The GameStop (NYES:GME) phenomenon is nothing new. Sure, the details are different. But the idea of a stock being bid up in an unrealistic buying frenzy is nothing new. So, as serious investors at Motley Fool, we must maintain our composure. We must focus on the nuts and bolts. Remember your investment process and don’t get caught up in the frenzy. Let’s take a look at GameStop and at an energy stock that’s a good buy today: Canadian Natural Resources (TSX:CNQ)(NYSE:CNQ).

GameStop stock flies high on market manipulations

Short-sellers are nothing new. They bet on a stock’s demise. This strategy gives them a way to make money off of their buy and sell opinions. One can have different opinions about the value of this. Some may call it smart, while others might call it destructive to markets.

When GameStop was targeted by short-sellers, we got to see the dysfunction this strategy creates. GameStop is an omnichannel video game retailer. It sells hardware and physical and digital game software. It also sells mobile and consumer electronics products and other merchandise.

The gaming industry is huge. GameStop’s revenue growth has not been huge. In fact, it’s been declining. Also, GameStop has been posting net losses in the last couple of years. It’s also burning through cash and racked with debt. So, we can see why short-sellers would bet on the stock falling.

Reddit sparks investor backlash on GameStop stock

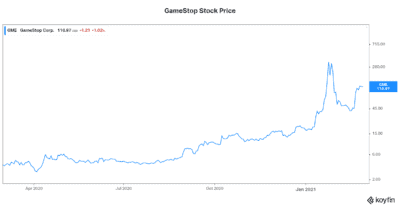

Many investors resent the whole idea of short-sellers. And this was put on full display when Reddit users attempted to sabotage the short-seller position in GameStop. The manipulation was real. It gained momentum that was both shocking and kind of impressive. We saw GameStop stock soar almost 2,000% in early January.

As investors, your best bet was to just sit and watch. Entering this game of speculation is just that, speculation. We shouldn’t subscribe to blind speculation. We should follow an investment process that is aimed at minimizing risk and maximizing upside — an investment that’s grounded in fundamentals.

Energy stocks finally see the light

Energy stocks are an investment opportunity today that have the backing of improving fundamentals. Within this group, there are many companies making solid cash flows. They’re creating value for shareholders, and they’re feverishly addressing the climate change issue so that they can make it through in the long term.

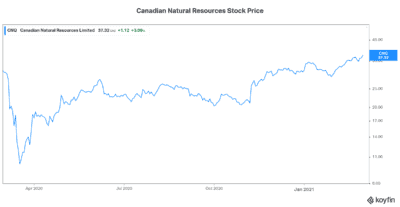

After going through many years of difficulty, energy stocks are rallying. Unlike GameStop, they’re rallying for good reason. This rally is the result of many factors. For example, the price of oil is rallying big. It’s now climbing over $60. And with this, we’re seeing energy companies’ fortunes changing. For example, Canadian Natural Resources stock has always been an impressive cash generator. Its business and operations are top quality. But, of course, it’s been caught up in the negative oil and gas industry fundamentals. So, Canadian Natural Resources stock could not shine.

Today, the oil and gas industry fundamentals are improving. Maybe now this top energy stock will actually be able to perform like one. It has so far in 2021. The graph below illustrates this.

Canadian Natural is reporting today. Expectations for Canadian Natural Resources are quickly rising as commodity prices strengthen. This will surely come through in the results.

Motley Fool: The bottom line

GameStop stock has been in the news a lot lately. We’re all fascinated by such a phenomenal return in such a short period of time. But we must remember that buying a stock like this type is speculation. And just as it went up so quickly and dramatically, it can do the same on the downside.

I’d rather invest in energy stocks like Canadian Natural Resources stock today. These beaten-down stocks are rising from the ashes. This rise is based on fundamentals. There’s a real investment case to be made to buy them.