Tesla Inc. (NASDAQ:TSLA) is the world’s most innovative battery electric carmaker. It’s clear, CEO Elon Musk has applied his brilliance to clean energy. Ballard Power Systems Inc. (TSX: BLDP)(NASDAQ:BLDP) is the world’s most innovative fuel cell company. But the fight to win the race toward environmentally friendly cars is just beginning. And Tesla’s battery-powered electric car is not the only possibility. Electric cars can take many forms. For example, a car can get its electric charge via a battery. Or it can also get its electric charge using hydrogen and oxygen (fuel cells).

Is Ballard Power stock the next Tesla?

So Tesla has gone down the battery route. But Ballard Power Systems has gone down the fuel cell route. Which is better may be up for debate. But we have at least seen an overwhelming agreement on one thing. Fuel cells are better suited for powering heavy duty vehicles. This includes buses, trucks, and trains. It also includes marine vehicles and maybe even airplanes. Fuel cells are clearly at least part of the solution toward zero emissions vehicles.

So the road ahead for fuel cells is very bright. And there are many markets to conquer. At this time, Ballard has been focusing on the heavy duty vehicle market. This market alone is huge. And there are many countries and regions that are on board. China, Europe, California, are just a few of the very sizable markets that Ballard is addressing.

Can Ballard Power stock really follow in the footsteps of Tesla stock?

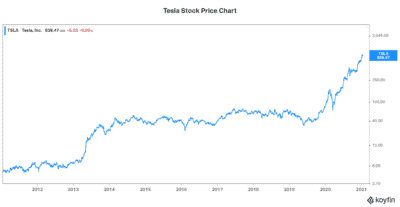

So let’s look back at where Tesla started. Tesla stock began trading on the NASDAQ in June 2010 at $17.00 a share. In August 2020, there was a 5 for 1 Tesla stock split. This meant that for every share of Tesla stock that a shareholder owned, they got five shares. So if you owned 100 shares, the stock split would mean that you now own 500.

Since its IPO, Tesla’s stock price has soared 22,000% to its current $851 per share. Its IPO was 10 years ago. This type of dramatic return is what we all strive for. Some of us may have been in on Tesla and have enjoyed this. Others may be looking for their Tesla.

Ballard Power stock rises

Well, 10 years later we may have another “Tesla” type stock. Ballard Power is in a similar industry. It’s fighting for the acceptance and adoption of fuel cells as a zero carbon energy solution for vehicles. Like in 2010, the timing for this remains right. I would argue it’s even more right now. Countries are mandating that vehicles be zero emission vehicles. There are different timelines. But the end result is that countries around the world are targeting zero emissions. And they are legislating for this.

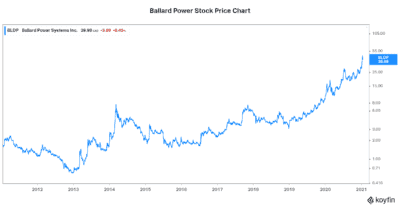

As we can see from Ballard’s stock price graph, something is happening. That something is widespread acceptance of fuel cells. It’s increasing adoption of fuel cells around the world. And it’s increasing acceptance that fuel cells are part of the climate crisis solution.

For its part, Ballard enjoys a leading market share in the fuel cell industry. The company is positioned to reap the rewards of the clean energy movement, just as Tesla did in the earlier days. Ballard Power stock has soared 1000% since 2019. This is just a fraction of Tesla stock’s return. I dare say, there’s so much more room for Ballard Power stock to go higher.

The bottom line

Tesla stock has been the poster stock for environmentally-friendly electric cars/vehicles. But the more we learn, the more we realize that fuel cells will be part of the solution too. Ballard Power stock has already begun its ascent. I expect Ballard stock to follow in the footsteps of Tesla’s stock price in the next decade.