It can be tempting to simply go for growth stocks, value stocks, or even funds when it comes to investing. These stocks are either exciting and strong or solid and stable. But if you’re going to be a strong investor, a dividend stock is a must for your portfolio.

A good dividend stock will give you cash every single quarter or even month, like a paycheque. That passive income isn’t a luxury but can be used for reinvesting, paying down debt, or simply providing you with more household income. During a pandemic, it could even be the difference between staying afloat and sinking beneath the surface.

With more waves of the pandemic already underway, it could mean another wave of layoffs. That means you need to prepare, and quickly, for another economic downturn. Having cash on hand isn’t enough. Instead, find a strong dividend stock that you know will continue making payouts even amid a crash.

A high-yield dividend stock

There are many dividend stocks out there to choose from, and many are considered high yield right now. So, be careful. Not every dividend stock is created equal. Even as I give you this stock as an example, do your research before making a decision. That being said, Brookfield Property Partners (TSX:BPY.UN)(NASDAQ:BPY) is a strong company that could bring in solid passive income for years.

Brookfield currently pays an incredible 11.21% dividend yield as of writing. That yield is exciting, because you can see your portfolio grow by leaps and bounds if you choose to reinvest that income rather than spend it. Just a $10,000 investment in the company today would bring in annual income of $1,193!

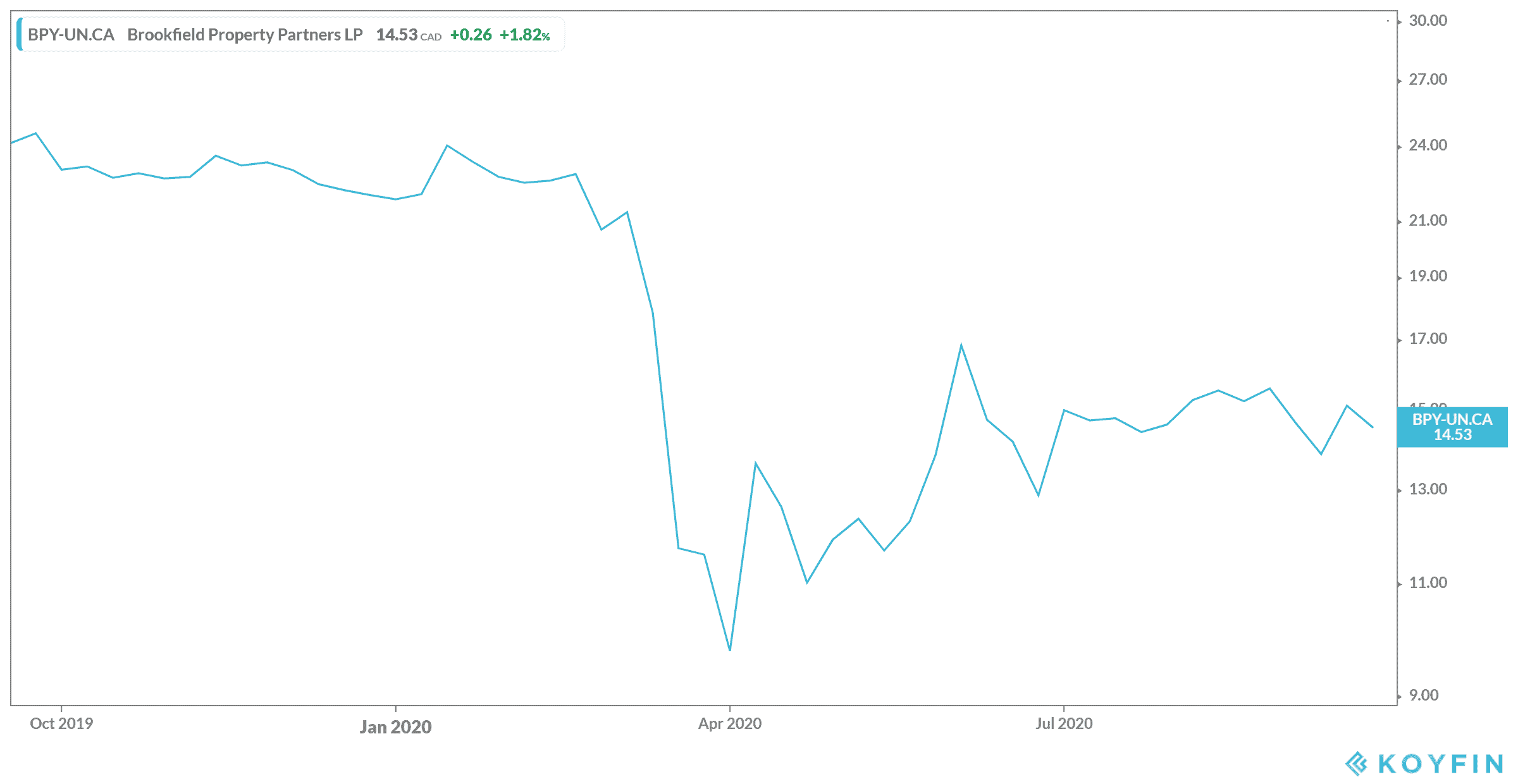

With a pandemic now happening, that dividend stock is a strong buy, as it has continued to pay this solid dividend. You can practically count on the company continuing to deliver the dividend, even amid another crisis. This is also strengthened by the fact that the company is backed by Brookfield Asset Management, an investment firm that’s been around since 1899, with trillions to fall back on. So, right now, as you can see below, the company is still a bargain trading a below-crash levels.

So, say you were to invest $50,000 into Brookfield Property today, that would bring in $5,965 per year. By reinvesting those funds, you could see your portfolio skyrocket in the next few decades. In 20 years, you could have a portfolio worth $1.26 million with conservative share and dividend growth.

If that growth is done in a Tax-Free Savings Account (TFSA), you can see by its name that those funds would then be withdrawn tax free. That’s something you could live on for the rest of your life!

Bottom line

Whether its Brookfield Property or another dividend stock, these companies are the best way to protect your present and your future. By putting even just $10,000 into a dividend stock in a TFSA, you can bring in over a thousand dollars each year to reinvest. You’ll then relax knowing you have money set aside for an emergency and for the day you’re ready to enjoy it.