Dividend investors constantly search for high-quality stocks that pay reliable distributions. Ideally, the companies also offer above-average yields.

Is Enbridge stock a top dividend pick?

Enbridge (TSX:ENB)(NYSE:ENB) currently offers investors a dividend yield north of 8%. Historically, the warning signs normally start to go off for dividend investors when yields drift above the 7% mark. It doesn’t always mean a dividend cut is on the way but often signals concern in the market that the payout isn’t sustainable.

The energy sector certainly faces challenges. Oil prices remain low due to weak demand caused by pandemic lockdowns. Fuel usage is starting to pick up again, as people drive more and commercial fleets ramp up deliveries to reopening businesses. The airlines face a longer road to recovery, and jet fuel demand isn’t expected to recover for a few years.

This all impacts Enbridge’s pipeline network. The energy infrastructure giant transports roughly 25% of all the oil produced in Canada and the United States. Refineries cut crude oil demand as a result of reduced fuel consumption in the past six months. The drop resulted in a decline in throughput across Enbridge’s network, which normally runs near capacity.

Near-term risks remain, but Enbridge has the financial capacity to ride out the slump. The natural gas distribution utilities and the renewable energy facilities continued to perform well in the second quarter. This should help Enbridge maintain decent distributable cash flow until the liquids pipelines see throughput return to previous levels.

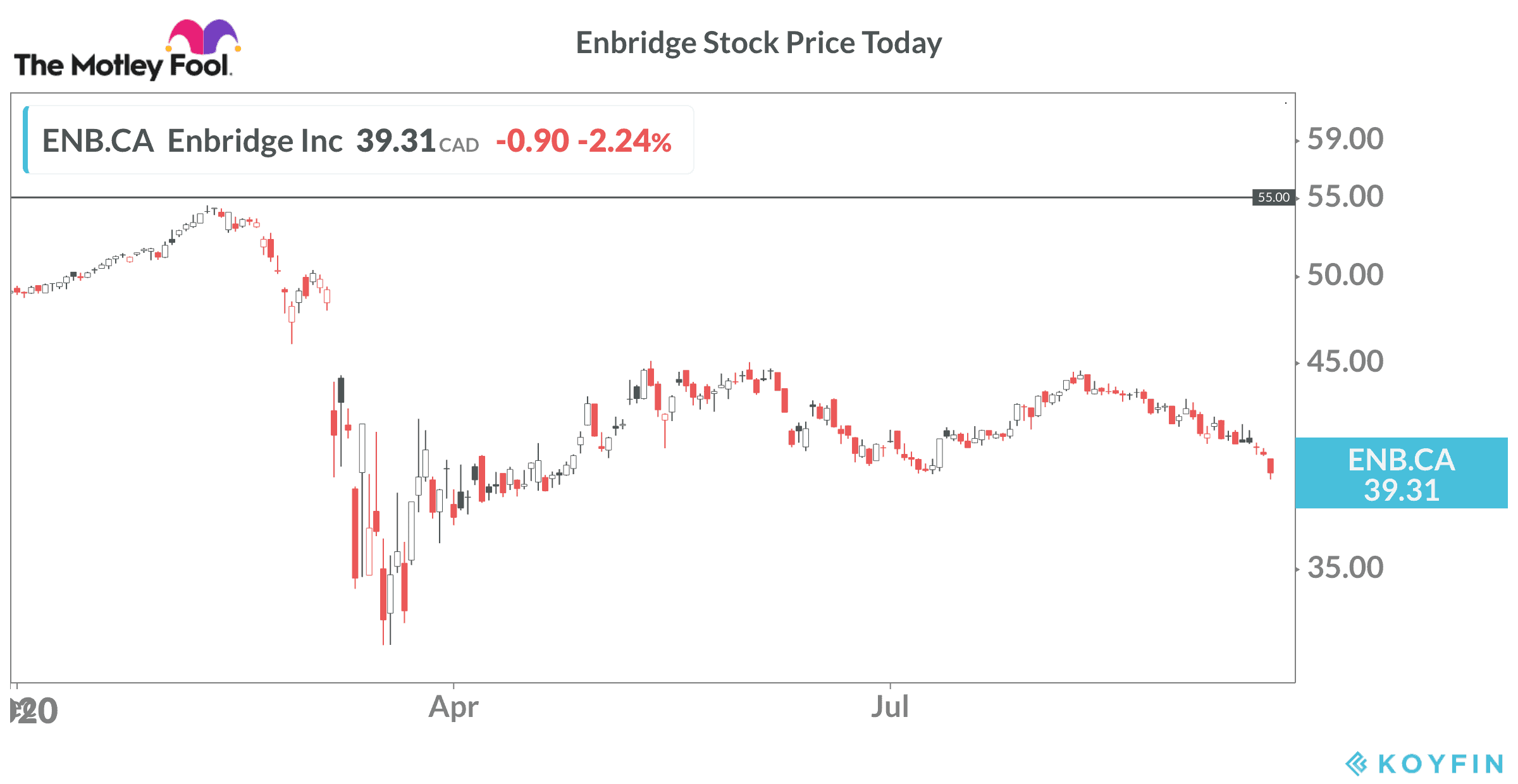

The stock trades near $40 per share compared to the 2020 high around $57, so the upside potential is significant. In the meantime, the dividend should be safe.

Is BCE stock cheap right now?

BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest communications company. The stock has always been a popular pick among income investors for its reliable dividends. That shouldn’t change anytime soon, even as BCE navigates the challenges of the pandemic.

BCE spent billions of dollars over the past decade to build a strong media division. The company bought a TV network, specialty channels, and radio stations. BCE is also a partner in MLSE, which owns the Leafs, Raptors, Argos, and Toronto FC pro sports teams.

BCE’s mobile, internet, and TV subscription services make up the bulk of the revenue and profits. These are considered essential services by most businesses and households and tend to be recession-resistant operations.

Once COVID vaccines become widely available, all aspects of the business should return to more normal revenue streams. BCE has a strong balance sheet, and low interest rates mean it can access capital very cheaply to finance network upgrades and potential acquisitions.

The stock trades near $55 per share and provides a solid 6% dividend yield. BCE started the year around $60, so it is holding up quite well, despite the challenging market conditions. Investors could see 20% upside in the share price over the next two years as the economy recovers.

The bottom line

Enbridge and BCE are leaders in their respective industries and have strong businesses that should ride out the downturn in decent shape. The stocks appear oversold right now and offer above-average yield that can be used for income or reinvested in new shares.

If you only buy one and can handle the added volatility, Enbridge looks like the best bet today. Investors who prefer more stability and are willing to take a slightly lower yield should probably make BCE the first choice.