The TFSA is a great tool to build an emergency fund to help us get through the next crisis. Investors can also use the TFSA as part of a savvy retirement planning strategy to minimize taxes paid to the CRA.

TFSA benefits

Canada launched the TFSA in 2009 to give people another tax-advantaged savings option that has more flexibility than the RRSP.

TFSA investments are made with after-tax income. The full value of profits the investments generated inside the TFSA can go straight into your pocket or be reinvested. The CRA doesn’t touch them.

Younger investors might decide to use the TFSA as a retirement planning fund while they are in the early years of their career. This gives you the opportunity to carry forward RRSP contribution space to be used when you are in a higher marginal tax bracket.

If a financial emergency occurs, the money is easily withdrawn from a TFSA without any tax implications or penalties. That’s not the case with RRSP savings.

Retirees benefit from the TFSA due to its tax-free status. The CRA does not include TFSA withdrawals when calculating net world income. This helps seniors avoid or minimize the OAS pension recovery tax. Once net world income tops a minimum threshold, the CRA implements a clawback on OAS payments.

Best stocks for a TFSA

People might be tempted to bet on the hottest new tech stocks or bombed-out cannabis firms. The strategy might work and generate massive returns in a short period of time. The risk, however, is that you could also lose your shirt. The change from being rich to broke can happen in a matter of days or weeks.

A better TFSA investing approach might involve buying stocks that pay reliable and growing dividends. These tend to be companies with decades of proven revenue and profit growth. They have the ability to ride out market crashes and reward long-term investors with higher share prices.

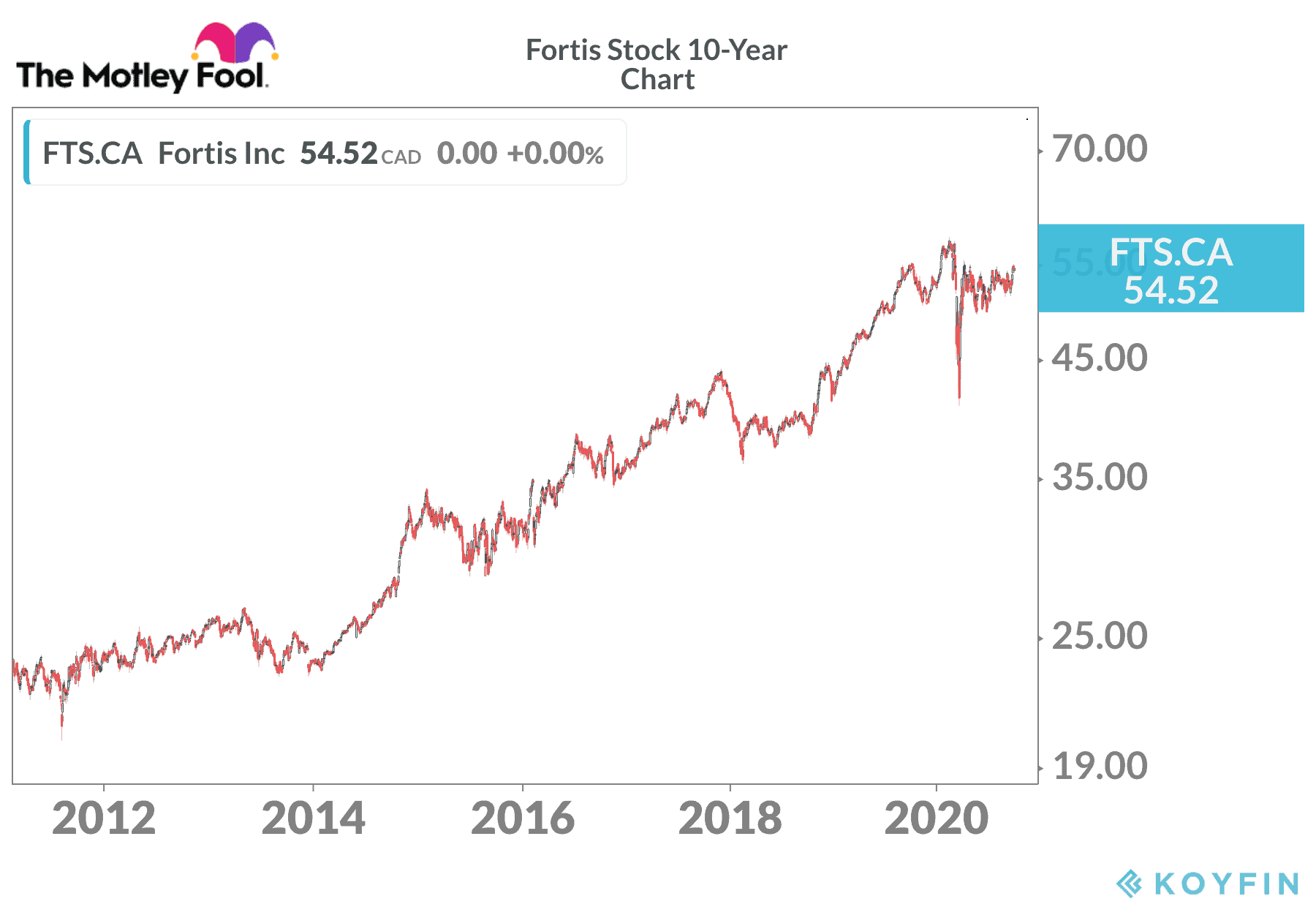

Fortis

Fortis (TSX:FTS)(NYSE:FTS) is one of those stocks you can simply buy and forget for years. The firm owns utility assets in Canada, the United States, and the Caribbean, with operations in power generation, electricity transmission, and natural gas distribution.

Fortis grows through strategic acquisitions and internal development projects. The current capital program of nearly $19 billion should boost the rate base significantly in the next few years. As a result, Fortis intends to raise the dividend by an average of 6% per year through 2024.

That’s great guidance in the current global economic conditions.

Investors received a dividend increase in each of the past 46 years, so the outlook should be reliable. At the time of writing, the payout provides a 3.7% yield.

Long-term investors have done well with this stock. A $1,000 investment in Fortis just 25 years ago would be worth $20,000 today with the dividends reinvested.

A $10,000 investment would be worth $200,000!

The bottom line on TFSA investing

A balanced TFSA portfolio is always recommended, and the TSX Index is home to many top dividend stocks that have generated similar returns. Patience is required, but the strategy of owning high-quality dividend stocks and using the distributions to buy new shares is a proven one for building wealth.