Despite the global pandemic, 2020 has so far turned out to be an overall good year for the market. While the COVID-19 related uncertainties increased the challenges for most businesses, the pandemic driven initial selloff around April created many opportunities for stock investors to buy stocks cheap. Some of these stocks saw a sharp recovery in the third quarter — and their rally is still expected to continue. Let’s take a look at one such stock that I’m watching closely this month to buy.

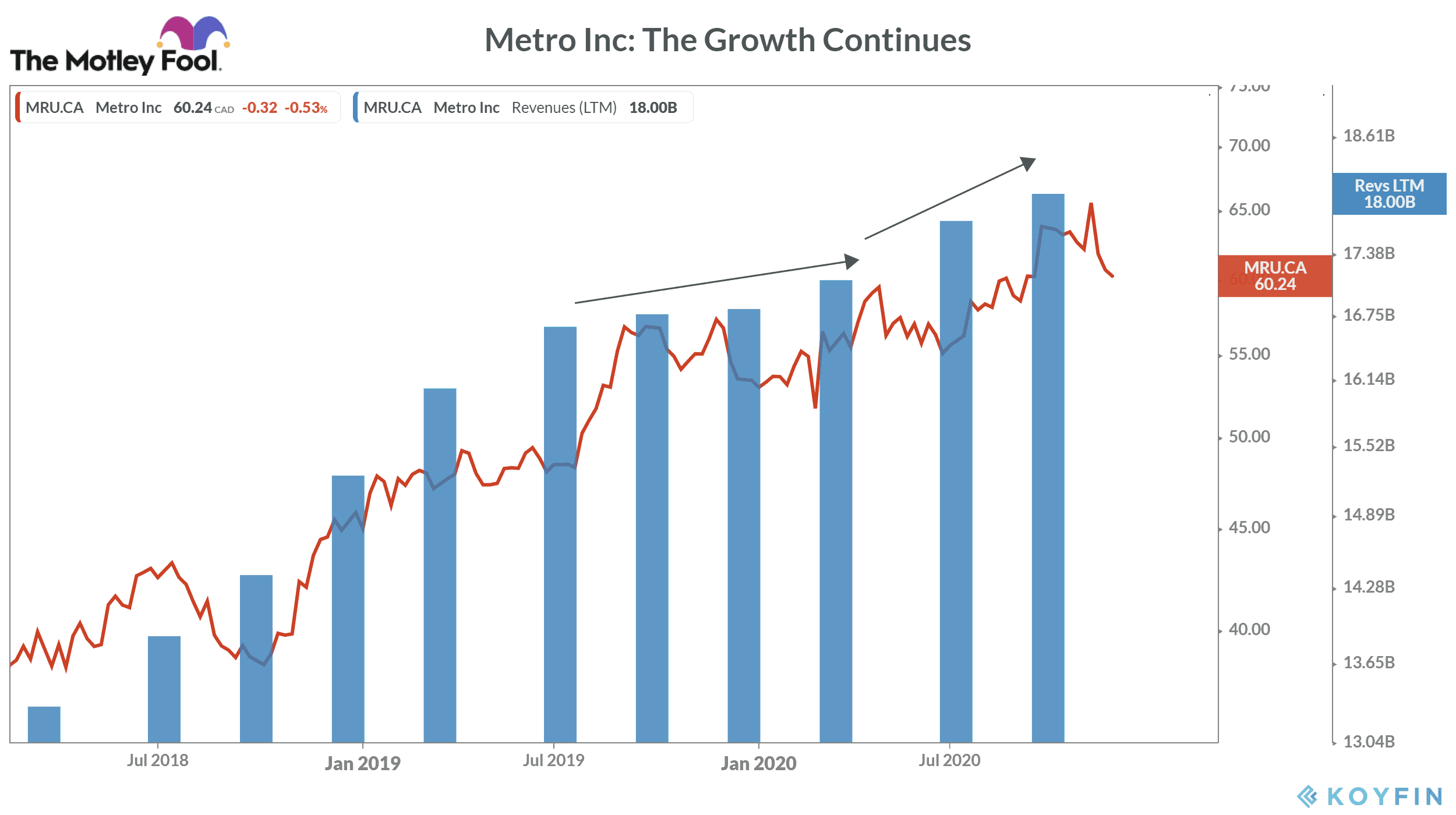

Metro’s stock price performance in 2020

Metro Inc. (TSX:MRU) is one of Canada’s leading food retailers with a market capitalization of about $15.1 billion. Under the names of Metro and Metro Plus, it runs around 327 superstores. The company also owns roughly about 232 discount stores. Apart from its primary food retail business, Metro also operates a chain of about 72 drugstores in Ontario under Metro Pharmacy and Food Basics Pharmacy.

Metro’s stock started 2020 on a strong positive note as it rose by 6.2% in the first quarter despite a 21.6% drop in the S&P/TSX Composite Index. The stock turned slightly negative in the second quarter and lost 1.6%. Its rally resumed in the third quarter as it pleased investors with its solid 14.1% positive returns for the quarter.

Falling after posting a fresh all-time high

Earlier this month, Metro’s stock reached its all-time high of $66.25 per share on November 9. It’s currently trading at $60.20 — about 9% lower from its all-time high.

Last week, the company released its fourth-quarter and full-year fiscal 2020 results. Metro’s Q4 earnings stood at par with Bay Street analysts’ estimates. The fact that the company couldn’t beat analysts’ Q4 earnings expectations — as it did in a previous couple of quarters — could be one reason why its stock has turned negative lately.

Nonetheless, if this Canadian food retailer’s overall fundamentals are still strong, then the recent decline could be considered a buying opportunity.

Recent fundamentals

In Q4 of fiscal 2020, Metro’s total sales rose by 7.4% on a year-over-year (YoY) basis to $ 4.1 billion. The quarterly revenues were at par with analysts’ consensus estimates. During the quarter, Metro registered a solid double-digit 10% growth in its food business same-store sales while its pharmacy business same-store sales rose by 5.5%.

As a result, its adjusted net profit stood at $193.1 million — up 11% YoY — also at par with analysts’ expectations. What makes Metro stock even more attractive to me right now is its improving profitability. In fiscal 2020, the company’s bottom line margin rose to 4.6% compared to 4.4% in fiscal 2019.

Foolish takeaway

Clearly, the ongoing trend in Metro’s financial is strongly positive with improving profit margin. After its Q4 earnings event, investment banks such as Royal Bank of Canada and Canadian Imperial Bank of Commerce have raised their price targets on the company’s stock.

I’d continue to watch Metro’s stock to buy it around a major support level near $58 per share as I expect the stock to continue soaring in the coming quarters.