Analysts fear rising coronavirus cases in major economies around the world could force new lockdowns and trigger a second market crash.

Investors who missed the opportunity to buy oversold stocks earlier this year might get another chance to add some of the best stocks on the TSX Index to their portfolios at cheap prices.

Bank of Nova Scotia

Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) began 2020 at $73 per share. The stock dipped below $47 in March and rebounded as high as $61 in early June. At the time of writing, the shares trade close to $55 and offer a 6.5% dividend yield.

Bank of Nova Scotia’s large international operations focused on Mexico, Peru, Colombia, and Chile make the stock more vulnerable to the near-term global economic shocks and a second market crash caused by the pandemic. However, the Pacific Alliance countries also hold strong growth potential in the coming decades.

Bank of Nova Scotia’s other divisions continues to generate solid profits and the bank has the capital to ride out the downturn. The dividend should be safe and the stock now trades at less than 10 times anticipated earnings. This is cheap compared to the other large Canadian banks.

Any move back toward the $50 point should be viewed as an opportunity to back up the truck.

BCE

BCE (TSX:BCE)(NYSE:BCE) is Canada largest communications firm. The business operates world-class wireless and wireline networks across the country. A shift to home offices will remain permanent for many people. The result should be growth in demand for higher-end internet packages to cover expanded broadband needs.

On the mobile side, the arrival of 5G provides BCE with strong potential for revenue growth. Added connectivity leads to higher data use and extra security concerns. BCE’s security and monitoring services can be bundled with mobile, internet, and TV subscriptions.

Canada’s new $10 billion infrastructure program includes funds to extend high-speed internet services to rural and remote communities. BCE is positioned well to benefit from the initiative.

The stock trades near $55 and provides a 6% dividend yield. BCE began 2020 at $60 and moved as high as $65 before the pandemic, so there is already decent upside potential. Look to buy on further downside.

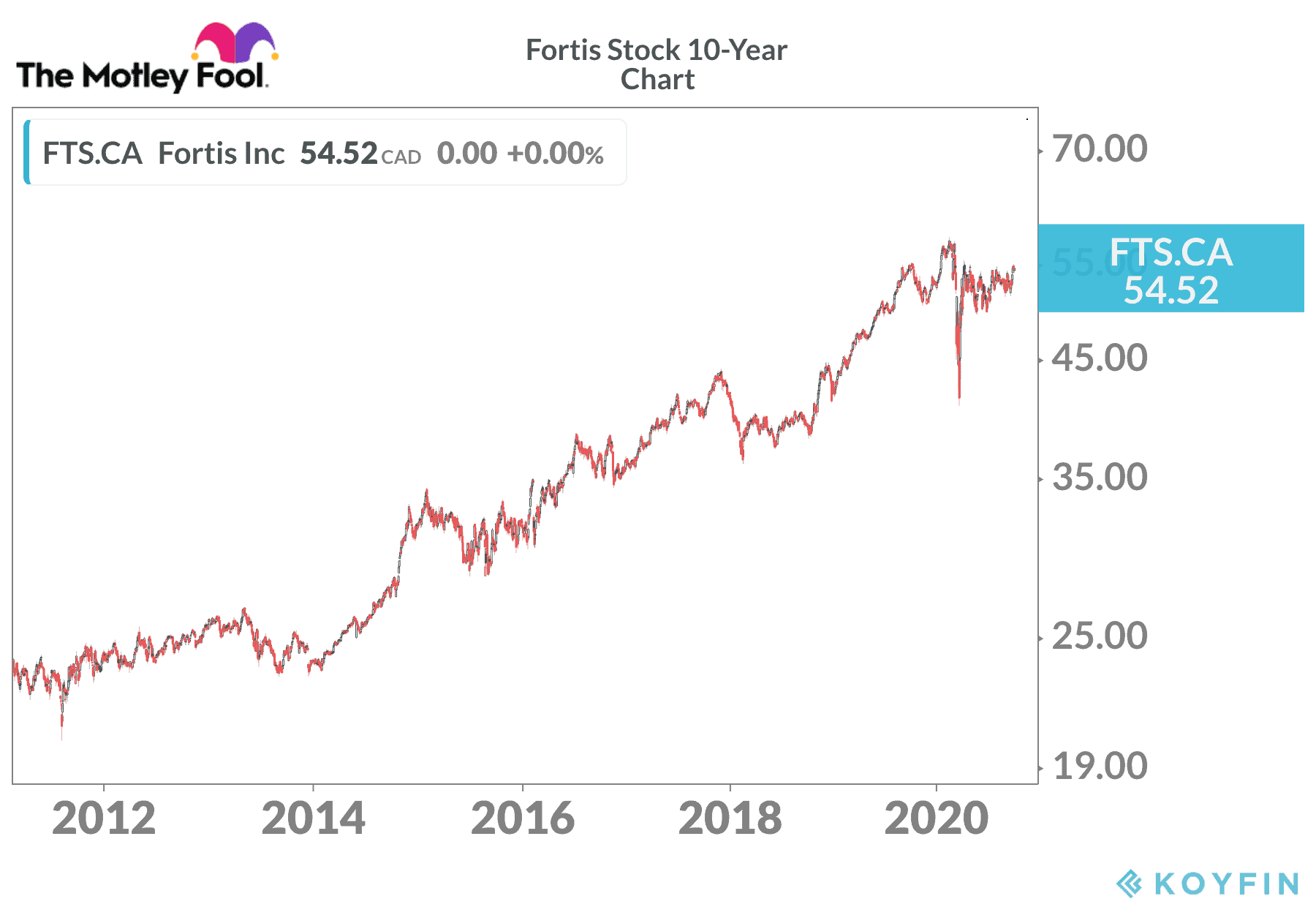

Is Fortis stock a good market crash hedge?

Fortis (TSX:FTS)(NYSE:FTS) is a North American utility company with businesses located in Canada, the United States, and the Caribbean. Operations include natural gas distribution, power generation, and electricity transmission.

Fortis gets most of its revenue from regulated assets, which means cash flow tends to be reliable and predictable regardless of the state of the economy. The board raised the dividend in each of the past 46 years and intends to hike the payout by 6% per year through 2024.

The stock trades close to where it began the year, indicating the stability of the shares despite the March market crash and the negative impact of the pandemic. In the event the stock market tanks again and Fortis shares sell off, investors should take advantage of the dip.

Otherwise, Fortis is a solid pick to use as a defensive investment through the current uncertain times. Investors get a decent 3.7% yield with strong dividend growth on the horizon.

The bottom line on investing in a market crash

A stock market crash always provides buy-and-hold investors with a rare opportunity to buy great companies at cheap prices.

Being greedy when the rest of the world is fearful takes guts. However, top investors such as Warren Buffett became billionaires by following this philosophy.