Looking for a little reason to celebrate the new year? The Tax-Free Savings Account (TFSA) contribution limit was increased another $6,000 in 2021! If you were 18 years of age or older in 2009, you are now able to contribute a grand total of $75,500 into the account. Now there are some rules, and you’ll want to be cautious about overcontributing, but it still is an amazing opportunity.

Celebrate the TFSA by keeping all your investment returns!

Just think, if you have never contributed before, you could potentially (depending on your age) add $75,500 to the account today, invest it, earn interest, dividends, and capital gains, and pay absolutely no tax! That’s right, you get to keep all your returns. For as long as the investments stay in your TFSA, those earnings are safe from the CRA. It is the perfect formula for building and compounding wealth. After facing a challenging 2020 and an “interesting” start to 2021, that is a reason to celebrate!

Do you have $6,000 that you’d like to invest in your TFSA this year? Here are two Canadian stock picks that should prosper in and out of the pandemic.

This stock has green future ahead

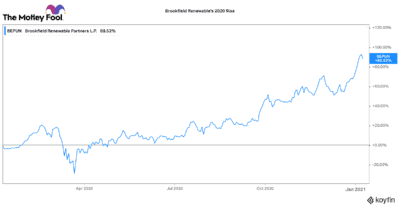

Brookfield Renewable Partners (TSX:BEP.UN)(NYSE:BEP) has been at the forefront of the strong renewable trade we saw beginning in 2020. It is one of the world’s largest pure-play renewable power stocks. Consequently, along with electric vehicle producers, stocks like BEP have shot up.

Right now, this TFSA stock is probably at the peak of its valuation range, and I would wait for a pullback before buying. There is a reason why it has seen strong investor demand. It is a global, diverse company of renewable-generating assets that are incredibly valuable in a climate-friendly world. Not only are its assets great, but management is incredibly skilled at finding diamonds in the rough.

BEP finds opportunities that have issues or are in regions that are unloved. It then re-capitalizes the projects, injects development/operational expertise, and eventually turns them into very attractive, cash-flow machines. BEP then sells those machines to low-cost-of-capital institutions at massive profits. In fact, as we speak, BEP is doing this in Brazil by building one of the world’s largest solar farms.

This company currently has a development pipeline that is almost double its current generating capacity. That just speaks to the opportunity in front of BEP. The stock isn’t cheap, but on any major pullback, it is a great opportunity to load this one into your TFSA.

This e-commerce stock pays a yield and is a perfect TFSA fit

Speaking about global trends, e-commerce has and will continue to be a major one. While most of the tech “e-commerce” stocks have sky-high valuations, there is one way you can play it and still get a great dividend. That is through investing in e-commerce and logistic-focused real estate.

WPT Industrial REIT (TSX:WIR.U) is a perfect TFSA income stock benefitting from e-commerce. It owns and manages a portfolio of modern logistics properties across the United States. The U.S. has been the epicentre of e-commerce for years now, which means logistic properties are seeing very strong demand.

Through the pandemic, WPT hardly saw any negative effects. In fact, it actually saw rental and occupancy rates increase over the year. Currently, the REIT has an attractive growth pipeline (supported by a joint venture) that could give it a strong earnings boost in 2021. It pays a 5% dividend and is great way to see e-commerce growth through a non-traditional, lower-valuation method. If I was looking for a higher-yield allocation to my TFSA, this stock is great bet today.