During 2020, energy has been of the worst-performing sectors on the TSX. Energy stocks have become popular among investors because of the massive upside potential as oil prices are rallying.

However, energy is an extremely cyclical industry. This means when the economy is tanking, or commodity prices are depressed, energy producers will crash heavily.

This is exacerbated during recessions. As economic activity slows, less energy is demanded by businesses and consumers. During 2020, however, the energy industry saw drop-offs in volumes not seen in a long time.

In addition to economic activity being down in 2020, mobility is down even more. So, even if GDP recovers substantially by the end of this year, with more people staying at home all over the globe, understandably, the energy demand will be impacted for a while.

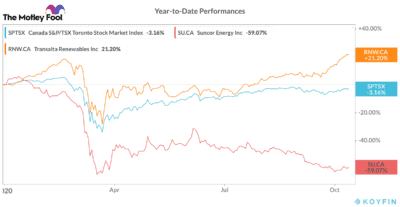

This is why energy stocks are struggling. Even best-in-class stocks like Suncor Energy (TSX:SU)(NYSE:SU) have seen share prices slashed considerably since the start of the year.

Should you buy Suncor or other energy stocks?

Suncor could be a great value stock at its current price, but it may be years before your investment pays off. As long as the world is dealing with the coronavirus pandemic, and mobility as well as economic activity remains low, demand for oil will be impacted.

So, although Suncor is trading roughly 60% down from where it started the year, it reflects how the market thinks the company will perform over the next few years. And, of course, things could always turn out worse than we expect, which is why you may want to avoid a stock like Suncor for the time being.

Instead, if you’re looking for high-quality, long-term investments today, I would stock with renewable energy stocks.

Renewable energy stocks on the TSX

Renewable energy is much more defensive. It’s a sub-sector of the utilities industry, one of the best industries for investors looking for defensive investments.

That’s good for investors, especially in this uncertain environment. Renewable energy companies have sticky demand for their services, and long-term power-purchase agreements ensure that these companies’ revenues stays robust.

However, despite the industry being defensive, it also offers major long-term growth.

Taking care of the environment is one of the most important issues the human race will have to deal with. And one of the easiest, most cost-efficient, and beneficial ways of dealing with the environment is through renewable energy.

These companies all have significant growth potential over the next few decades. I’d argue the growing passive income renewable energy stocks offer combined with their long-term growth potential is a far more attractive proposition than the value of oil and gas stocks at the moment.

One of the top renewable energy stocks I’d consider today is TransAlta Renewables (TSX:RNW).

TransAlta Renewables offers an attractive 5.2% yield, has 95% of its revenue contracted through power-purchase agreements, and continues to outperform the TSX.

The company gets most of its green energy from onshore wind farms. However, it also owns hydro and solar assets as well. Green energy stocks have vastly outperformed oil and gas stocks this year, even before the pandemic hit.

As you can see, there is a clear divergence in performance between the two companies. Plus, this performance differential may get even bigger if Joe Biden wins the election.

As you can see, there is a clear divergence in performance between the two companies. Plus, this performance differential may get even bigger if Joe Biden wins the election.

Bottom line

Suncor is one of the top oil companies on the TSX, and there could be value there for long-term investors. However, buying a top green energy stock like TransAlta Renewables is far more attractive in the current environment.

It offers investors a higher and safer dividend yield, plus more short-term capital appreciation.