Canadian banks have kicked off their earnings season this week. Bank of Montreal (TSX:BMO)(NYSE:BMO) reported a strong earnings. Also, Bank of Nova Scotia (TSX:BNS)(NYSE:BNS) stock is rallying on its strong earnings. Both beat expectations. And, importantly, both banks are feeling more optimistic about the future.

Let’s dive a little deeper to review the three most important takeaways from last quarter.

Here comes the sun: Canadian banks are signaling better times ahead

The banks are making the call: they’re expecting a strong economic recovery in 2021 and 2022. This bodes well for all. Bank stocks are rallying today on this notable shift. The confidence and optimism were evident on the earnings conference calls.

Bank of Montreal management put it well. They expect a “very strong recovery” in North America this year, assuming continued progress with vaccinations. So, the light at the end of the tunnel is increasingly clear. Bank of Montreal is Canada’s fourth-largest bank by market capitalization. It has one of the least-significant exposures to the Canadian personal and commercial banking (P&C) industry. This has proved beneficial in recent history. Assuming a recovery in 2021/22, this will be a negative characteristic for the bank.

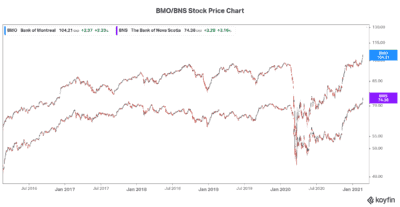

Bank of Nova Scotia is showing similar results. And signaling similar optimism. Performance is returning to pre-pandemic levels. Credit trends have turned the corner. Also, returns and dividends are well supported once again. Bank stocks are once again the pillars of strength we rely on. The price chart below shows the comeback that these bank stocks have made.

Provisions for credit losses (PCLs) tumbling

Loan impairment and provisions are moderating. This is good. This means that the banks’ lending business is improving. This means that the risk inherent in the banks’ business model is declining significantly.

For example, PCLs were down 56% at BMO. And they plummeted more than 30% at Scotiabank. This just signals an improving credit environment. And, anecdotally speaking, BMO mentioned that it’s noticing a clear rise in optimism among its lending customers.

Recall for a minute the dire situation that the banks were in less than a year ago. PCLs were soaring. The environment was riddled with uncertainty. And the economy was in tatters. Well the tide is finally turning. I said back then that the banks would make it through just as they made it through the 2008 financial crisis. Bank stocks have, in fact, thrived. Their shareholders have continued to collect their dividends and watch their positions increase in value.

Bank stocks rally on strong wealth management performance

Canadians are accumulating more wealth. We are living longer. These trends are clear in Canada. But they’re not only Canadian trends. These are global trends. And the banks and their wealth management segments are booming because of it.

For example, Bank of Nova Scotia’s global wealth management segment reported a 34% increase in earnings. Also, Bank of Montreal’s wealth management segment was particularly strong. The segment reported a more than 20% increase in net income. This shows renewed strength.

Motley Fool: The bottom line

Canadian banks have not faced their last crisis. Even this COVID pandemic crisis is not over. But we are once again being shown strength and resiliency. Canadian bank stocks like Bank of Nova Scotia are reflecting this today. The first-quarter results of banks have shown that the tide is turning. The crisis began in March 2020. It took one year of uncertainty and hardship. Those who’d bought bank stocks in the height of the uncertainty are sitting pretty today. Let’s use this as a lesson.