The TSX Composite Index fell 5.3% this month as investors cashed out some profits amid uncertainty around the new benefits. But the Justin Trudeau government gave investors another reason to rejoice. It upped the new recovery benefits to $500 a week, bringing them on par with the Canada Emergency Response Benefit (CERB). This announcement of CERB extensions sent the stock market up 1.1% on September 28 and just averted another market crash.

CERB extensions avert another stock market crash

Back in April, the stock market began to rally even when the gross domestic product (GDP) contracted. This rally was backed by the liquidity the CERB provided. The $2,000 benefit payment increased household disposable income by 10.8% in the second quarter, even when millions of Canadians were jobless.

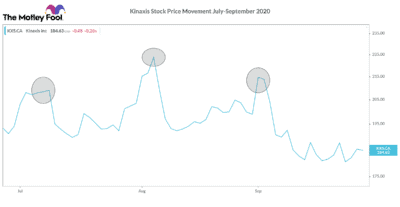

Canadians saved some of the benefits money and invested it in virus stocks like Kinaxis (TSX:KXS), Lightspeed POS (TSX:LSPD)(NYSE:LSPD), and Shopify (TSX:SHOP)(NYSE:SHOP). Hence, these stocks have doubled and tripled since March. In September, they fell around 13% after investors encashed some amount to prepare for a life without CERB. Now that the liquidity is back with the new CERB extensions, these stocks would return to growth.

The CERB extensions are better and more flexible than CERB. The Canada Recovery Benefit (CRB) and Employment Insurance (EI) are extensions to CERB and will give you $500 a week for 26 weeks. Also, the Canada Revenue Agency (CRA) will give $500 a week in sickness (up to two weeks) and caregiving (up to 26 weeks) benefits. It would pay these benefits after the end of the benefit period.

How to tap the next stock market rally

If you missed the April-August rally when the stock market surged as much as 30%, now is your chance to jump in. The new CERB extensions would once again fuel the stock market growth as banks are no longer an attractive investment with their near-zero interest rates. You can tap the next stock market rally through your Tax-Free Savings Account (TFSA).

Just set aside $100 from your $500 weekly benefits in your TFSA. Don’t rush to buy the virus stocks as soon as you get your payment. The overall market would be in the buy mode at that time, and you will land up buying the stock at its peak.

For instance, if you look at the above graph, Kinaxis stock peaked in the first five days of the month between July and September. It was in the first week of the month that the CRA processed CERB payments. For the rest of the month, the stock traded around $195, a 13% discount from its peak of $224. As a smart investor, wait for the stock to normalize and buy it in the second week. You will get a 13% discount.

Which stock should you buy?

All three stocks are good investments with the potential to thrive in the post-pandemic economy. Among the three, Lightspeed POS has higher growth potential as it is in its early stages of growth. It is trading at 33 times its sales and has an annual revenue growth rate of 51%.

Lightspeed maintained its revenue growth rate in the pandemic-driven lockdown even when its client base of restaurants and retailers took a big hit. In the second quarter, its revenue surged 51% even when the company did not enhance its e-commerce offerings, and the restaurant revenue was weak. In the coming few years, it would register revenue from its e-commerce stores, Lightspeed Capital, and restaurant platform. All this would accelerate its revenue growth and, therefore, its stock price.

Lightspeed has recently completed its U.S. initial public offering (IPO), in which it raised $397 million. It will use this capital for future growth opportunities. It might undertake acquisitions or broaden its platform beyond restaurants and retailers.

Even if Lightspeed stock reaches its all-time high, it marks a 16.7% upside. But the stock has the potential to make new highs in the coming few years. If you had invested $400 from your April CERB payment in Lightspeed, you would now have $995 in your TFSA.