While there isn’t a perfect way to invest, the Canadian Tax-Free Savings Account (TFSA) certainly gets you close. Since its creation in 2009, the Canada Revenue Agency (CRA) has added new limits each year. In total, with the addition of a further $6,000 limit, Canadians have $75,500 available in their TFSA limit.

What’s great is the TFSA limit can be used for anything: short-term goals, long-term goals, retirement, nest eggs, education — you name it. And it’s all tax free. The only real catch is staying within the limit.

It’s now been a month that the new TFSA limit of $6,000 has been made available. So, if you’re ready to start investing, now is the time with these perfect stocks.

Tech stocks

Here’s the thing, tech stocks have been doing really well during all this market volatility. While many are indeed rising from momentum, there are certainly some safe stocks that are perfect to reach your TFSA limit. One I would absolutely consider right now is Constellation Software (TSX:CSU).

The company has been an acquisition powerhouse for decades — something you really don’t see in the tech sector. It buys up Software as a Service (SaaS) companies and provides everything from development to installation across North America and Europe in both the private and public sectors.

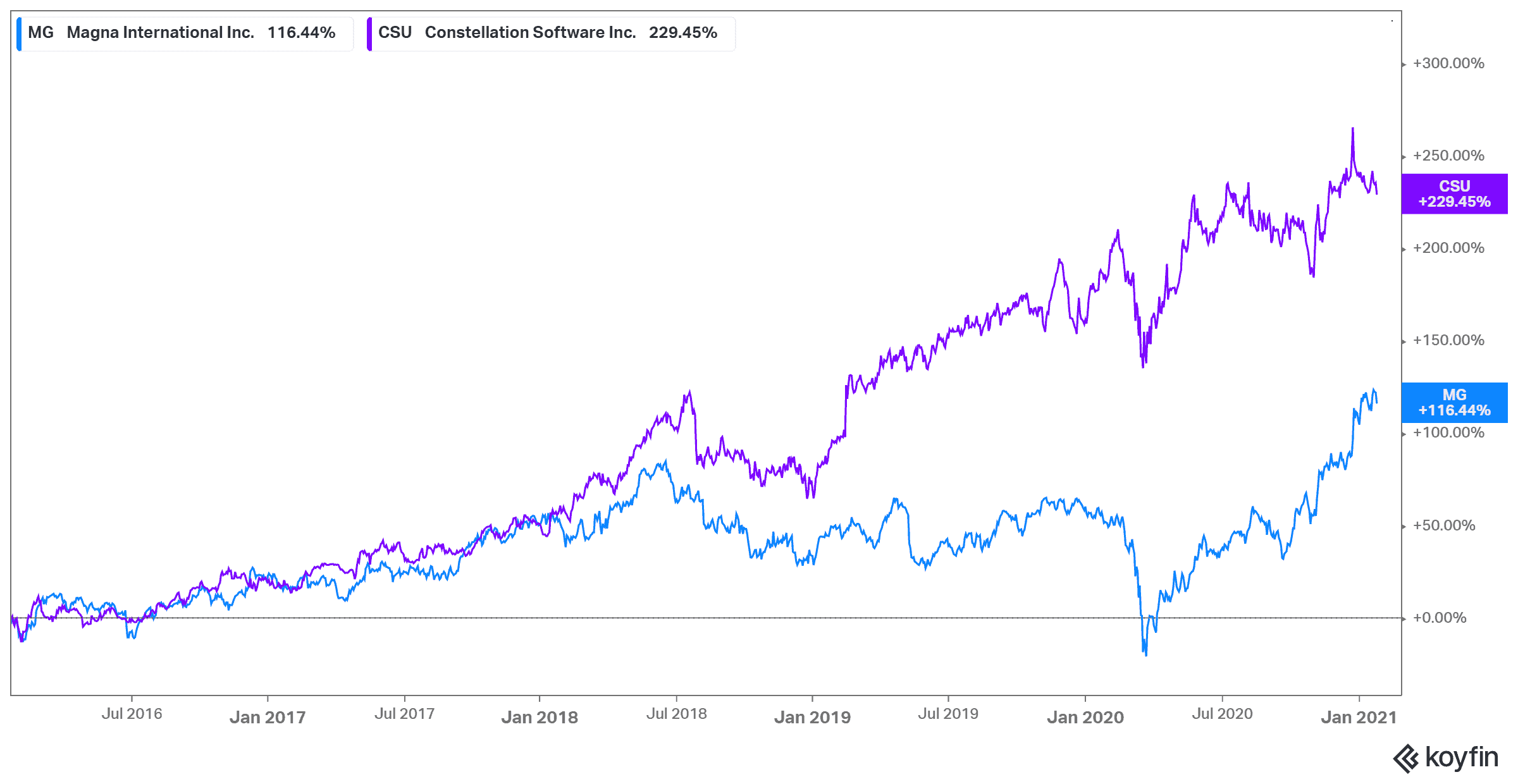

If you were to look at the company’s financials, you wouldn’t even know there had been a downturn, and that’s why it’s perfect for your TFSA limit contribution. You want stability but also growth, and Constellation has that. The company has a $33 billion market capitalization and has remained around 15% in year-over-year returns. Shares are up 15% this year, but 230% in the last five years for a compound annual growth rate (CAGR) of 46%! So, while the stock is pricey, it’s the perfect buy for your TFSA room.

Electric vehicles

It can seem like electric vehicles (EVs) are still a relatively new phenomena, but they certainly aren’t. In fact, the origins can be traced back over 100 years. So, that’s why this is another stable option to consider for your TFSA limit, as the world shifts towards EVs. And there is a huge shift. The new United States president Joe Biden recently announced he would put US$27 billion towards EVs by 2025. That’s a lot of investment to take advantage of.

When it comes to Canadian investments, you’ll want to look at software for EVs. Now there are a lot of overpriced options out there, but I think Magna International (TSX:MG)(NYSE:MGA) is the perfect option. The company is a parts manufacturer for automobiles, but recently partnered with LG Electronics to start building parts for electric vehicles. This a huge shift that will see enormous revenue come in for long-term holders.

The stock has risen 40% in the last year, much from the news. The company has a $28 billion market capitalization, and while revenue fell during the pandemic, it’s set to explode with this new addition. As the market continues to consolidate, Magna will remain in a powerful position. So, while shares are up, the stock is still undervalued — especially when you consider that in the last five years, it’s grown 116% for a CAGR of 23%! All this makes it another perfect option for your TFSA limit.