While it might not be a bubble, e-commerce stocks have boomed this last year. These companies have soared amidst the work-from-home economy, with people and companies alike needing products delivered wherever they might be. While e-commerce already looked to continue booming for the next few years, in the last year it’s gone into overdrive.

In fact, some economists predict that the e-commerce industry will grow to $6.5 billion by 2023. But there’s a way to take advantage far before that. With the fourth quarter up for many companies in the next month or so, let’s look at the top e-commerce stocks you should consider.

Lightspeed

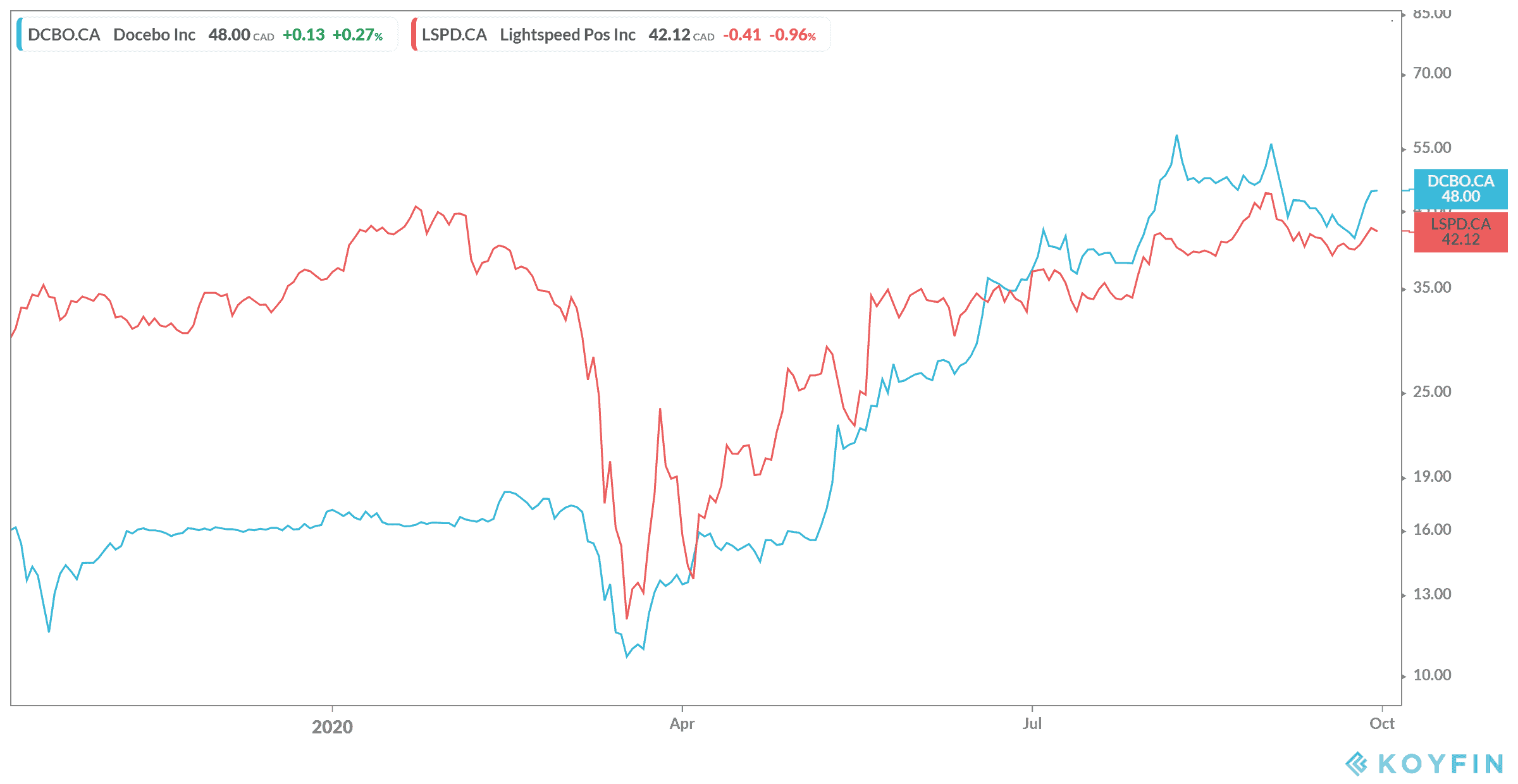

Lightspeed POS Inc. (TSX:LSPD) is a point-of-sale system mainly provided to retail and restaurant chains. Many of these chains have had to figure out a way to get online, setting up the perfect chance for Lightspeed to expand. The company has seen a massive increase in subscriptions to its service, and it looks to only be the beginning.

Since arriving on the scene in 2019, Lightspeed has grown about 130% as of writing. Its now trading near all-time high prices seen before the crash. The company continues to see year-over-year growth in revenue, most recently of 58% during the last quarter. What’s different about this next quarter? Well, the company is now on the New York Stock Exchange.

This gives them plenty of room to grow in the United States, where most of its clients are from. So expect some more huge growth in subscription services when earnings come out in early November.

Docebo

Another stock set to soar with e-commerce is Docebo Inc. (TSX:DCBO). The company offers learning management systems to companies looking to train employees anywhere in the world. The company came onto the scene just at the right time. Today, businesses need to be able to train workers from home. It also provides the opportunity to hire someone in another country — or at least another province — for the best person for the position.

Docebo has seen huge gains, growing almost 300% since its initial public offering in share price. In August, the company saw year-over-year growth of 55% in subscription revenue, the strongest growth in company history. You can continue to expect this type of growth from Docebo for years to come. And you can definitely expect to see this type of growth during the next earnings report.

Foolish takeaway

Both of these companies have provided investors with the opportunity for huge growth. While e-commerce has been around for a while, the pandemic has seen an enormous move to the use of e-commerce. Lightspeed and Docebo have a few things in common as to why the companies will continue to do well.

First, each came onto the scene last year, right before the pandemic hit, so both were able to see massive jumps in share price that should have taken years of proving their worth. Second, each also relies on subscription revenue. Subscriptions mean it’s not just a one and done buy. Instead, this is recurring revenue investors can look forward to for years to come.

As revenue continues to grow, more and more companies will then climb on board to these strong companies. So right now provides the perfect opportunity to buy up these strong stocks while the market is down, and before another strong earnings report.