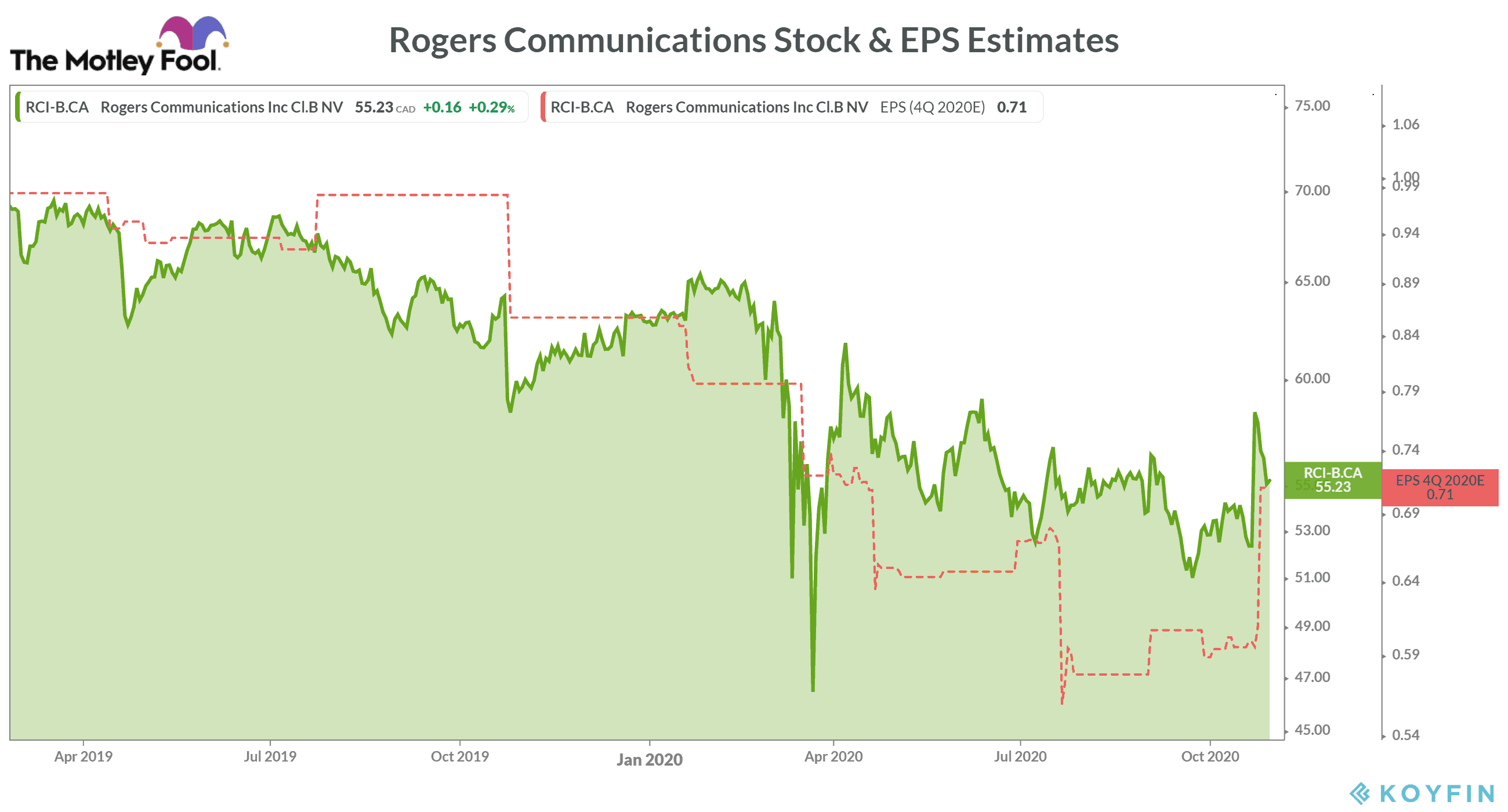

Rogers Communications (TSX:RCI.B)(NYSE:RCI) released its third-quarter earnings last week, and its stock has been falling since then. The stock has lost 6% in the last four sessions, despite beating analysts’ quarterly earnings estimates. Let’s take a closer look at its earnings highlights and find out what could be driving its recent pessimism and whether it’s a good idea to continue holding its stock.

The prevailing negative trend in Rogers Communications’s earnings growth

In the third quarter, Rogers Communications reported $1.08 earnings per share. The earnings improved by 80% sequentially from $0.60 in the previous quarter, as it managed to beat analysts’ consensus EPS estimates of $0.78.

However, the earnings fell 9.2% as compared to $1.19 per share in the third period of 2019. Also, it was the fifth quarter in a row when Rogers Communications’s EPS fell on a year-over-year (YoY) basis, which hurt investors’ sentiments. This could be one of the key reasons why the stock has turned negative, despite its better-than-expected Q3 earnings.

The consistent sequential decline in revenues

In the third quarter of 2020, Rogers Communications fell by 2.4% to $3.67 billion in the third quarter, despite a 16.2% sequential improvement. As in the case of its earnings, the company’s revenue was also higher than Wall Street’s revenue estimate of $3.34 billion. Notably, its total sales saw a sequential decline for the third consecutive quarter — adding to investors’ pessimism.

EBITDA drop and weakening bottom-line margin

In the last quarter, the Toronto-based communications and media company reported adjusted EBITDA of $1.6 billion. It was down about 4.3% compared to the $1.7 billion adjusted EBITDA a year ago.

Its lower EBITDA also hurt the company’s bottom line. The company’s adjusted net profit fell to $548 million in Q3 2020 — showcasing a 10.6% YoY drop. As a result, its net profitability also suffered. The company reported a 15% adjusted net profit margin in the last quarter compared to 16.3% a year ago.

Big bets on 5G technology

While various reasons — including COVID-19-related headwinds — have hurt Rogers Communications’s results in the last couple of quarters, the worst period might already be over. We should remember that Rogers currently owns Canada’s first and largest 5G network, and the company claims its 5G network to be 10 times bigger than its peers.

During its latest earnings conference call, the company CEO Joe Natale highlighted that “5G requires the right infrastructure, the right partners and investments to be ready to fully capitalize on its potential. We are well prepared in this regard.”

Bottom line

As of October 28, Rogers Communications stock is trading with 14.6% year-to-date losses against an 8.7% drop in the S&P/TSX Composite Index. Overall, I expect its big bets on 5G to pay off well in the coming quarters as more consumers start using 5G enabled devices — especially after Apple’s recent 5G iPhone announcement. That’s why it would be a good idea to hold its stock at least for the medium term.