BCE (TSX:BCE)(NYSE:BCE) is Canada’s largest telecom services company. It is a position backed by an extensive reach of its world-class wireless and fibre networks. It is also backed by BCE’s financial health and financial strength. This is what we at Motley Fool Canada like to see. It’s what makes BCE stock the best stock to buy now.

So, let’s look at the specific reasons why BCE stock is the best stock to buy right now.

BCE stock: A dividend-growth king

BCE is a dividend stock that’s currently yielding a healthy 6%. Consider this for a moment. BCE is one of the most cash flow-rich, steady companies out there. And it’s yielding 6%. Investors should pounce at the chance to get this yield.

BCE released its 2020 earnings results last week. At that time, the company announced another dividend increase. This time, the dividend was increased by 5.1%. It’s the 13th consecutive year of a 5% or higher dividend increase, and it’s reflective of BCE management’s commitment to its status as a dividend stock. Its dividend and dividend growth are key.

BCE is resilient to stock market and economic weakness

The TSX is trading near all-time highs. It would be wrong to assume that this is consistent with reality. The more accurate assessment is that the stock market is getting caught up in some form of euphoria once again. Granted, there are some bright spots. The tech sector, including BCE, is outperforming as it leads us into the future. BCE has been instrumental in this pandemic. It has brought us out into the virtual world — for shopping, working, appointments, and more.

But the price that is being paid in this pandemic is huge: there is massive amounts of stimulus, a high unemployment rate, and many parts of the economy have been broken. We can recover from this. But I think it would be naïve to think that there won’t be some long-term structural problems. In short, recovery will take time. And this might become more obvious once we get back to normal.

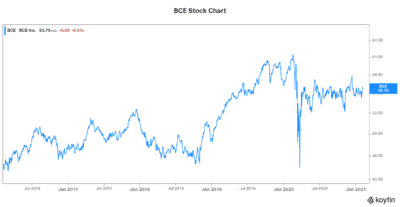

BCE is immune to much of this strife. For example, BCE delivered 96% of 2019 EBITDA in 2020. Also, BCE stock was down 7%. Consider this for a moment. 2020 was a really rough year. But as far as BCE and BCE stock is concerned, it seems like it was just a small, inconsequential nuisance. BCE stock is the best stock to buy right now for many reasons. One big reason is its resiliency.

BCE is accelerating its investment in the long term

The final reason that BCE stock is the best stock to buy is because of its commitment to long-term investment in its business. The telecom industry is rapidly changing. New advances such as fibre optics and 5G are changing the landscape. And BCE is committed to keeping up with these changes.

BCE will be spending $1 billion to $1.2 billion in the next two years on network improvements and enhancements. This capital-expenditure plan has been accelerated to meet the needs of its customers. BCE will be investing in upgrading its core network. This will lay the foundation for 5G growth. It will also connect more Canadians in rural areas. And lastly, it will speed the rollout BCE’s fibre optic network. This fibre optic delivery brings the fastest speeds and a better overall experience.

Motley Fool: The bottom line

In conclusion, BCE stock is the best stock to buy right now for its defensive attributes. In fact, it is a cash flow machine. It has a dividend yield of 6% and a strong history of delivering shareholder value.