BCE Inc. (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. Its position is backed by an extensive reach of its world-class wireless and fibre networks. It is also backed by BCE’s financial health and financial strength.

BCE reported third-quarter results last week. These results once again highlighted why BCE is a top stock to own for decades to come.

BCE is a stock to own for its stability and resiliency

The coronavirus has wreaked havoc on the health and vitality of the country, as well as the economy. In the early months of the coronavirus pandemic, even the poster child of stability, BCE was under some pressure. Operating revenue fell 9% as BCE’s retail outlets were closed and reduced economic activity took hold.

But today, we are already seeing a recovery in all of BCE’s operating segments. Retail stores have re-opened, live sports are back on, and the economy has been gradually coming back to life. Revenue in the third quarter was 2.6% lower than the last year but up 8% sequentially. BCE’s broadband market share grew and the company posted profitable wireless growth, with 128,000 new subscriptions.

BCE continues to invest in its network

BCE’s resiliency has been accompanied by a relentless focus on the long-term. Today, the company remains committed to building the best network. You see, BCE has the financial health and strength to do this. Its $3.25 billion in free cash flow generation in the first nine months of the year and its strong liquidity pretty much guarantees this.

The rollout of fibre to the premises (FTTP) is key to BCE’s goal of building the best network. This fibre optic communication delivery brings the fastest speeds and a better overall experience. In fact, it will double internet speeds. BCE has completed 58% of its FTTP rollout plan, which includes a roll out to rural areas. This has brought increased revenue and profitability.

BCE is also investing in 5G networks. 5G is the fifth generation technology standard for cellular networks. It delivers faster speeds, more reliability, and higher performance across the board. Wireless speeds in Canada are already two to three times faster than the global average. This speaks to the top notch performance of telecom companies like BCE.

With the continued roll out of 5G networks, speeds and performance will continue to improve. This roll out is still in early stages, but BCE is already seeing greater profitability on the 5G network. Data usage among 5G subscribers is twice as high with approximately 20% higher revenue.

Buy BCE stock for its dividend and its stability

The third quarter signaled the return of consistent, predictable results for BCE. Operating metrics are recovering, and they foreshadow what’s to come for BCE stock.

The telecommunications industry is surrounded by high barriers to entry. This protects BCE, along with its strong competitive advantages. BCE has built a moat around it, and this has served BCE stock very well. BCE is well-known for its stability and predictability for these reasons.

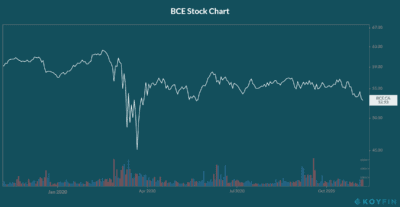

Given all of this, it is clear to me that BCE is a stock to buy today. The stock’s 17.5% decline in the last 12 months, along with its dividend yield of 6.3%, is a strong buying opportunity. The graph below highlights BCE stock’s one-year performance.

The bottom line

BCE is in an enviable position. The company provides local, long distance, wireless, satellite, television and Internet services. These are essential services in the best of times. In today’s times, they are even more essential.

With huge numbers of people working from home, staying home more, and searching for ways to connect digitally, BCE is increasingly important. But this is not only a short-term phenomenon: it is also a long-lasting trend which BCE stock will benefit from for decades to come.