The markets across North America are trading with high volatility these days, as the U.S. presidential elections are less than two weeks away. While the uncertainties related to the election results have increased market volatility lately, investors could use this volatility to buy good stocks cheap.

Let’s take a quick look at one cheap but great TSX stock with an amazingly high dividend yield that you can buy today.

Brookfield Property Partners

Brookfield Property Partners (TSX:BPY.UN)(NASDAQ:BPY) is a Hamilton, Bermuda-based global real estate giant with total assets worth about US$86 billion. The company owns and operates some of the most iconic commercial properties in the world. Its parent company Brookfield Asset Management manages assets worth US$550 billion.

Due to the ongoing pandemic, Brookfield Property Partners has registered a sharp drop in its revenue in the first half of 2020. In the second quarter, its revenue fell by 30.5% to US$1.4 billion. This resulted in a massive quarterly loss of US$1.3 billion for the company.

During the quarter, the commercial real estate company generated US$178 million of funds from operations. It was sharply lower as compared to US$335 million in the second quarter of 2019. Due to the COVID-19, its occupancy in the portfolio fell by 20 basis points to about 92.3% — hurting its operating performance.

Previously in the first quarter of 2020, it reported a 27% drop in its revenue to US$1.1 billion and lost around US$445 million.

The trend in financials is likely to turn positive soon

After facing pandemic-related headwinds in the first half of 2020, Brookfield Property Partners’s operating and financial performance is likely to improve in the second half.

In its second-quarter earnings conference call, its CEO Brian Kingston stated, “While we’re not completely out of the woods, we expect the severity of the impact of the shutdowns to be largely isolated within the second quarter.” The company expects its leisure-focused hotel business to recover at a much faster rate than its other businesses.

Brookfield Property Partners will announce its third-quarter results in the first week of November. Wall Street analysts expect it to return to profitability in Q3. According to analysts’ latest consensus data, the company is expected to report an adjusted net profit of US$882 million in the third quarter with a solid 69% margin.

Foolish takeaway

The upcoming U.S. elections are likely to keep the broader market — including Brookfield Property Partners stock — volatile in the next month. However, its strong third-quarter results on November 6 could be enough to drive a rally in its stock prices.

We shouldn’t forget the fact that the company currently has an amazing 10.1% dividend yield — making its stock even more attractive. Its strong balance sheet could help Brookfield Property Partners maintain its solid dividend, despite the pandemic’s challenges.

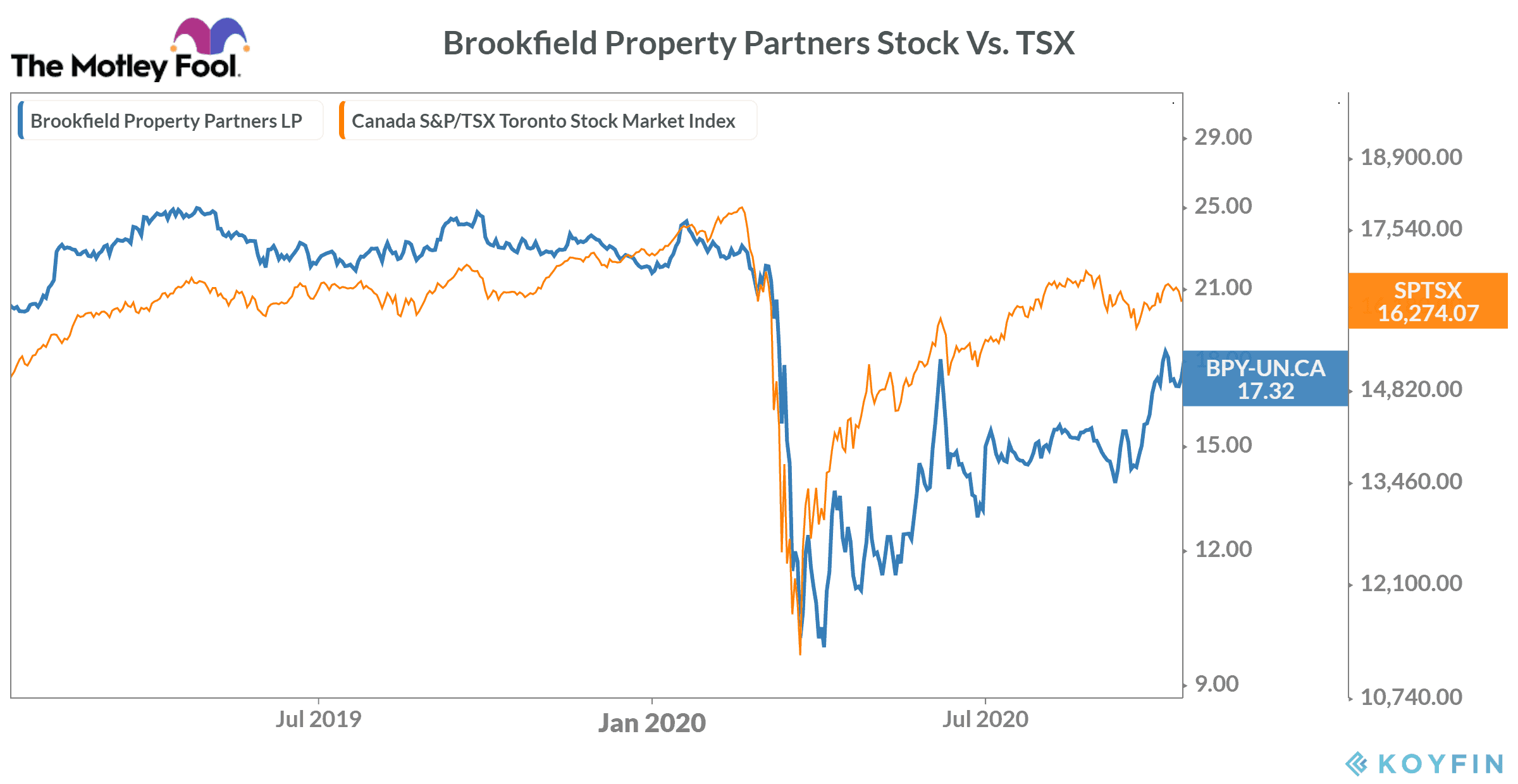

These are some of the reasons you may want to buy its stock before it starts rallying. It has already risen by 8% in October so far, but the stock is still down 27% on a year-to-date basis.