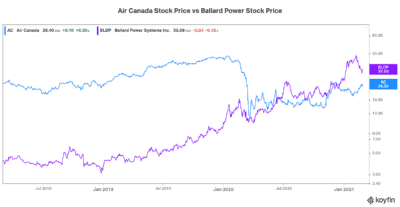

Air Canada (TSX:AC) stock is staging a rebound. Up 16% in 2021, the market is clearly saying something. The feeling is increasingly optimistic. But will Air Canada’s stock price continue to rally? Or will this rally fizzle out, as its hardships continue? Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP) stock, however, has come a long way. So too has its outlook and prospects. We can say that Ballard has experienced a coming of age. In its infancy, it was this exciting fuel cell stock with technology that was as interesting as it was new and unproven.

But that was decades ago. Today, Ballard Power stock has finally exploded higher. After many years of being dead money, Ballard’s time has finally come. It’s impressive that the company even survived this long to get another chance at showcasing its fuel cell technology. But it did. Would you like to see how dramatically all of this has changed? Here are three reasons to buy Ballard Power stock today.

Air Canada is in the cyclical airline industry, but Ballard Power will benefit from the secular shift toward the fuel cell industry

The race to decarbonize is on. What’s the best way for us to play this theme? Certainly not Air Canada stock. I think there’s no better way that than by investing in a company that’s been fighting this fight for decades.

Ballard Power got its start in 1979. Ballard Research Inc. was founded by Geoffrey Ballard and two others. Their goal was to investigate environmentally clean energy systems with commercial potential. In the early days, they conducted research and development of high-energy lithium batteries, which eventually led to developing fuel cells. The fist fuel cell stack was developed in 1986.

In between then and now, Ballard continued pursuing the goal. It’s surely been a long road. But all these years later, everything is coming together. For example, the political environment has never been better for clean energy companies. Also, fuel cell costs have come down dramatically. Lastly, fuel cells have many years of performance data that prove the concept. Simply put, fuel cells are the best clean energy source for heavy-duty vehicles. This means buses, trucks, trains, and ships, and, maybe even one day, Air Canada’s planes. It is, as they say, the perfect storm.

Ballard’s successful share offering speaks volumes

After many years of investor indifference, Ballard is recapturing interest. Air Canada’s stock price, by contrast, has reflected decreasing investor confidence. Through no fault of its own — the virus has decimated the airline business.

Many of us can recall the internet bubble era. At that time, Ballard Power stock was swooped up in the frenzy. It’s no wonder. It had compelling technology. Also, the concept of environmentally friendly energy was gaining interest — at least on the fringes. So, in the market bubble, Ballard stock soared past $150. It subsequently came tumbling right back down to the depths of nothing in the early 2000s. That made sense, because Ballard did not yet have much substance backing it up.

2021 is different. Ballard’s fuel cells are in buses are deployed all over the world. The company has partnerships with many players in the transportation industries. And investors are taking notice. Ballard Power stock price is soaring. And the company is actually in a position to successfully raise money again. To further its growth plans, Ballard raised $550 million through a share issue. The issue went extremely well, benefitting from strong demand and interest.

Air Canada stock is struggling to survive, yet Ballard Power is ready to conquer the fuel cell industry

Ballard is at the forefront of the fuel cell market. For example, the company has the largest market share by far. It also has the expertise. And it has unrivalled relationships. The thing that I’m watching is simple: How long will it take for Ballard to translate this into significant revenue growth? How long will it take for Ballard’s financials to catch up to expectations?

Motley Fool: The bottom line

There are many reasons to take a pass on Air Canada stock and buy Ballard Power stock instead. In short, a perfect storm is sending this fuel cell stock higher.