As we head further into 2021, the TSX continues to trade around all-time highs. Maybe it seems a precarious situation to many of us. We are undoubtedly expecting a market crash in 2021. Regardless, I would like to review the best stocks to buy right now. If a market crash happens, we can always add to our positions at lower prices. The list includes energy stocks Suncor Energy (TSX:SU)(NYSE:SU) and Enbridge (TSX:ENB)(NYSE:ENB). It also includes high-growth stocks BlackBerry (TSX:BB)(NYSE:BB) and Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP).

Let’s take a closer look at these best stocks to buy right now.

Enbridge stock: A defensive, predictable high-yield stock

How would you like to start collecting a dividend yield of 7.5% right now? It sounds appealing, right? How would you like to collect this dividend without taking on too much risk? Sounds even better, right? If it sounds too good to be true, it’s not. Enbridge stock is the answer.

The oil and gas industry is going through an existential crisis. Investor sentiment is therefore in the dumps. But a company like Enbridge will be essential for decades to come. And it is increasingly part of the emerging renewable energy industry. The chart below shows the unimpressive performance of Enbridge stock.

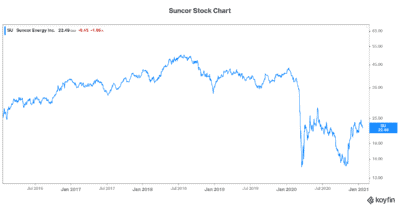

Suncor stock: The best energy stock to buy right now

Suncor Energy is Canada’s leading integrated energy company. It’s a company that has a track record of operational excellence. And it has a strong history of growth and shareholder value creation.

Today, I’m recommending Suncor as one of the best stocks to buy. Its history plays a big part in my recommendation. But Suncor stock’s current valuation does as well. Suncor stock has plummeted in recent years. All the while, its cash flows have been strong and rising. This disconnect can be easily explained. But the explanation falls short of justifying this contradiction.

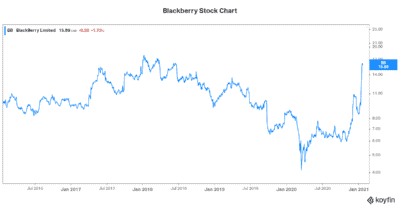

BlackBerry stock: The best technology stock for the future

BlackBerry stock has already started its upward climb. But this is just the beginning, because BlackBerry’s businesses have strong long-term growth tailwinds. And BlackBerry is a recognized leader in both of its businesses. For example, cars are increasingly connected. And BlackBerry’s technology is a leading force. The big news in this segment is the BlackBerry IVY partnership. BlackBerry and Amazon Web Services have partnered to provide a top-tier vehicle software solution. This solution applies to every vehicle and every platform. It will transform the automobile software industry.

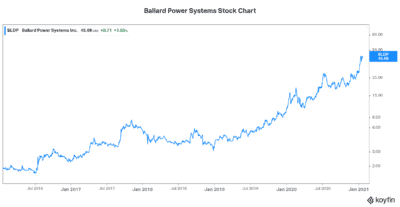

Ballard Power Systems stock: The best clean energy stock to buy now

Ballard Power is at the forefront of the fuel cell market. For example, the company has the largest market share by far. It also has the expertise and unrivalled relationships.

The fuel cell market for heavy duty vehicles is rapidly growing and expanding. Across the globe, countries are employing fuel cells to power their buses. They’re also employing fuel cells to power their trains. And in the future, marine vehicles and even airplanes might very well be powered by fuel cells. Car companies are even testing fuel cell-powered automobiles. So, the growth here is huge. Ballard Power Systems stock will continue to soar as the fuel cell market grows.

Motley Fool: The bottom line

The four best stocks to buy right now are all leaders in their own right. Some of them are unfairly punished, like Suncor stock and Enbridge stock. And the others, like BlackBerry stock and Ballard Power stock, are just simply leaders that have massive growth ahead of them. Investors can’t go wrong with these stocks. Be comfortable with the volatility and stick with them.