Most of us aim to maximize our RRSP contributions. If we can do it, it’s the way to go. Maximizing our Registered Retirement Savings Plan contributions maximizes our benefits. So we shouldn’t leave anything on the table. In fact, effectively saving for retirement means utilizing every tool and benefit available. So the next step is to find the best stock to buy right now.

The benefits of the RRSP

The RRSP is a tax-free savings vehicle. That means that any money you make here is not taxed. For example, capital gains escape taxation. Also, dividend income from top dividend stocks escapes taxation. This means that you can reinvest 100% of these gains. You can effectively grow your money much more quickly. This is because you can reinvest 100% of your dollar gains. In a taxable account, you could only reinvest the after-tax dollar gains, which can be much lower is some cases. This lower base means that your money would grow more slowly.

Also, RRSP contributions can be deducted from your income for tax purposes. And this means lower taxes paid at the end of the year. You might even get a refund. And there you have more dollars to invest for your retirement.

But even if you’re already convinced of this, you may have another problem. Where should you invest all this money? The answer to this question is diversification. Keep a well-diversified portfolio of fixed income securities and equity securities. For example, high growth stocks should be complemented by top dividend stocks.

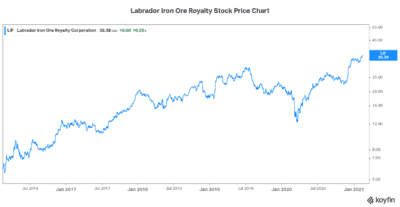

Top RRSP stocks to buy: Labrador Iron Ore

The two top dividend stocks to buy right now for your RRSP are defensive stocks. They both pay a generous dividend. And they are both resilient in their own ways.

Labrador Iron Ore Royalty Corp. (TSX:LIF) is a gem among dividend stocks. It’s one of the lesser known ones. But that doesn’t detract from its appeal; it adds to it. Labrador Iron Ore Royalty owns a 15.1% interest in Iron Ore Company of Canada, owns mining leases and licenses covering 18,200 hectares of land near Labrador City from which it collects a 7% royalty, and receives a $0.10 cent per tonne commission on the product sold by IOC.

As a royalty company, Labrador Iron Ore does not bare any of the operation risks or expenses. The company keeps a pristine balance sheet. Its entire raison d’etre is to pass on its ample cash flow to its shareholders. This takes the form of its regular dividend. Once a year, extra cash flow is paid out in a special dividend. The result has been explosive returns for shareholders. Today, the opportunity in Labrador Iron Ore Royalty stock still exists.

Labrador Iron Ore is defensive because of its royalty model. It’s defensive because of its first rate assets and operations. And it’s defensive because of its pristine balance sheet. It’s one of the best stocks to buy right now for your RRSP.

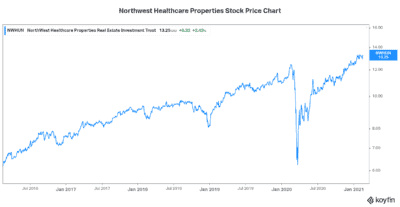

Top stock to buy for your RRSP: NorthWest Healthcare Properties

NorthWest Healthcare Properties REIT (TSX:NWH.UN) is another top dividend stock to buy for your RRSP. NorthWest is another pretty defensive dividend stocks. It’s defensive because it owns healthcare real estate around the world. NorthWest is a part of all areas of healthcare. From hospitals, to imaging clinics, to general medical buildings, it’s owns prime healthcare real estate.

NorthWest Healthcare REIT is yielding over 6%. NorthWest Healthcare Properties has long-term demographics on its side. The population is aging, interest rates will remain low for the foreseeable future, and strong demand supports its value.

The bottom line

Your RRSP is the prime place to put your money to accumulate retirement wealth. This is because zero taxes and income tax deductions boost RRSP returns dramatically. Top stocks to buy are Labrador Iron Ore Royalty stock and NorthWest Properties Healthcare REIT stock.