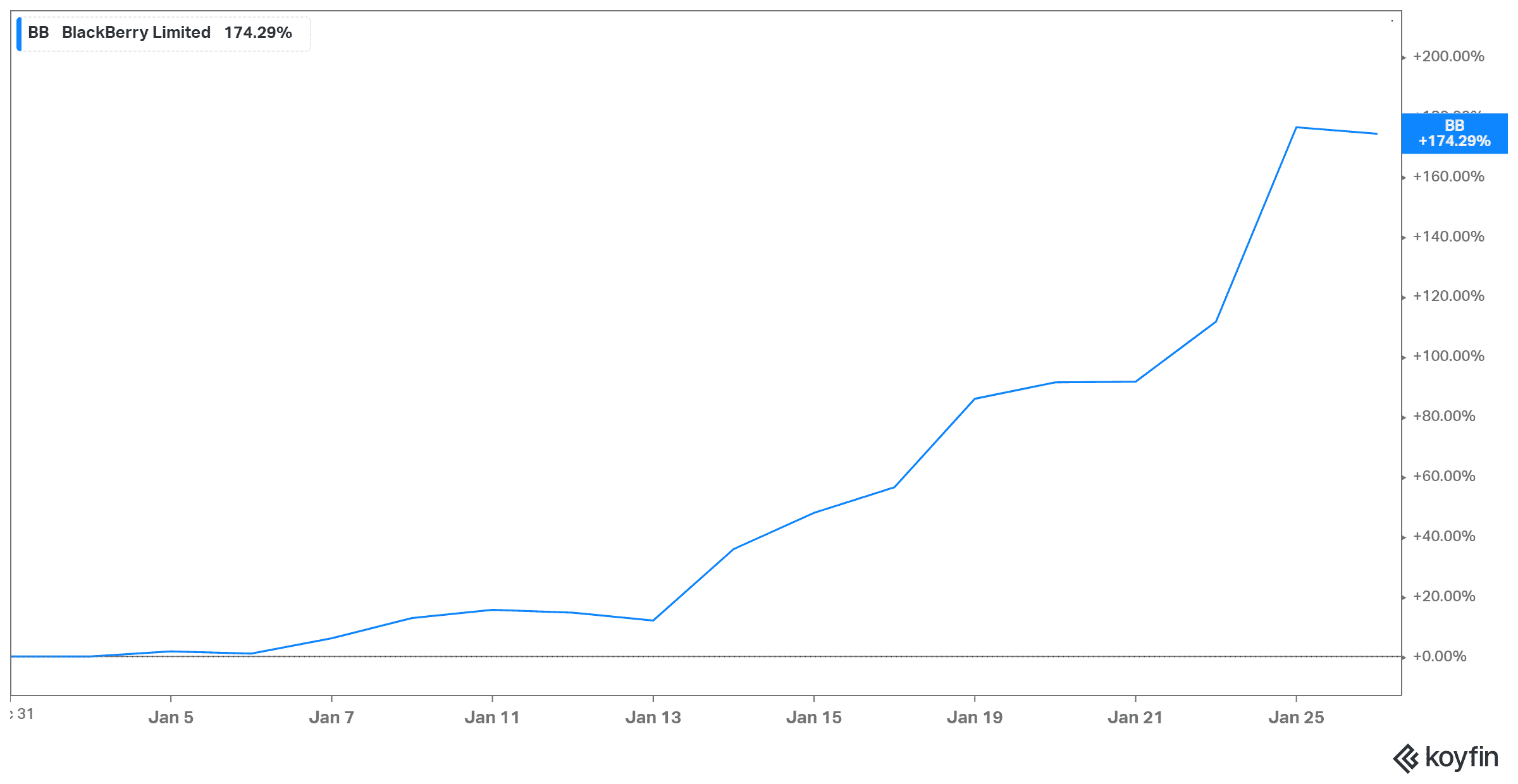

Shares of BlackBerry (TSX:BB)(NYSE:BB) have been on a tear of late. The stock finally seemed to hit that jolt after years of digging its way back from the dumps. The stock once traded at triple-digit prices, only to sink to the single-digit status. Yet now, shares have more than doubled in the last month. This is down to a few reasons.

The catalyst

There were a number of changes that caused the massive surge in BlackBerry shares. First, there was the new president of the United States. President Joe Biden stated he would put US$27 billion towards electric vehicles (EVs) through to 2025. That investment is one that BlackBerry would see directly. The company has partnerships with a number of car companies that use its QNX technology for their vehicles.

Yet another partnership that also surged from the news was the one between BlackBerry and Amazon Web Services. The company partnered with BlackBerry to create a more functional data platform with its Intelligent Vehicle Data (IVY) program. Its IVY program is already in a number of EVs but will likely be introduced to even more through the president’s initiative.

The sell off

Shares have risen 174% as of writing in the last month alone. That’s a share change of $8 per share to $22.85 as of writing. That move was incredible, and it’s why there was a huge sell-off recently from insiders. At least two executives of BlackBerry sold shares due to the bolstered share price, according to filings with the U.S. Securities & Exchange Commission. First, there was Chief Marketing Officer Mark Wilson on January 20, who sold more than US$990,000. This reduced his shares by 60%! Then Chief Financial Officer Steve Rai also sold stocks, amounting to almost US$430,000. This liquidated all of his directly owned shares.

What does this mean? Do the executives think there’s going to be a collapse? In short, not exactly. Right now seems like a good price. With all this momentum, it’s a good time for anyone to sell a bit of their stake and wait for a dip to get back in. All in all, BlackBerry is a solid company. Its Cylance investment, QNX technology and IVY program are all great reasons to hold onto this stock. And if you don’t sell off, fine! Just keep holding onto it for the next few years when you’ll continue to see a rise, even if there is a dip.

Foolish takeaway

There has been a lot of excitement around BlackBerry stock lately. But as Warren Buffett once said, “be greedy when others are fearful, and fearful when others are greedy.” Right now, it’s time to maybe play the wait and see approach. BlackBerry isn’t likely to suddenly have even more great news like the president’s announcement or settling a patent issue. Share growth should start to slow, so when it does, that’s when you can jump back in. Until then, be a bit cautious about BlackBerry, and maybe even act like the execs and sell a stake! There’s no harm in being careful in this volatile market.