These days, there are plenty of quality Canadian stocks with great long-term potential that are worth a buy. Some started the year with potential, while others have recently become attractive due to improving valuations or attractive business developments.

When looking for businesses to buy, we’re always looking for great long-term stocks. So, we need to make sure that in addition to high-quality businesses with long-term potential, the industry it operates in has plenty of long-term opportunities too.

A great company in a maturing industry will have a tough time growing its value, even if it’s growing its slice of a shrinking pie. This makes the industry as important as the business itself.

With that in mind, here are three of the top Canadian stocks that could double in 2021.

A top Canadian gold stock

Throughout the last few months, gold prices have come down from their new all-time highs. This has resulted in gold stocks selling off significantly too.

It’s no surprise to see gold stocks sell off significantly, as they are leveraged to the price of gold. However, sometimes the selloff can get excessive, such as is the case with B2Gold (TSX:BTO)(NYSE:BTG).

B2Gold is one of the lowest-cost gold producers you can buy. It’s also a great long-term growth stock with a strong management team.

The Canadian gold stock has grown its production for 12 consecutive years, all while keeping costs at the low end of the producers in the industry.

This makes B2Gold one of the top stocks to buy, and recently it’s gotten extremely cheap. The company’s operations and cash flow are so strong that it even pays a 3.7% dividend.

Whether or not B2Gold doubles this year will have to do with whether or not momentum can return to the gold sector. Currently, the consensus analyst target price for B2Gold is nearly $11. So, if B2Gold were to hit its target price, that in itself would be a 100% gain.

The stock is an incredible long-term investment, and, considering it’s so heavily undervalued, that makes it one of the top Canadian stocks to buy today.

A high-potential green energy stock

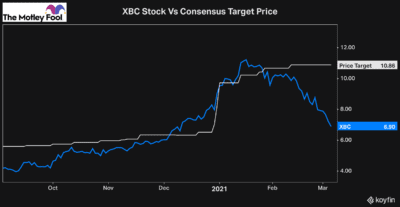

Another top Canadian stock that could double from here in 2021 is Xebec Adsorption (TSX:XBC). Xebec has a tonne of potential over the next few decades, as the world intensifies its fight against climate change.

The company is an early leader in the renewable natural gas and hydrogen technology sector. The company has a tonne of potential and has been making a string of high-value acquisitions to help build out its expertise and grow its sales.

The stock was one of the top performers in 2020 but has since fallen out of favour. It’s still an incredible long-term investment, though, so I would use this opportunity to gain exposure to Xebec at this massive bargain.

Over the last six weeks, the stock has fallen roughly 40%.

You can see just how much value Xebec has today. So, as the stock comes back into favour and investors recognize its potential, there’s a strong possibility it could grow 100% from here.

A Canadian Bitcoin stock

Lastly, one of the highest-potential Canadian stocks to buy today is BitFarms (TSXV:BITF). BitFarms is a top Canadian Bitcoin miner with major growth potential.

Bitcoin itself is already highly volatile. So, when you take mining companies that are leveraged to the price of Bitcoin, the growth potential increases dramatically. Unfortunately, though, so does the risk.

So, it’s important to be aware of the downside potential if the cryptocurrency sector falls out of favour. It’s also crucial to keep up to date with the mining company’s operations and how it’s staying competitive.

If all goes right, though, BitFarms could more than just double. In the last year, the stock is up 950%. It has a tonne of potential to be one of the top Canadian stocks of 2021.