Top integrated energy giant Suncor Energy (TSX:SU)(NYSE:SU) stock entered a crucial range last week. The stock lost more than 5% and closed at $16 last week. Notably, the Canadian energy titan continues to look weak, which might open a further downside for the stock.

Suncor Energy stock and its bleaker outlook

When oil prices settled around $40 per barrel for the last few months, energy companies hoped for a slow-but-stable recovery. However, the pandemic’s second wave has marred those estimates and oil companies are preparing for a slower and delayed recovery.

Suncor Energy management announced plans to trim its workforce by 10-15% over the next 12-18 months. The company cut its dividends by 55% in April to retain cash amid the pandemic. Investors can expect more of such measures in order to sustain longer in case of delayed recovery.

A $24 billion Suncor Energy will report its third-quarter earnings later this month. It has already lost more than $4 billion during the first six months of 2020. Its third-quarter earnings are not expected to please investors.

Along with the impact on its bottom line, management commentary will be an important indicator for investors. In September, Suncor Energy trimmed its production guidance for 2020 on the back of a fire at its Base Plant facility. So, in a nutshell, Suncor Energy is undoubtedly grappled with challenges, and the stock could see further downside.

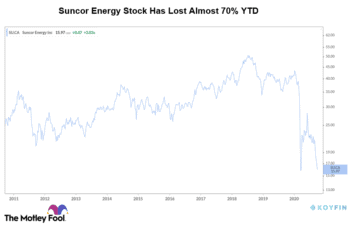

Suncor Energy stock at multi-year lows

Suncor Energy stock fell to $14—its 16-year low levels amid the dreadful coronavirus crash in March. Those levels might again act as support in the short term. In case the stock breaches below $14, it might push the stock further lower.

However, despite the weakness, I am positive about Suncor Energy stock for the long term. Its large integrated energy operations and operational efficiency stand tall among peers. The company looks strong fundamentally. The pandemic-driven uncertainty is hampering the Canadian energy giant. But notably, none of the energy companies across the globe are well placed in the current situation.

Suncor Energy stock is currently trading at a dividend yield of 5.4%, higher than TSX stocks at large. Its stable dividends will compensate for the stock’s potential weakness to some extent.

Warrant Buffett-led Berkshire Hathaway added to its Suncor Energy position during the second quarter of 2020. However, the stock has significantly corrected recently from those levels. It will be interesting to see whether the legendary investor further averaged it in the Q3.

What should investors do?

SU stock is currently trading at a price-to-book ratio of 0.6 times and looks insanely cheap from the valuation standpoint. That’s discounted compared to peers as well as to its own historical average. It has fallen almost 70% so far this year.

Interestingly, Suncor Energy stock might trade volatile in the short term and remains a risky bet. However, it’s a worthwhile opportunity for long-term investors to play the post-pandemic recovery. A one-time investment could be imprudent right now, but buying in portions will fetch a better deal.