The Canada Pension Plan (CPP) allows Canadians to have money ready and waiting for them upon retirement. These earnings are usually matched by your employer, putting aside cash you can take out once you turn 60. Up until 2019, the goal was to have one quarter of your average work earnings set aside for retirement.

But this year, that changed. Now, the goal is to have one third of your work earnings set aside in CPP, up to a maximum. That maximum is set to increase by 14% each year until 2025. For 2021, the maximum will be $61,600, an increase of $2,900 from 2020.

Employer and employee rates are also changing. Whereas before contribution rates were 5.25%, in 2021 that jumps to 5.45%. If you’re self-employed you have to cover both, so that’s a jump from 10.5% to 10.9%! These are again up to a maximum of $3,166.45 for both employer and employee contributions, and $6,332.90 for self-employed contributions.

How will it affect you?

If you’re about to retire, you want all the cash you can put away. On the one hand, you’ll now have money put aside for retirement for you. That’s great! However, what if you could be using that cash to invest yourself? It’s a fair question, as right now we’re in a volatile market that’s likely going to crash. When it does, you’ll want to have multiple companies on a watch list ready to be bought in bulk.

There’s also the problem of when you’re going to retire. If you want to retire at 60, that doesn’t leave much room to take advantage of the enhancement program, if that’s what you want to do. Instead, you’ll be taking out money earlier than necessary, perhaps. Especially if you have funds saved away for retirement already.

One option? Delay payments

If you’re able to either continue working and using the CPP enhancement program, you can continue to build up a retirement nest egg. You could also choose to retire at 60, but not take out CPP right away.

Why? Because if you wait until 70 you can increase your payments by 8.4%! That’s a huge jump when you need that money to help you survive the next several decades.

Meanwhile, make your own retirement nest egg that doesn’t involve CPP. Whether you’re about to retire or it’s another decade away, now is a great time before another market crash to do some research. Find companies that will set you up for those decades of retirement. Then, when shares dip, buy up and watch them grow for the next several years.

A great option would be to take 10% of each pa cheque and put that aside in a Tax-Free Savings Account (TFSA). You can choose to make regular contributions, or simply invest once a year when you see a stock you’re watching fall in share price. Need some options?

Enbridge: A retiree’s dream!

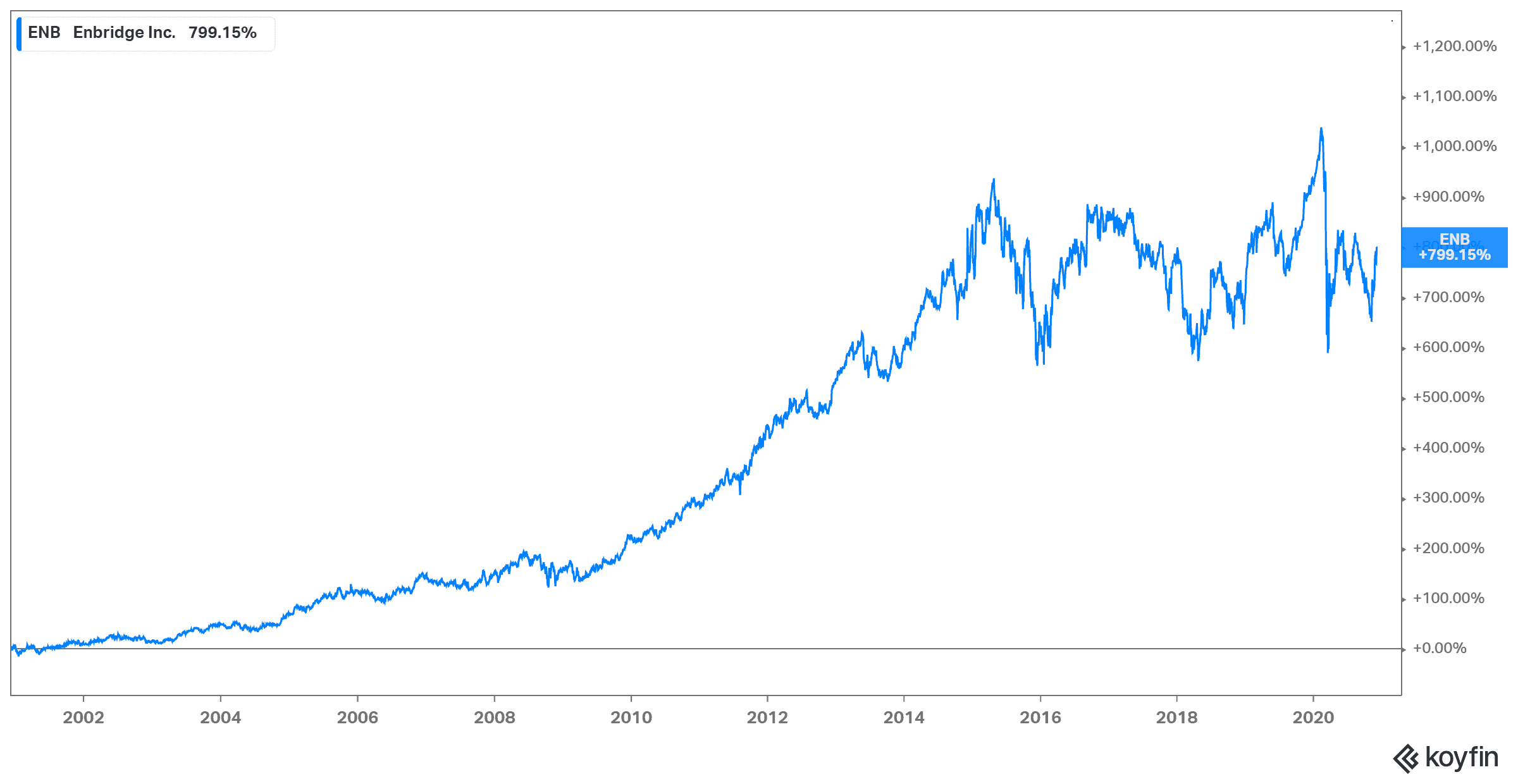

A fantastic option for those about to retire has to be Enbridge Inc. (TSX:ENB)(NYSE:ENB). Enbridge is a strong option right now, with a price to book (P/B) ratio of 1.5x, and shares at a 10% discount year to date. Economists, however, believe this stock is about to boom once its pipeline projects are up and running, ending the trapped Alberta oil sands.

Meanwhile, the company has a whopping 8% dividend yield supported by long-term contracts. These contracts will last decades for investors about to retire, and could see you through every year of retirement. So while shares have been down the last few years, oil and gas will come back.

When it does, Enbridge should be one of the first to see a rebound. If you have it for another 20 years, you could see a similar 800% increase, just like the last two decades.