable plan that will ensure long-term growth. These are the many reasons why Fortis is a top stock to buy when the market crashes.

Northwest Healthcare Properties: A top stock to buy for yield and growth

Northwest Healthcare (TSX:NWH.UN) stock is attractive for its 6.9% yield and its anticipated growth. This REIT is owner/operator of a diversified portfolio of global healthcare assets. It has exposure to a defensive stream of revenue. Northwest currently enjoys a 97.3% occupancy rate, and 85% of its revenue is backed by public healthcare funding.

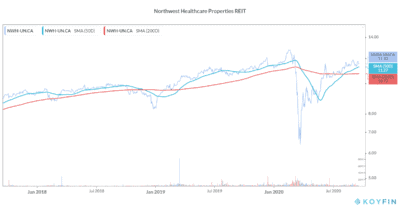

Northwest Healthcare Properties REIT’s share price was also hit hard in the March 2020 market crash. It fell by more than 50% to $6.64. This is despite the fact that Northwest’s revenue and income were only marginally affected by the coronavirus crisis. Today, the stock price has recovered to $11.50. The chart below illustrates this as well as the moving averages.

I will buy Northwest when the next market crash takes it down below $10.

Motley Fool: The bottom line

There are admittedly many top stocks to buy when the market crashes. In this article, I have focused on two defensive stocks that I’m ready to snatch up. We at Motley Fool believe in investing for the long term. Given the unprecedented economic challenges ahead, I am sticking with more defensive stocks at this time.