Canadians have quite a few reasons to be scared right now. Businesses are opening up yet again across the country, along with schools and many facilities, sending COVID-19 cases skyrocketing. In some cases, the numbers reach higher than the peak of the first wave.

Then there is the financial setback. There is no more wide-sweeping Canada Emergency Response Benefit (CERB), which means no more money and extensions coming in for Canadians still affected by COVID-19. After all, not every business has opened up since the outbreak.

So what are Canadians to do? There’s the fear of getting sick coupled with the fear of losing a pay cheque. So what are you going to do now that you can’t count on that $2,000 every four weeks? Well, first of all, if you really still depend on CERB, you can still receive it.

It’s true. Until December 2, 2020, eligible Canadians can receive CERB in arrears by applying to the benefit period you were eligible for. So let’s say you started working part-time again. You didn’t apply to CERB because you thought you would make more than $1,000 per month. That didn’t happen, so you could now apply for that period.

But there is another way to bring in that $2,000 today.

Make your own payments

If you find the right stock, you could bring in $2,000 annually in dividends alone. Granted, this is not for the investor who is living paycheque to paycheque. Rather, this is for the investor who has some funds set aside that they are interested in investing, hoping to create a larger nest egg should an emergency occur.

In this case, I would highly recommend a stock that combines the income of dividends, with the growth of an industry. Right now, one to consider is TransAlta Renewables Inc. (TSX:RNW). This stock has a beaten down share price, and the potential to grow by leaps and bounds over the next several years.

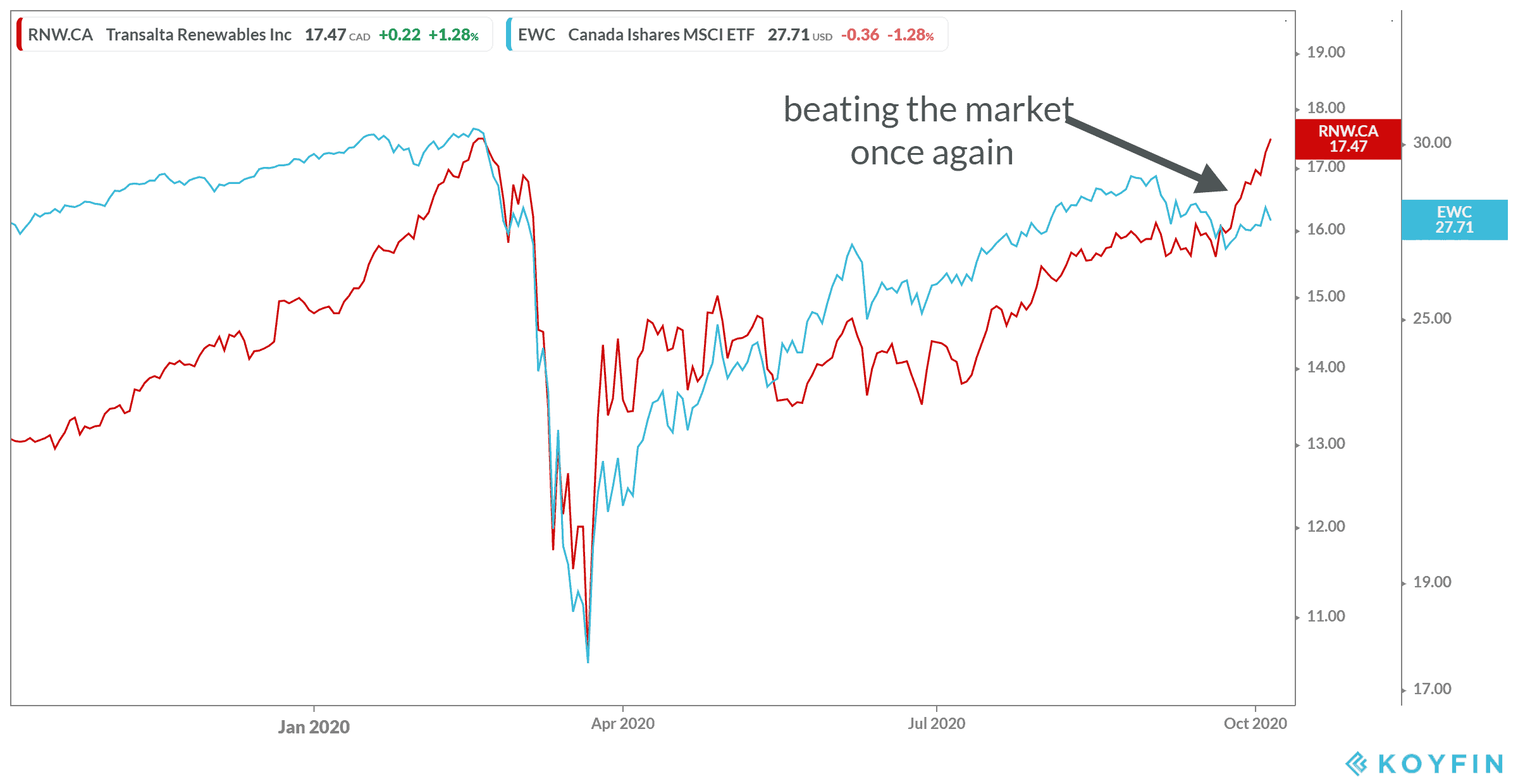

Let’s start with its share price. The company currently trades at about $17.50 at writing. While this is actually up 33% from its one-year return, it shows the company is outpacing the market. People who panicked during the first wave aren’t panicking now that the second is underway. Instead, they realize the strength of a company like TransAlta.

That comes from the company setting up in a growing industry: renewable energy. Economists believe oil and gas will slowly be pushed out over the next few decades to almost nothing. Meanwhile, renewable energy companies will receive all the investments and government money. That puts TransAlta in a prime position.

It also means its dividend yield is quite safe at 5.45% as of writing. In order to bring in $2,000 in dividends today, you would have to invest about $37,000 as of writing. That’s just over half of your Tax-Free Savings Account (TFSA) contribution room, so you’ll still have plenty of room to diversify.

Meanwhile, given the company has a compound annual growth rate (CAGR) of 17.8% in the last five years, you can look forward to years of solid growth. And that includes dividends, which have grown 3.8% compound annual growth rate (CAGR) in the last five years. Again, if you’re looking for nest egg growth, this is the perfect investment. But remember, CERB is still available until the end of this year.