Warren Buffett recently made important bets in the health sector. His Berkshire Hathaway conglomerate bought US$5.7 billion worth in shares in four U.S. pharmaceutical companies in the third quarter: AbbVie, Bristol-Myers Squibb, Merck, and Pfizer. The company already had stakes in Biogen, Johnson & Johnson, Teva Pharmaceuticals, and DaVita, a kidney dialysis company. Another healthcare stock that could interest Warren Buffett and that could also interest you is WELL Health Technologies (TSX:WELL). Here’s why WELL Health stock is a good buy in the healthcare sector.

WELL Health business is growing fast

The COVID-19 pandemic accelerated the digital transformation of healthcare. WELL Health, a healthcare company that leverages technology to support patients and doctors, has seen its business grow strongly in the past few months.

WELL Health has a rapidly growing digital portfolio of healthcare assets. It has approximately 2,000 clinics serving more than 10,000 medical practitioners across the country. The company’s portfolio of clinics is also growing in importance. It has 19 wholly owned clinics and approximately 180 physicians in these clinics. WELL Health launched in March VirtualClinic+, a digital healthcare communication platform that connects patients to physicians via video, phone, and secure messaging.

The most recent results from WELL Health show that the business is growing fast. Indeed, revenue increased by 50% in the third quarter.

WELL Health achieved digital services revenue of $2.48 million, up 149% year over year. The company’s positive third-quarter results were driven by a significant increase in its clinical patient services revenue from the second quarter of 2020 to the third quarter of 2020 due to a return to physical clinic visits after lockdowns related to COVID-19. At the same time, WELL Health’s virtual care revenue continued to grow in the quarter.

Over the past few months, WELL Health has continued to grow with a number of key acquisitions. These acquisitions have diversified WELL Health’s business and increased its market share and reach.

For example, the healthcare company acquired earlier this month DoctorCare, which provides billing and back-office services to physicians. WELL Health also recently completed the acquisition of Insig Corporation, a leading Canadian virtual care platform. In August, WELL Health acquired the services division of Cycura, a Toronto-based cybersecurity startup, to protect personal health information.

The company entered the U.S. market in September via the acquisition of a majority stake in Circle Medical, a U.S.-based telemedicine provider.

WELL Health stock will do well in the coming years

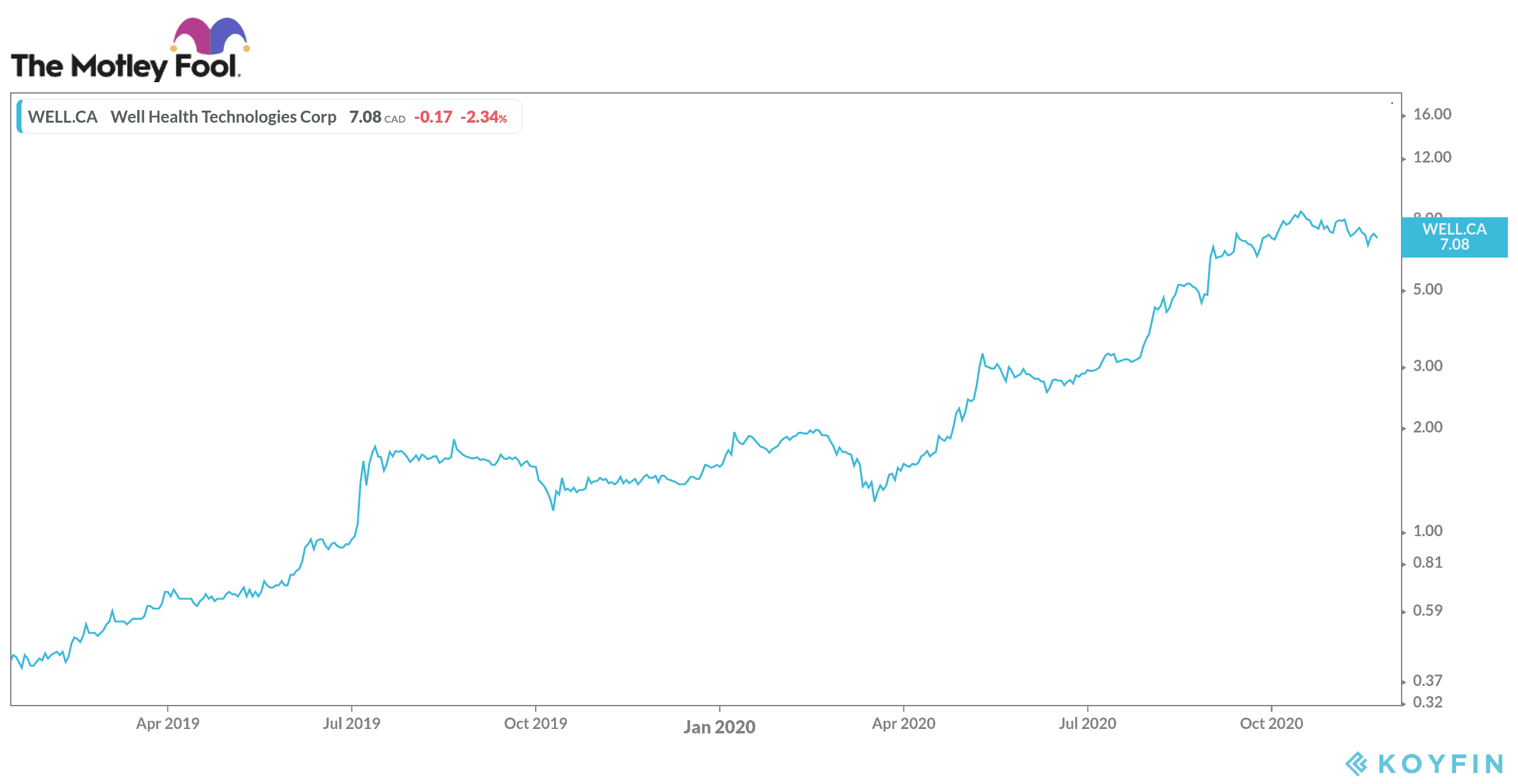

WELL Health stock has been one of the top performers on the TSX in 2020. The stock has risen by more than 350% since the start of the year and is up about 6,345% since its IPO in 2016.

As the second wave of the pandemic hits North America, WELL Health stock is well positioned to progress in the months to come.

WELL Health stock could easily double or triple in the next two years. The company posted strong earnings in the third quarter. The management team is able to strategically acquire companies that complement its corporate structure. Plus, WELL Health has no debt on its balance sheet. WELL Health stock is clearly poised for success in the healthcare sector.