The best investment bargains are found during a crisis. A good number of beaten-down Canadian real estate investment trusts (REITs) are available for contrarian investors to buy. Income yields shot up after sell-offs when COVID-19 struck North America early this year, and daring investors are taking this opportunity to set themselves up for juicy income yields for life in Tax-Free Savings Accounts (TFSAs).

Some property trusts faced more existential threats than others during the worst part of the pandemic. Rent collections for retail REITs were pathetic during the second quarter, as non-essential businesses were forced shut. However, retail properties fared much better when compared to hotels. They have multi-year leases that offered some income protection. Rent deferrals mean they can recoup some losses.

On the contrary, hotel REITs don’t have long-term leases. They required vibrant domestic and international travel and an outgoing culture to maintain solid bookings. These preconditions were absent during lockdowns this year.

However, things could change soon with the hopes of a vaccine. The popular American Dr. Antony Fauci was quoted by Bloomberg on Thursday as saying “the end is in sight” and that COVID-19 won’t be a pandemic for “a lot longer,” while citing the rapid progress in vaccine development.

Investors may want to check out beaten-down REITs that fared badly during the pandemic. Their recovery could be meteoric.

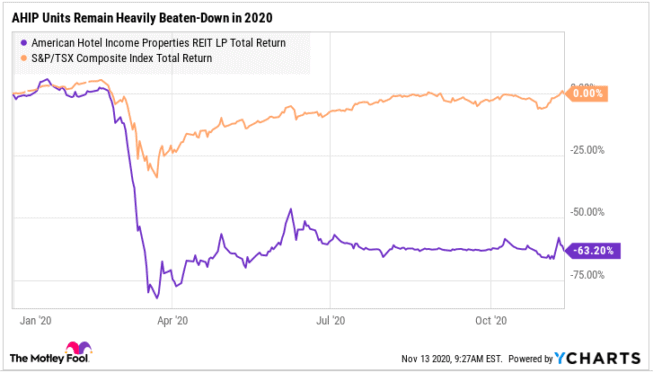

One such trust is a hotel property owner that remains on my radar. I recommended it as a buy for April 2020. It’s up 24% since then. Business is recovering impressively, and vaccine availability could make units surge.

American Hotel Income Properties REIT on a strong recovery path

We witnessed a remarkable recovery in American Hotel Income Properties’s (TSX:HOT.UN) revenue, occupancy rates, cash flow, and net operating income during the third quarter of 2020.

AHIP owns a portfolio of 78 premium-branded hotels located in the United States. Most of its properties were recently renovated. All its hotels were open during the third quarter to September 30.

Quarterly revenue increased 69.8% sequentially to US$46.3 million, as revenue per available room (RevPAR) shot up by 67% sequentially. Although revenue remained 47.7% lower than last year’s quarter, the rapid recovery in occupancy rates month on month is very encouraging.

Watch the ever-improving occupancy rates

AHIP REIT’s hotels are not as reliant on group and corporate customers as peers are. This explains its better performance relative to peers.

AHIP’s hotel occupancy rates increased to 57.1% for the third quarter, up from 34.7% during the second quarter. Occupancy continued to improve to 58.3% in October. Although the occupancy numbers remain 19% lower than last year, the recovery is notable.

Net operating income for the third quarter increased by 239% sequentially to US$14.6 million. The figure is still 50.8% lower than last year’s comparable quarter, but that was nonetheless a very commendable performance.

Most noteworthy, AHIP was one of the few hotel owners to report positive funds from operations (FFO) during the quarter. The REIT is already generating positive cash flow before the pandemic is over.

Further, AHIP’s unrestricted cash balance was up 51% on September 30, as compared to December 2019 levels. The trust successfully negotiated reliefs on its outstanding loans. Management deferred payment of outstanding purchase consideration for 12 hotels from December 2020. This will be made in installments over the next year, giving the trust some breathing space.

Should you buy the dip on the beaten-down hotel REIT?

Signs of recovery on AHIP are already encouraging. The trust’s units remain deeply underwater for 2020. Investors could still record significant capital gains, as business returns to normalcy over the next few years.

Although leverage is elevated at a 58.2% debt-to-gross book value, the trust has no significant debt maturities until June 2022 and the average interest rate on the debt is manageable at 4.55%. If interest rates remain subdued until 2023, as the Bank of Canada anticipates, then AHIP could manage to survive the current onslaught.

Its new CEO Jonathan Korol has even agreed to receive half of his salary in units through 2021 to align his interests with those of shareholders. He has faith in the trust’s prospects for the future.

Perhaps now is the best time to pounce on the beaten-down hotel REIT before it reinstates legally mandated income distributions. Units could surge soon.