These days there’s a lot of interest in stocks that still have recovery potential. One of the biggest and most popular stocks that’s already started to show signs of recovering is Suncor Energy Inc (TSX:SU)(NYSE:SU).

During 2020 most industries crashed from the coronavirus then recovered throughout the rest of the year. Energy stocks, however, have lagged the rest of the market. These stocks have yet to fully recover, which is offering investors exceptional value today.

In addition to the price of oil falling dramatically in the past year, demand was significantly impacted as well. People are staying at home and not driving to work. Consumers aren’t shopping as much. People are spending less time with friends. All of the drop-off in mobility due to virus restrictions has hurt the demand for oil considerably.

This demand is slowly starting to come back. In the U.S, gasoline demand is about 10% below where it was this time last year, with jet fuel down 25%.

Therefore, as we continue to get the virus under control here and around the world, energy stocks like Suncor have a major opportunity to rebound as oil demand picks up.

So although plenty of energy stocks offer investors incredible value today, here’s why analysts have Suncor rated as one of the best.

Suncor stock

Suncor is one of the biggest and best energy stocks in Canada. On top of it being one of the biggest oil companies, producing up to 750,000 barrels of oil per day, the company also owns midstream and retail operations.

This diversification vertically integrates Suncor’s business, which is why the stock is so attractive. By vertically integrating, companies can save on costs and increase profitability.

So while others in the oil and gas industry can struggle mightily when the price of oil is declining, Suncor can absorb these shocks a lot better than most of its peers.

It’s no surprise, then, that Suncor stock is one of Warren Buffett’s few Canadian holdings. The company is an incredible long-term investment and offers tremendous upside. Currently, Suncor is trading down more than 40% off its 52-week high.

It’s not just Warren Buffett who likes Suncor either. Analysts have the stock rated a buy and see considerable upside for investors over the next year.

Analysts are bullish on Suncor stock

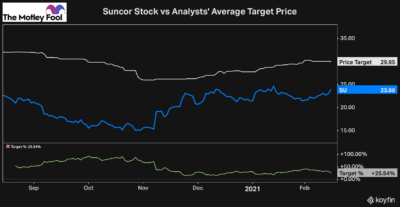

There are currently 25 analysts with a rating on Suncor stock. Six analysts rate Suncor a hold while the rest rate it as either a buy or a strong buy.

So it should come as no surprise that the consensus among these analysts is that Suncor is considerably undervalued.

Suncor stock has been recovering rapidly since November. Despite that recovery, though, the stock remains more than 25% below analysts’ target prices.

Furthermore, as the economy continues to rebound and the energy industry’s outlook improves, you can expect these target prices to be increased. So you can reasonably expect Suncor to make significant gains over the course of the next year.

Of course, that’s assuming the economic recovery pans out the way many expect it to.

Bottom line

With over 25% upside in the shares, according to analysts, plus another 3.5% return investors can receive from the dividend, Suncor presents a major opportunity for investors.

Energy continues to be some of the cheapest stocks to buy today. I wouldn’t wait too long to gain exposure, though. From the chart, you can see that Suncor stock has been rallying recently and that discount to the target price has been narrowing.

So if you’re going to take a position in this incredible long-term stock, I would do it soon.